Question: I want the same answer pleasse Case study (3) the As of December 31, 2018, Eman Corporation reported Dividends payable 20,000 Treasury stock 300,000 Paid-in

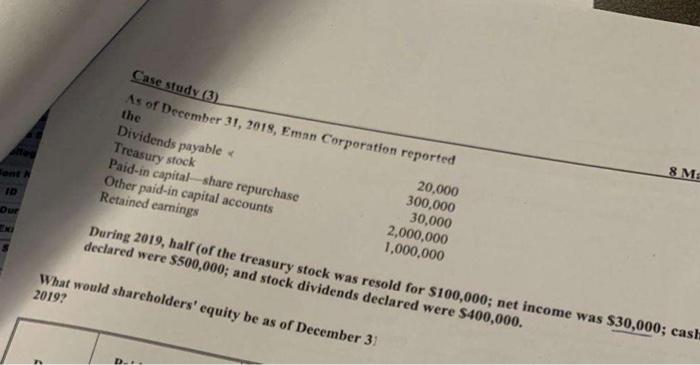

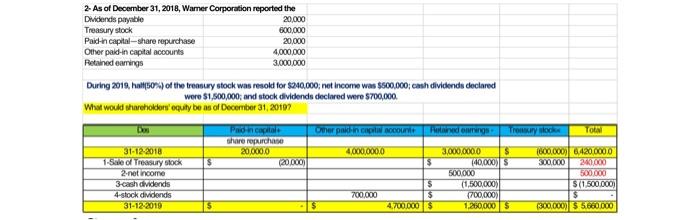

Case study (3) the As of December 31, 2018, Eman Corporation reported Dividends payable 20,000 Treasury stock 300,000 Paid-in capital share repurchase 30,000 Other paid-in capital accounts 2,000,000 Retained earnings 1,000,000 ent 8 M: ID our During 2019, half of the treasury stock was resold for $100,000; net income was $30,000; cash declared were $500,000; and stock dividends declared were $400,000. What would shareholders' equity be as of December 31 2019? 2- As of December 31, 2018, Wamer Corporation reported the Dividends payable 20.000 Treasury stock 600,000 Paid-in capital-share repurchase 20.000 Other pakd-in capital accounts 4,000,000 Retained earrings 3,000,000 During 2018, 150%) of the trendy stock was resolt for $240,000, net income was $600,000 cash dividends declared were $1,500,000, and stock dividends declared were $700,000 What would shareholder equly be as of December 31, 2017 Des Procopter Omer pakt in court domingo Tros TONI share repurchase 31-12-2018 20.00070 40000000 3/000/0000 $ 600.00064200000 1- Sale of Treasury sock (20.000) $ 140,000) 300.000 246000 2.net income 500.000 500.000 3-cash dividends $ (1,500,000) S (1.500.000) 4-stock dividends 700,000 $ 700,000) $ 31-12-2019 4.700.000 1,250,000 $ (300.000 $5660.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts