Question: i want the answer to part B only Task Use the following information below: BBF Inc. Balance Sheet at 31/12/2017 & 31/12/2018 Assets 2017 2018

i want the answer to part B only

i want the answer to part B only

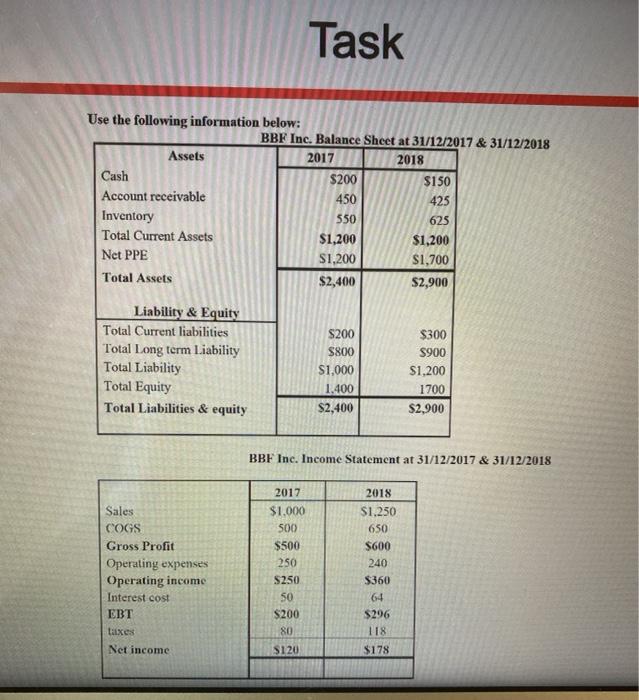

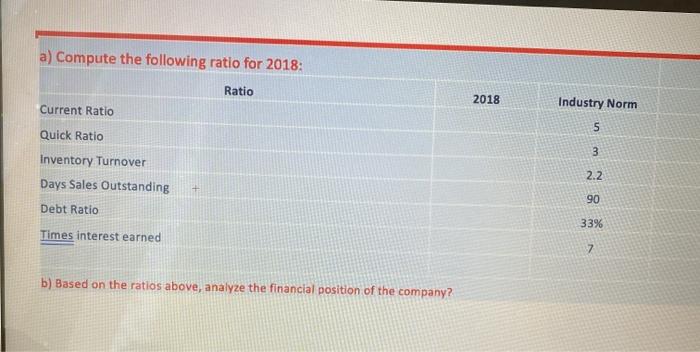

Task Use the following information below: BBF Inc. Balance Sheet at 31/12/2017 & 31/12/2018 Assets 2017 2018 Cash $200 $150 Account receivable 450 425 Inventory 550 625 Total Current Assets $1,200 $1,200 Net PPE S1,200 $1,700 Total Assets $2,400 $2,900 Liability & Equity Total Current liabilities Total Long term Liability Total Liability Total Equity Total Liabilities & equity S200 S800 $1,000 1.400 $2,400 $300 5900 $1,200 1700 $2,900 BBF Inc. Income Statement at 31/12/2017 & 31/12/2018 Sales COGS Gross Profit Operating expenses Operating income Interest cost EBT taxes Net income 2017 $1.000 500 $500 250 S250 SO $200 80 SI20 2018 $1.250 650 $600 240 $360 64 $296 118 $178 a) Compute the following ratio for 2018: Ratio 2018 Current Ratio Industry Norm 5 Quick Ratio 3 Inventory Turnover Days Sales Outstanding 2.2 90 Debt Ratio 33% Times interest earned N b) Based on the ratios above, analyze the financial position of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts