Question: I want help in this question without using excel to know how to calculations are done Question Three: (6 marks) James Bond wants to sell

I want help in this question without using excel to know how to calculations are done

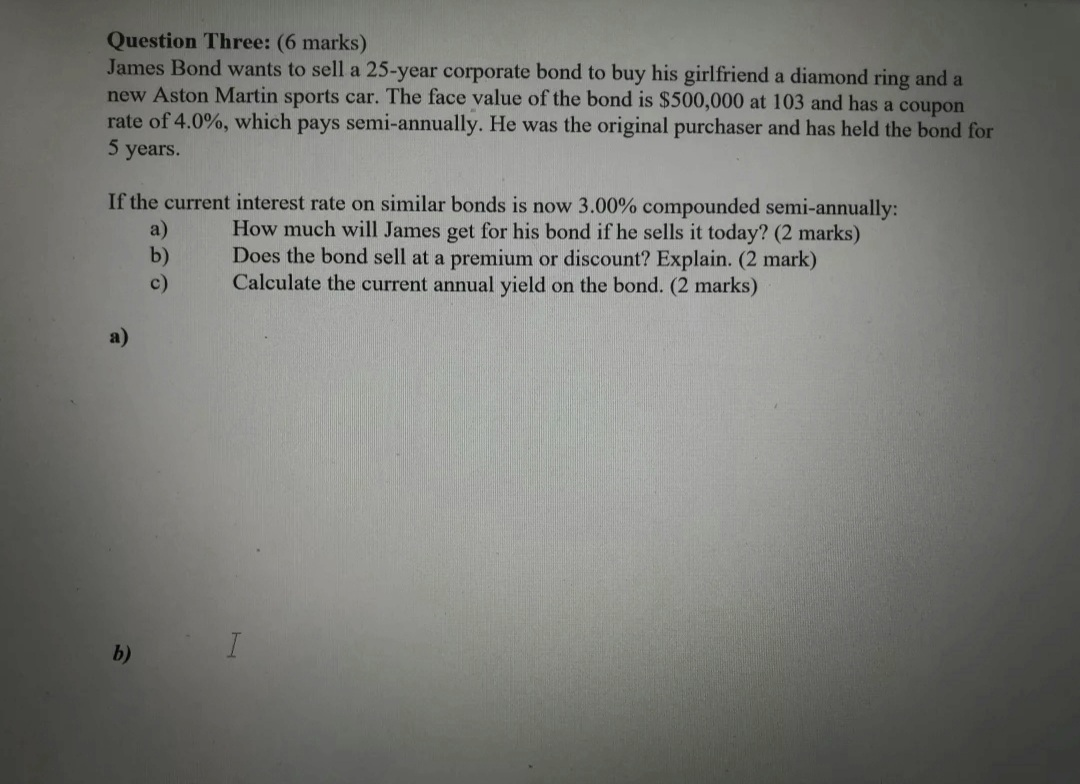

Question Three: (6 marks) James Bond wants to sell a 25-year corporate bond to buy his girlfriend a diamond ring and a new Aston Martin sports car. The face value of the bond is $500,000 at 103 and has a coupon rate of 4.0%, which pays semi-annually. He was the original purchaser and has held the bond for 5 years. If the current interest rate on similar bonds is now 3.00% compounded semi-annually: a) How much will James get for his bond if he sells it today? (2 marks) b) Does the bond sell at a premium or discount? Explain. (2 mark) Calculate the current annual yield on the bond. (2 marks) a) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts