Question: i want detail answer based on excelsheet please dont write the formula of it 1. Assume the risk-free rate of return is 3% and the

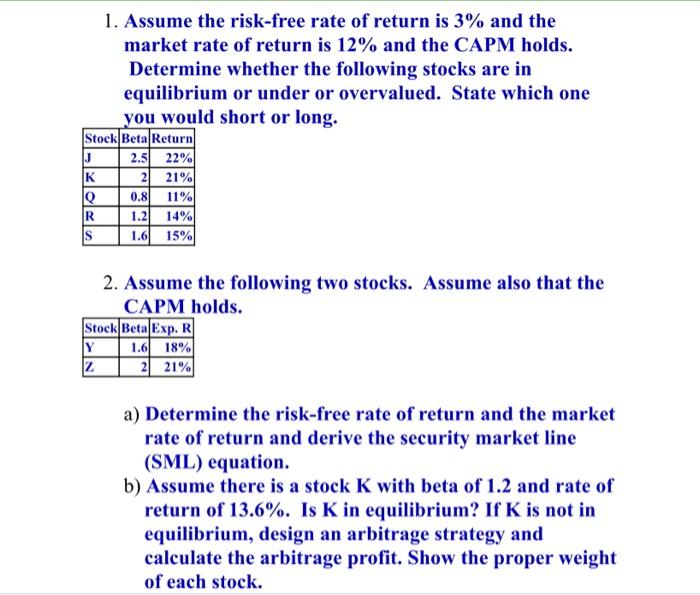

1. Assume the risk-free rate of return is 3% and the market rate of return is 12% and the CAPM holds. Determine whether the following stocks are in equilibrium or under or overvalued. State which one you would short or long. Stock Beta Return J 22% K 21% Q 11% R 1.2 14% s 15% 2.5 2 0.8 1.6 2. Assume the following two stocks. Assume also that the CAPM holds. Stock Beta Exp. R Y 1.6 18% Z 2 21% a) Determine the risk-free rate of return and the market rate of return and derive the security market line (SML) equation. b) Assume there is a stock K with beta of 1.2 and rate of return of 13.6%. Is K in equilibrium? If K is not in equilibrium, design an arbitrage strategy and calculate the arbitrage profit. Show the proper weight of each stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts