Question: i want answer in 30 mins and correct answer thanks for your help Barbie's Boutique is interested in going to the market to raise additional

i want answer in 30 mins and correct answer thanks for your help

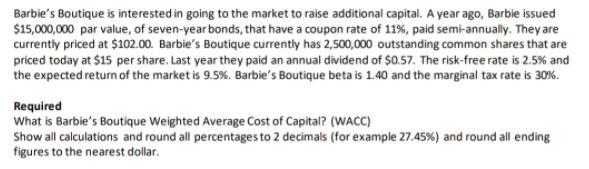

Barbie's Boutique is interested in going to the market to raise additional capital. A year ago, Barbie issued $15,000,000 par value of seven-year bonds, that have a coupon rate of 11%, paid semi-annually. They are currently priced at $102.00. Barbie's Boutique currently has 2,500,000 outstanding common shares that are priced today at $15 per share. Last year they paid an annual dividend of $0.57. The risk-free rate is 2.5% and the expected return of the market is 9.5%. Barbie's Boutique beta is 1.40 and the marginal tax rate is 30%. Required What is Barbie's Boutique Weighted Average Cost of Capital? (WACC) Show all calculations and round all percentages to 2 decimals (for example 27.45%) and round all ending figures to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts