Question: I want an expert to solve this problem in an excel file and Send it to me and the written words please should be clear

I want an expert to solve this problem in an excel file and Send it to me and the written words please should be clear , or he solves it and writes it on an external paper and sends it here.

I want an expert to solve this problem in an excel file and Send it to me and the written words please should be clear , or he solves it and writes it on an external paper and sends it here.

Note, this question, its answer is already on the site, but the answer is not clear and I cannot understand it.

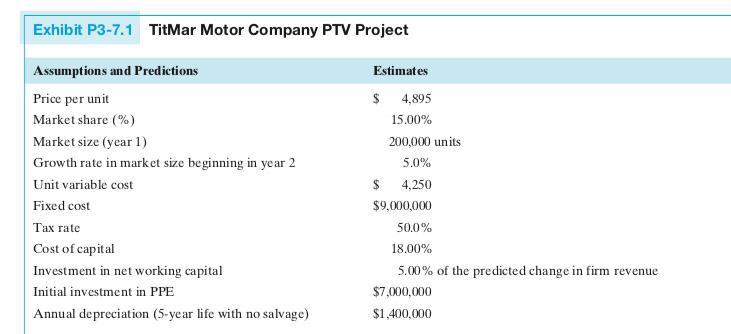

PROJECT RISK ANALYSIS - BREAKEVEN SENSITIVITY: The TitMar Motor Company is considering the production of a new personal transportation vehicle (PTV). The PTV would compete directly with the innovative new Segway. The PTV will utilize a three- wheel platform capable of carrying one rider for up to six hours per battery charge thanks to a new battery system developed by TitMar. TitMars PTV will sell for substantially less than the Segway but will offer equivalent features. The pro forma financials for the pro- posed PTV project, including the forecasts and assumptions that underlie them, are set out in Exhibit P3-7.1. Note that revenue is calculated as follows: price per unit * market share (%) * market size and units sold = revenues/price per unit. The project offers an expected NPV of $9,526,209 and an IRR of 39.82%. Given TitMars stated hurdle rate of 18%, the project looks like a winner. Even though the project looks very good based on managements estimates, it is risky and can turn from a positive NPV investment to a negative one with relatively modest changes in the key value drivers. Develop a spread- sheet model of the project valuation and answer the following questions:

a. If the firms market share turns out to be only 5%, what happens to the projects NPV and IRR?

b. If the market share remains at 15% and the price of the PTV falls to $4,500, what is the resulting NPV?

Exhibit P3-7.1 TitMar Motor Company PTV Project Assumptions and Predictions Price per unit Market share (%) Market size (year 1) Growth rate in market size beginning in year 2 Unit variable cost Fixed cost Tax rate Cost of capital Investment in net working capital Initial investment in PPE Annual depreciation (5-year life with no salvage) Estimates $ 4,895 15.00% 200,000 units 5.0% $ 4,250 $9,000,000 50.0% 18.00% 5.00% of the predicted change in firm revenue $7,000,000 $1,400,000 Exhibit P3-7.1 TitMar Motor Company PTV Project Assumptions and Predictions Price per unit Market share (%) Market size (year 1) Growth rate in market size beginning in year 2 Unit variable cost Fixed cost Tax rate Cost of capital Investment in net working capital Initial investment in PPE Annual depreciation (5-year life with no salvage) Estimates $ 4,895 15.00% 200,000 units 5.0% $ 4,250 $9,000,000 50.0% 18.00% 5.00% of the predicted change in firm revenue $7,000,000 $1,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts