Question: I. When developing a financial plan for a corporation you should consider which of the I. How much net working capital will be needed? II.

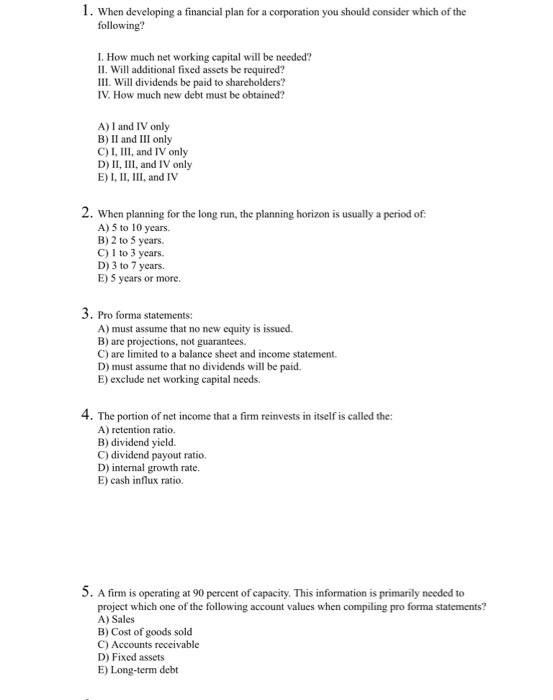

I. When developing a financial plan for a corporation you should consider which of the I. How much net working capital will be needed? II. Will additional fixed assets be required? III. Will dividends be paid to shareholders? IV How much new debt must be obtained? A) I and IV only B) I and III only C) L, III, and IV only D) II, II, and IV only E) I, II, III, and IV 2. When planning for the long run, the planning horizon is usually a period of. A) 5 to 10 years. ) 2 to 5 years. C) 1 to 3 years. D) 3 to 7 years. E) 5 years or more. 3. Pro forma statements: A) must assume that no new equity is issued. B) are projections, not guarantees C) are limited to a balance sheet and income statement. D) must assume that no dividends will be paid. E) exclude net working capital needs. 4. The portion of net income that a firm reinvests in itself is called the: A) retention ratio. B) dividend yield. C) dividend payout ratio. D) internal growth rate. E) cash influx ratio. S. A firm is operating at 90 percent of capacity. This information is primarily needed to project which one of the following account values when compiling pro forma statements? A) Sales B) Cost of goods sold C) Accounts receivable D) Fixed assets E) Long-term debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts