Question: I want to double check my calculation for the amortization chart. On the final year, I calculated the principal paid is $178,061.52 I am not

I want to double check my calculation for the amortization chart. On the final year, I calculated the principal paid is $178,061.52

I am not sure how other people are getting $178,061.53 and not $178,061.52 even after I rounded to 2nd decimal places on excel and BAII calculator.

$190,525.83 - $12,464.31 = $178,061.52

When doing the calculation for amortize chart, does the final beginning balance and principal paid need to be exact match? even though it's off by 1 cent? is it possible they intentionally added the 1 cent to break even for the ending balance?

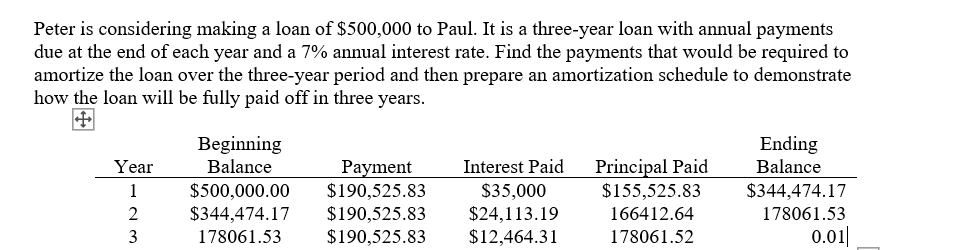

Peter is considering making a loan of $500,000 to Paul. It is a three-year loan with annual payments due at the end of each year and a 7% annual interest rate. Find the payments that would be required to amortize the loan over the three-year period and then prepare an amortization schedule to demonstrate how the loan will be fully paid off in three years. Year 1 2 3 Beginning Balance $500,000.00 $344,474.17 178061.53 Payment $190,525.83 $190,525.83 $190,525.83 Interest Paid $35,000 $24,113.19 $12,464.31 Principal Paid $155,525.83 166412.64 178061.52 Ending Balance $344,474.17 178061.53 0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts