Question: I want the answer as soon as possible thx Sameer. Hani, and Ali are partners in SHA Partnership. On 1/1/2021, they decide to liquidate their

I want the answer as soon as possible thx

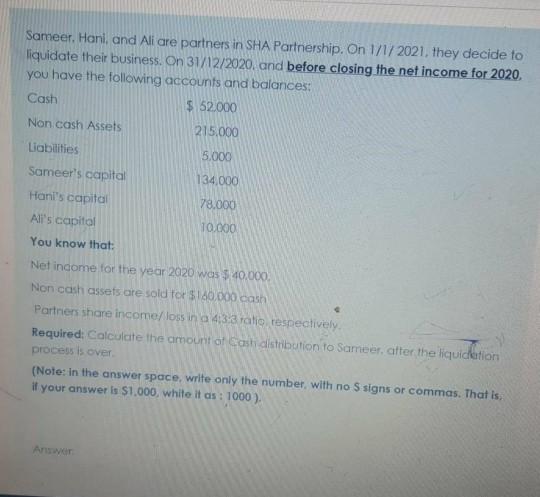

Sameer. Hani, and Ali are partners in SHA Partnership. On 1/1/2021, they decide to liquidate their business. On 31/12/2020, and before closing the net income for 2020, you have the following accounts and balances: Cash $ 52.000 Non cash Assets 215,000 Liabilities Sameer's capital Hani's capital Ali's capital 5.000 134,000 78.000 10.000 You know that: Net income for the year 2020 was $ 40.000, Non cash assets are sold for $160.000 cash Partners share income/loss in a 433 ratio respectively. Required: Calculate the amount of costi distribution to Sameer, after the liquidation process is over (Note: in the answer space, write only the number, with no 5 signs or commas. That is if your answer is $1.000, while it as : 1000 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts