Question: I want the answer in excel please! Case Study John Crockett furniture company is considering adding a new line to its product mix, and the

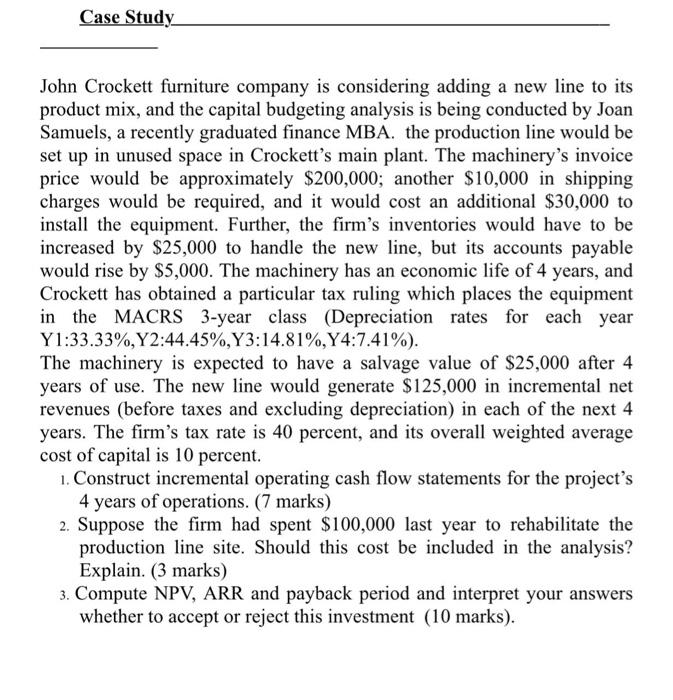

Case Study John Crockett furniture company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by Joan Samuels, a recently graduated finance MBA. the production line would be set up in unused space in Crockett's main plant. The machinery's invoice price would be approximately $200,000; another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. Further, the firm's inventories would have to be increased by $25,000 to handle the new line, but its accounts payable would rise by $5,000. The machinery has an economic life of 4 years, and Crockett has obtained a particular tax ruling which places the equipment in the MACRS 3-year class (Depreciation rates for each year Y1:33.33%,Y2:44.45%,Y3:14.81%,Y4:7.41%). The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate $125,000 in incremental net revenues (before taxes and excluding depreciation) in each of the next 4 years. The firm's tax rate is 40 percent, and its overall weighted average cost of capital is 10 percent. 1. Construct incremental operating cash flow statements for the project's 4 years of operations. (7 marks) 2. Suppose the firm had spent $100,000 last year to rehabilitate the production line site. Should this cost be included in the analysis? Explain. (3 marks) 3. Compute NPV, ARR and payback period and interpret your answers whether to accept or reject this investment (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts