Question: I wasn't able to solve this question completely for an assignment got confused. Any way anyone can help. I don't want just the answers, but

I wasn't able to solve this question completely for an assignment got confused. Any way anyone can help. I don't want just the answers, but would really appreciate a step-by-step so I can learn the process and what I am doing wrong.

I wasn't able to solve this question completely for an assignment got confused. Any way anyone can help. I don't want just the answers, but would really appreciate a step-by-step so I can learn the process and what I am doing wrong.

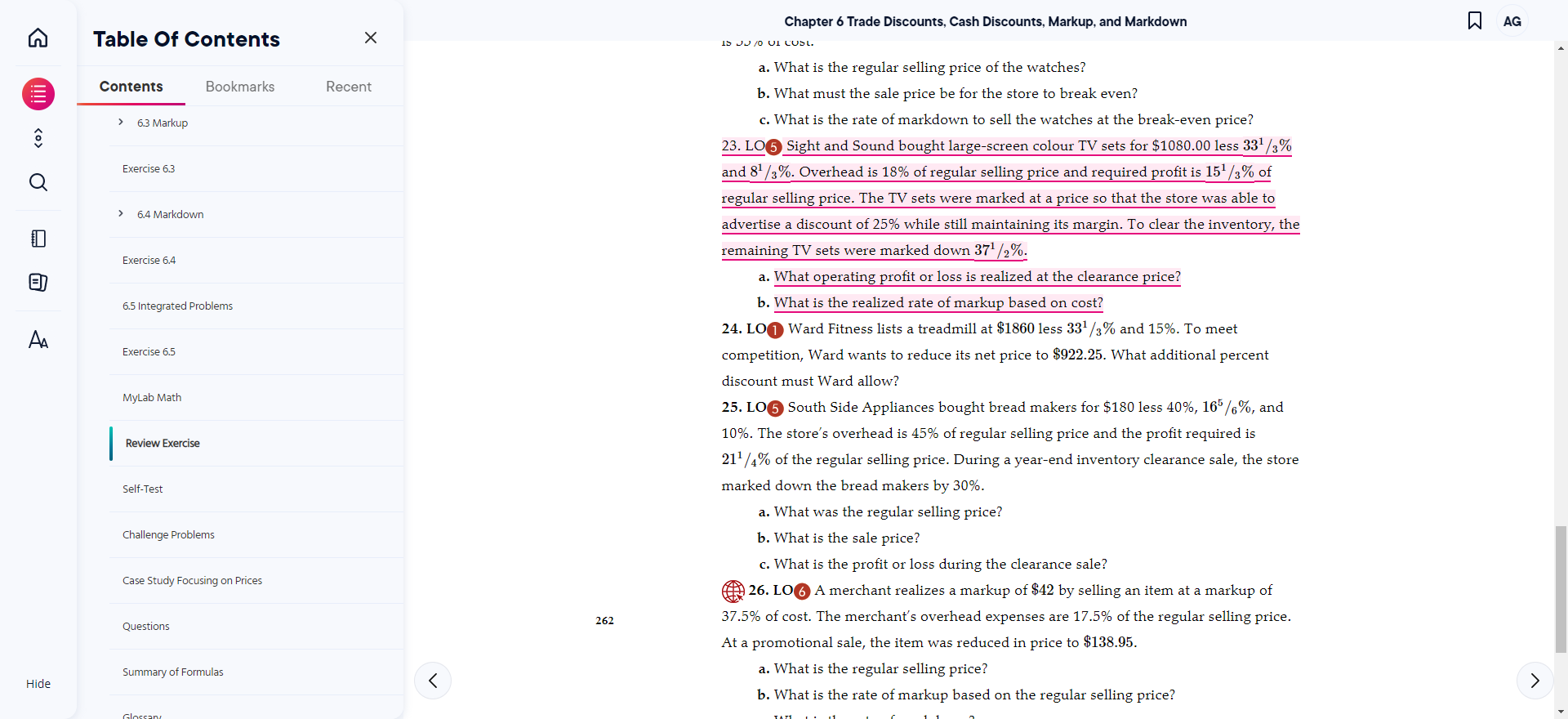

Chapter 6 Trade Discounts, Cash Discounts, Markup, and Markdown AG un Table of Contents IS JJ /0 01 COSL. Contents Bookmarks Recent 63 Markup

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts