Question: I want the answer in clear steps using a financial calculator Calculating the NPV for Project Long Project Long requires an initial investment of $100,000

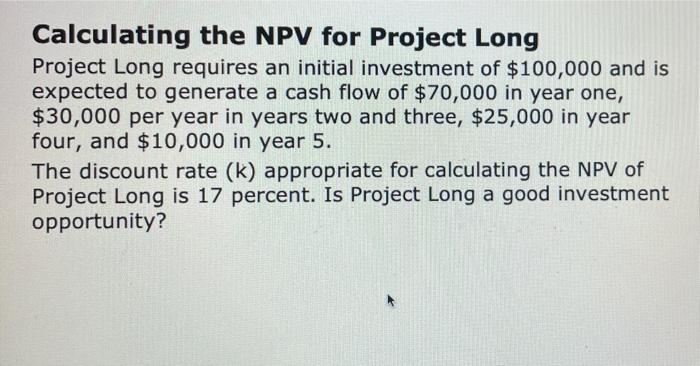

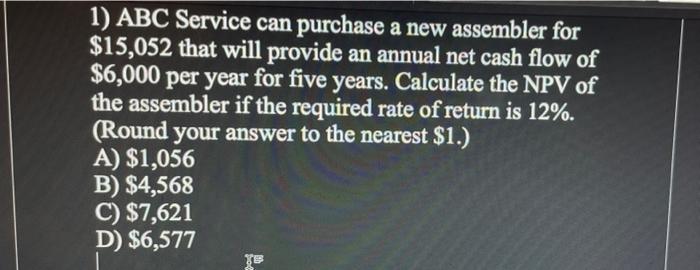

Calculating the NPV for Project Long Project Long requires an initial investment of $100,000 and is expected to generate a cash flow of $70,000 in year one, $30,000 per year in years two and three, $25,000 in year four, and $10,000 in year 5. The discount rate (k) appropriate for calculating the NPV of Project Long is 17 percent. Is Project Long a good investment opportunity? 1) ABC Service can purchase a new assembler for $15,052 that will provide an annual net cash flow of $6,000 per year for five years. Calculate the NPV of the assembler if the required rate of return is 12%. (Round your answer to the nearest $1.) A) $1,056 B) $4,568 C) $7,621 D) $6,577

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts