Question: i will also he posting part c and part d afted I answer. thank you! (: 1.25/5 Marin Inc.'s bank statement from Main Street Bank

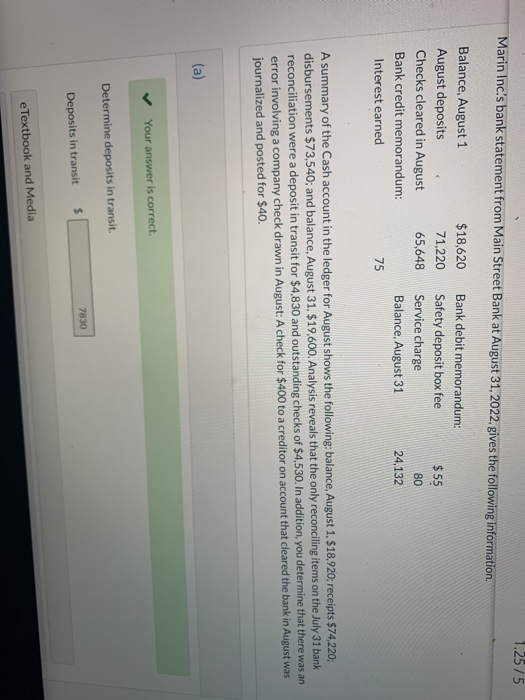

1.25/5 Marin Inc.'s bank statement from Main Street Bank at August 31, 2022, gives the following information Balance, August 1 August deposits Checks cleared in August Bank credit memorandum: Interest earned $18,620 71,220 65,648 Bank debit memorandum: Safety deposit box fee Service charge Balance, August 31 $55 80 24,132 75 A summary of the Cash account in the ledger for August shows the following: balance, August 1, $18,920; receipts $74,220; disbursements $73,540; and balance, August 31, $19,600. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $4,830 and outstanding checks of $4,530. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40. (a) Your answer is correct. Determine deposits in transit. 7830 Deposits in transit $ eTextbook and Media (b) Determine outstanding checks. (Hint: You need to correct disbursements for the check error.) Outstanding checks $ e Textbook and Media List of Accounts Attempts: 0 of 3 used Submit Answer Save for Later mplete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts