Question: I wasn't able to complete.. please help! Journal Entries for Material, Labor, Overhead, and Sales Micro Enterprises had the following job order transactions during the

I wasn't able to complete.. please help!

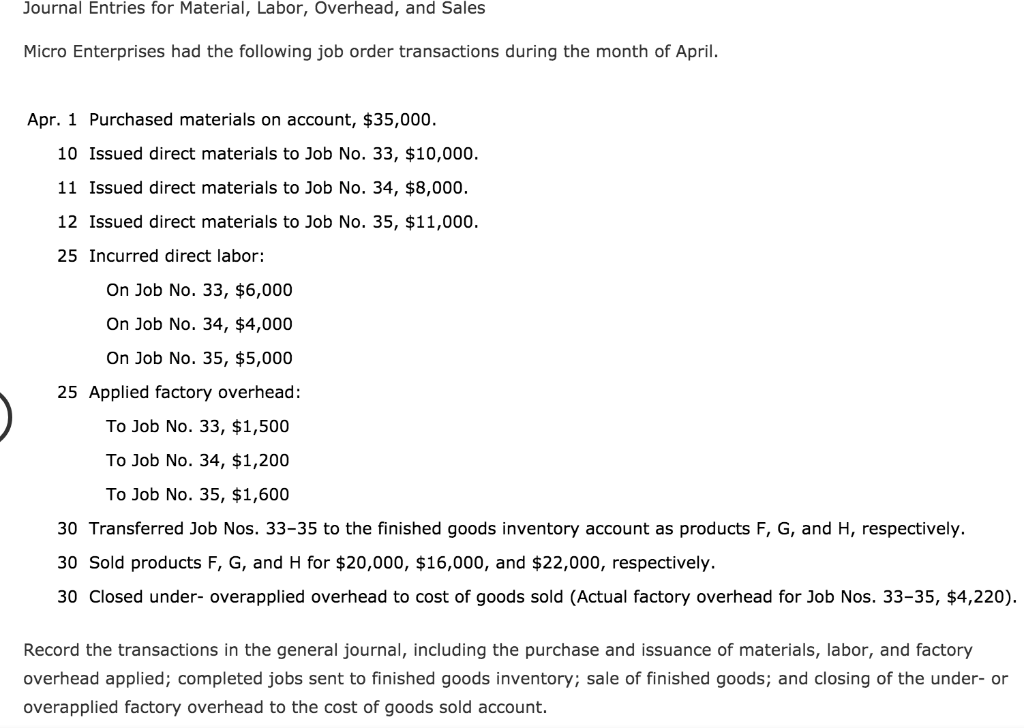

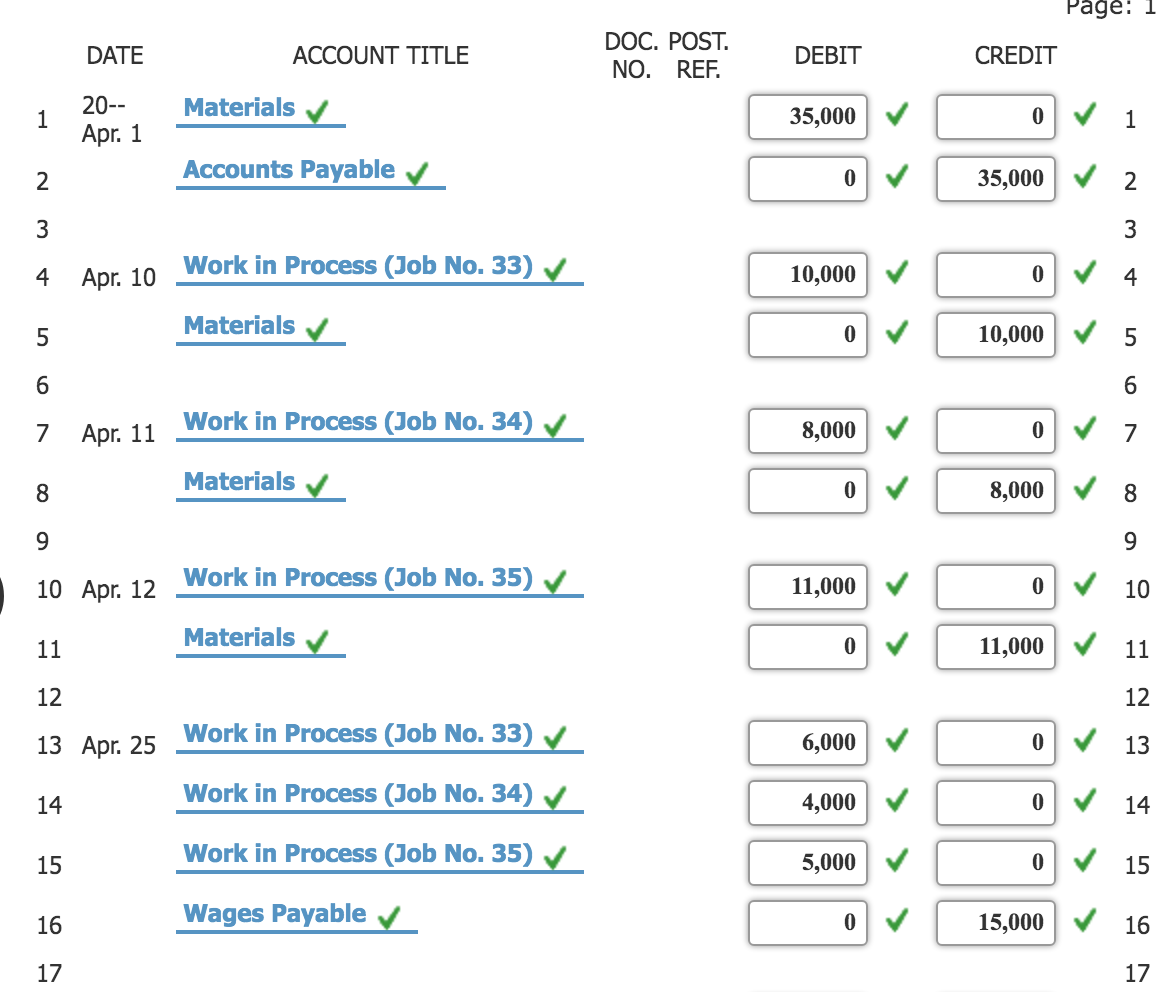

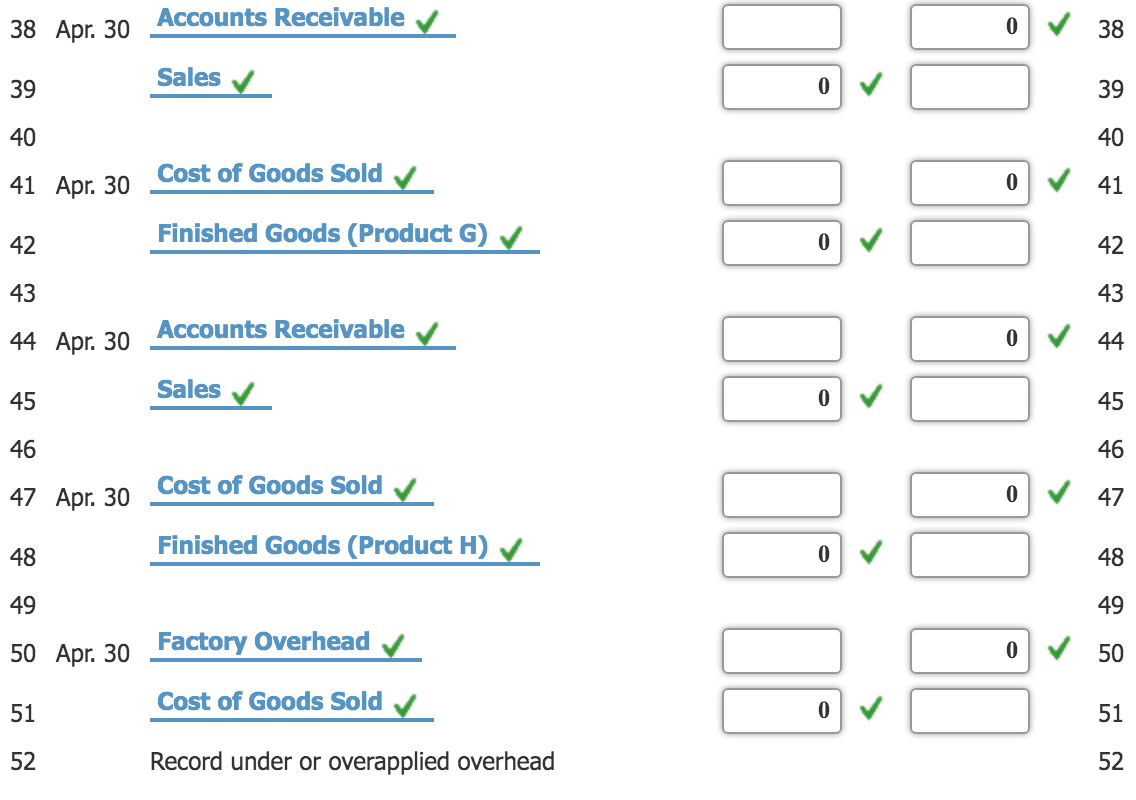

Journal Entries for Material, Labor, Overhead, and Sales Micro Enterprises had the following job order transactions during the month of April. Apr. 1 Purchased materials on account, $35,000. 10 Issued direct materials to Job No. 33, $10,000. 11 Issued direct materials to Job No. 34, $8,000. 12 Issued direct materials to Job No. 35, $11,000. 25 Incurred direct labor: On Job No. 33, $6,000 On Job No. 34, $4,000 On Job No. 35, $5,000 25 Applied factory overhead: To Job No. 33, $1,500 To Job No. 34, $1,200 To Job No. 35, $1,600 30 Transferred Job Nos. 33-35 to the finished goods inventory account as products F, G, and H, respectively. 30 Sold products F, G, and H for $20,000, $16,000, and $22,000, respectively. 30 Closed under- overapplied overhead to cost of goods sold (Actual factory overhead for Job Nos. 33-35, $4,220). Record the transactions in the general journal, including the purchase and issuance of materials, labor, and factory overhead applied; completed jobs sent to finished goods inventory; sale of finished goods; and closing of the under-or overapplied factory overhead to the cost of goods sold account. Page: 1 DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 20- Apr. 1 Materials 1 35,000 0 0 35,000 1 2 Accounts Payable Apr. 10 Work in Process (Job No. 33) 10,000 10 000 Materials 10,000 7. Apr. 11 Work in Process (Job No. 34) 8,000 Materials 8,000 10 Apr. 12 Work in Process (Job No. 35) 11,000 0 11 Materials 11,000 11 13 Apr. 25 Work in Process (Job No. 33 6,000 0 Work in Process (Job No. 34) 4,000 Work in Process (Job No. 35) 5,000 16 Wages Payable 0 15,000 18 Apr. 25 2 Work in Process (Job No. 33) . 1,500 Work in Process (Job No. 34) 1,200 20 Work in Process (Job No. 35) 1, 6000 0 21 Factory Overhead (Applied) 4,300 23 Apr 30 Finished Goods (Product F) Work in Process (Job No. 33) Apr 30 Finished Goods (Product G) Work in Process (Job No. 34) 29 Apr. 30 Finished Goods (Product H) 30 Work in Process (Job No. 35) 31 32 Apr. 30 Accounts Receivable Sales 35 Apr 30 Cost of Goods Sold 36 Finished Goods (Product F) 38 Apr. 30 Accounts Receivable v Sales 41 Apr. 30 Cost of Goods Sold v Finished Goods (Product G) / 43 - 44 Apr. 30 Accounts Receivable v 45 Sales Sales v 000 47 Apr: 30 Cost of Goods Sold / Finished Goods (Product H) / 50 Apr. 30 Factory Overhead Cost of Goods Sold Record under or overapplied overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts