Question: i was not given the PV factor table Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project requires

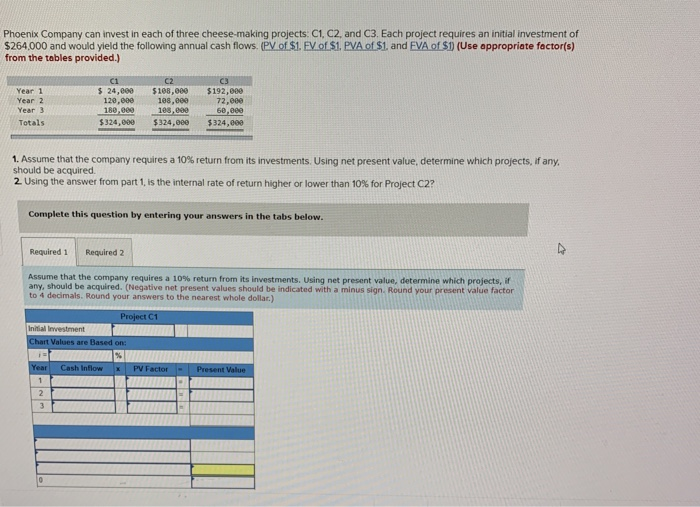

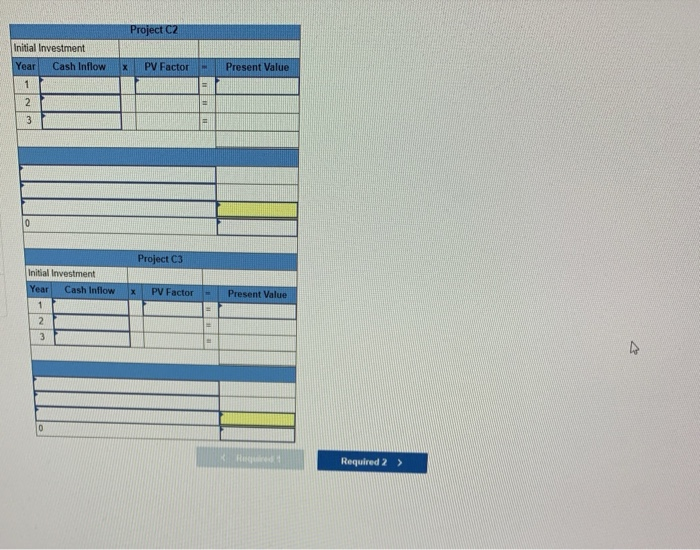

Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project requires an initial investment of $264,000 and would yield the following annual cash flows PV of $1. FV of $1. PVA of $1, and EVA of S1) (Use appropriate factor(s) from the tables provided.) Year 1 $ 24,000 120,000 180.00 5108,000 1e8,eee les.ee $324.ee $ 192,000 72.000 60,000 $324.000 $324.00 1. Assume that the company requires a 10% return from its investments. Using net present value, determine which projects, if any. should be acquired 2. Using the answer from part 1, is the internal rate of return higher or lower than 10% for Project C2? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company requires a 10% return from its investments. Using net present value, determine which projects, if any, should be acquired. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar) Project C1 Investment Chart Values are Based on Year Cash flow PV Factor - Present Value Project C2 Initial Investment Year Cash Inflow X PV Factor - Present Value Project C3 Initial Investment Year Cash Inflow X PV Factor - Present Value Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts