Question: I want this problem to be solved again i feel there are mistakes in answer i received requirements are: calculate the net income or loss

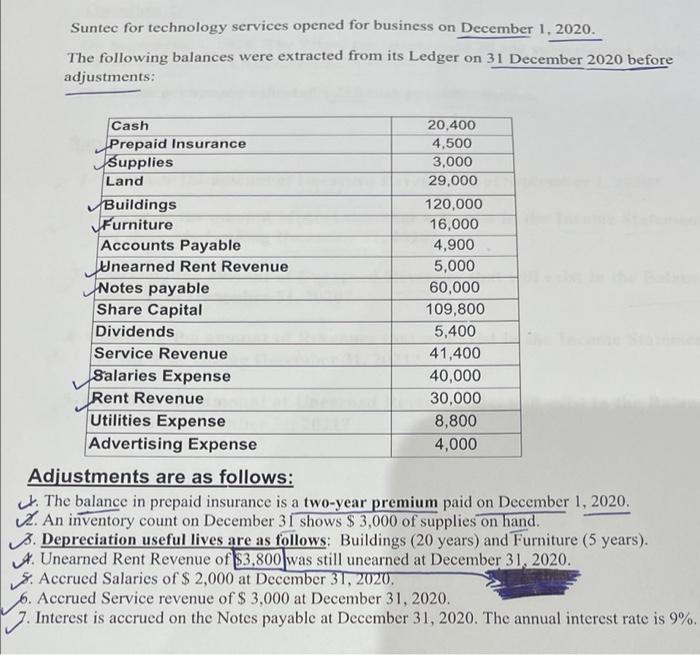

Suntec for technology services opened for business on December 1, 2020. The following balances were extracted from its Ledger on 31 December 2020 before adjustments: Cash 20,400 Prepaid Insurance 4,500 Supplies 3,000 Land 29,000 Buildings 120,000 Furniture 16,000 Accounts Payable 4,900 Unearned Rent Revenue 5,000 Notes payable 60,000 Share Capital 109,800 Dividends 5,400 Service Revenue 41,400 Salaries Expense 40,000 Rent Revenue 30,000 Utilities Expense 8,800 Advertising Expense 4,000 Adjustments are as follows: 4. The balance in prepaid insurance is a two-year premium paid on December 1, 2020. 2. An inventory count on December 31 shows $ 3,000 of supplies on hand. 3. Depreciation useful lives are as follows: Buildings (20 years) and Furniture (5 years). 4. Unearned Rent Revenue of $3,800 was still unearned at December 31, 2020. 3. Accrued Salaries of $ 2,000 at December 31, 2020, 6. Accrued Service revenue of $ 3.000 at December 31, 2020. Interest is accrued on the Notes payable at December 31, 2020. The annual interest rate is 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts