Question: i want the solution ways Question 1 (12 points) On December 31, 2010, Atlas Company finished consultation services for Palestine Company and accepted in exchange

i want the solution ways

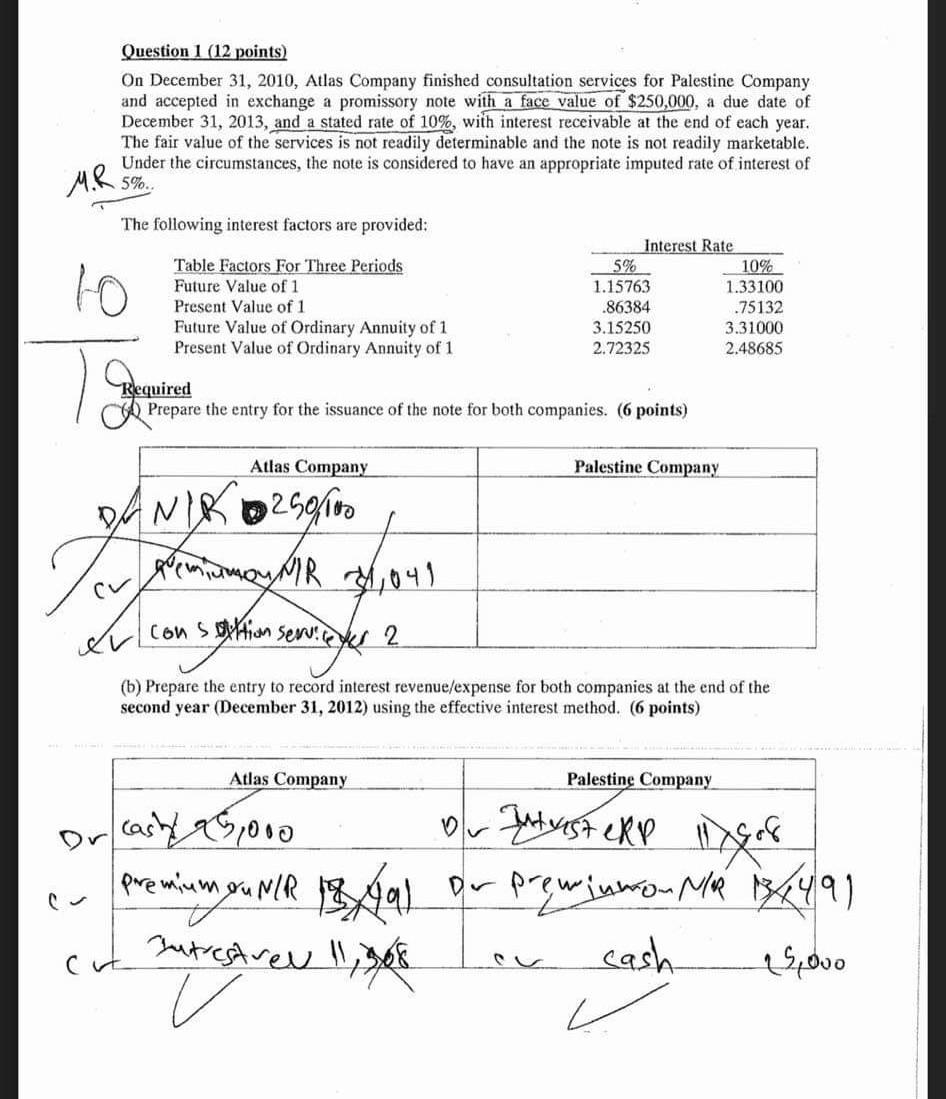

Question 1 (12 points) On December 31, 2010, Atlas Company finished consultation services for Palestine Company and accepted in exchange a promissory note with a face value of $250,000, a due date of December 31, 2013, and a stated rate of 10%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of M.R. 5%.. The following interest factors are provided: Interest Rate 5% 10% 10 Table Factors For Three Periods Future Value of 1 1.15763 1.33100 Present Value of 1 .86384 .75132 3.15250 3.31000 Future Value of Ordinary Annuity of 1 Present Value of Ordinary Annuity of 1 2.72325 2.48685 Required Prepare the entry for the issuance of the note for both companies. (6 points) Atlas Company Palestine Company DANIR 250/100 Te WIR $1,041 constion services 2 ev (b) Prepare the entry to record interest revenue/expense for both companies at the end of the second year (December 31, 2012) using the effective interest method. (6 points) Atlas Company Palestine Company Dr Cash 5,000 Dr Intrest CRP 11/ger linger premium ou N/R 18 491 Our preminmou MR 13/491 cut Intrestrev 11, 308 cash 25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts