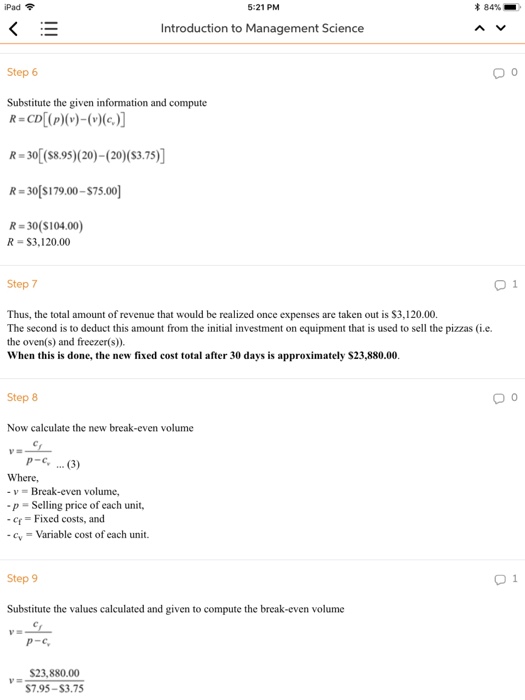

Question: I was able to answer a and b but I dont understand how the answer in c came about. Why do I need to deduct

I was able to answer a and b but I dont understand how the answer in c came about. Why do I need to deduct the 3120 on my fixed cost. The problem stated that there will only be a difference in the variable cost

I was able to answer a and b but I dont understand how the answer in c came about. Why do I need to deduct the 3120 on my fixed cost. The problem stated that there will only be a difference in the variable cost

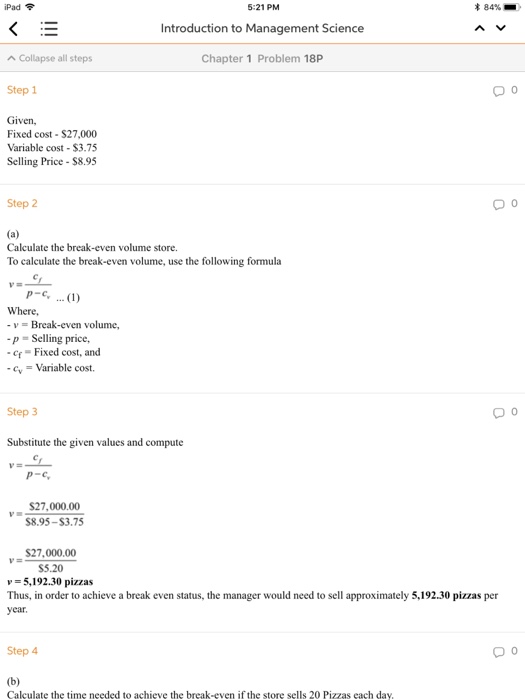

sells academic supplies, toiletries, sweatshirts and T-shirts, magazines, packaged food items, and canned soft drinks and fruit drinks. The manager of the store has noticed that several pizza de- livery services near campus make frequent deliveries. The manager is therefore considering sell ing pizza at the store. She could buy premade frozen pizzas and heat them in an oven. The cost of the oven and freezer would be $27,000. The frozen pizzas cost $3.75 each to buy from a dis- tributor and to prepare (including labor and a box). To be competitive with the local delivery services, the manager believes she should sell the pizzas for $8.95 apiece. The manager needs to write up a proposal for the university's director of auxiliary services a. Determine how many pizzas would have to be sold to break even b. If The General Store sells 20 pizzas per day, how many days would i take to break even? c. The manager of the store anticipates that once the local pizza delivery services start losing business, they will react by cuting prices. If after a month (30 days) the manager has to lower the price of a pizza to $7.95 to keep demand at 20 pizzas per day, as she expects, what will the new break-even point be, and how long wi it take the store to break even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts