Question: I was wondering if you could help me with Problem 8-5A Chapter 8 in the book fundamental accounting principles. aoe are the December 31, 2017,

I was wondering if you could help me with Problem 8-5A Chapter 8 in the book fundamental accounting principles.

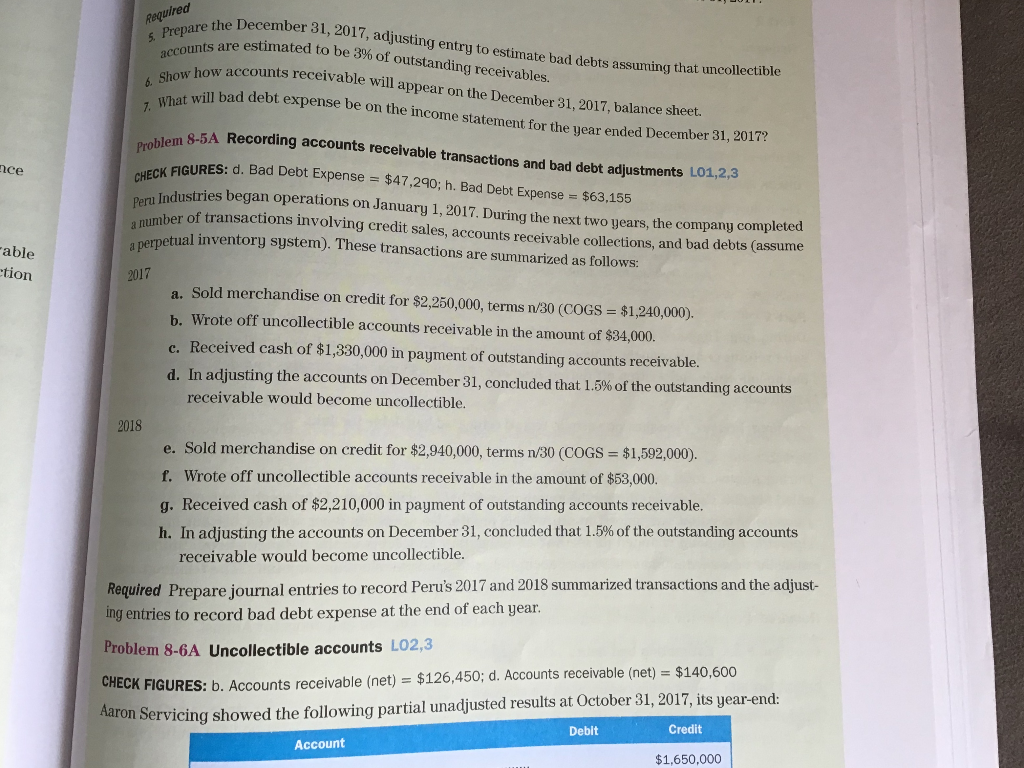

aoe are the December 31, 2017, adjusting entry to estimate bad debts assuming that uncollectible Required nts are estimated to be 3% of outstanding receivables. w how accounts receivable will appear on the December 31, 2017, balance sheet. huat will bad debt expense be on the income statement for the year ended December 31, 201 What w A Recording accounts recelvable transactions and bad debt adjustments LO Problem 8-5A FIGURES: d. Bad Debt Expense ustries began operations on January 1, 2017. During the nce $47,290; h. Bad Debt Expense $63.155 number of transactions involving credit sales, accounts receivable collections, and bad debts (assume a perpetual inventory system). These transactions are summarized as follows next two years, the company completed able tion 2017 a. Sold merchandise on credit for $2,250,000, terms n/30 (COGS $1,240,000). b. Wrote off uncollectible accounts receivable in the amount of $34,000. c. Received cash of $1,330,000 in payment of outstanding accounts receivable. d. In adjusting the accounts on December 31, concluded that 1.5% of the outstanding accounts receivable would become uncollectible. 2018 e. Sold merchandise on credit for $2,940,000, terms n/30 (COGS $1,592,000). f. Wrote off uncollectible accounts receivable in the amount of $53,000. g. Received cash of $2,210,000 in payment of outstanding accounts receivable. h. In adjusting the accounts on December 31, concluded that 1.5% of the outstanding accounts receivable would become uncollectible. Required Prepare journal entries to record Peru's 2017 and 2018 summarized transactions and the adjust ing entries to record bad debt expense at the end of each year. Problem 8-6A Uncollectible accounts L02,3 CK FIGURES: b. Accounts receivable (net) = $126,450; d. Accounts receivable (net)-$140,600 on Servicing showed the following partial unadjusted results at October 31, 2017, its year-end CHE Debit Credit Account $1,650,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts