Question: i will ask you to obtain the info and do the calculation to make an assessment of the situation, you could use another industry such

i will ask you to obtain the info and do the calculation to make an assessment of the situation,

i will ask you to obtain the info and do the calculation to make an assessment of the situation,

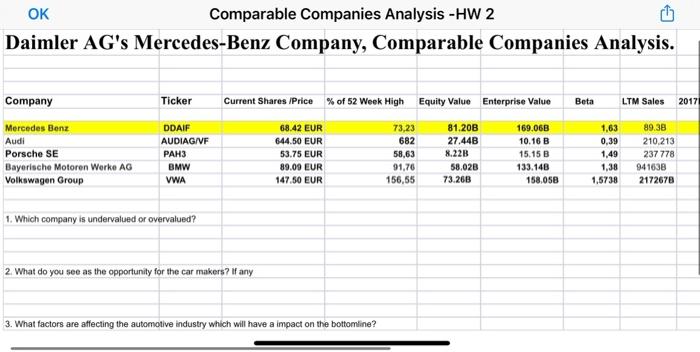

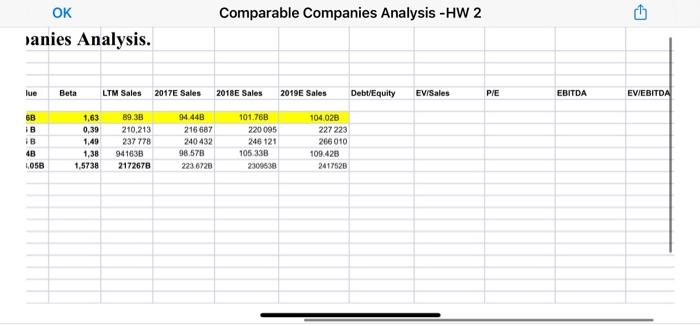

- - - Come Companies Mise Accu Mote Hamil St Art G1 Com 31 Daimler AG's Mercedes-Benz Company, comparable Companies Analysis. Company Tic Current SER 882 ITA Mere 10 Porsche SE 11 WAG HO 1 15 when 2 DOAR AUDIAGNV HO WWA 14 14 1912. What you 30 123 W OK Comparable Companies Analysis -HW 2 Daimler AG's Mercedes-Benz Company, Comparable Companies Analysis. Company Ticker Current Shares /Price% of 52 Week High Equity Value Enterprise Value Beta LTM Sales 2017 Mercedes Benz Audi Porsche SE Bayerische Motoren Werke AG Volkswagen Group DDAIF AUDIAG/VF PAH3 BMW VWA 68.42 EUR 644.50 EUR 53.75 EUR 89.09 EUR 147.50 EUR 73,23 682 58,63 91,76 156,55 81.20B 27.44B 8.22B 58.02B 73.26B 169.06B 10.16 B 15.15 B 133.14B 158,058 1,63 0,39 1,49 1,38 1,5738 89.38 210.213 237 778 941638 2172678 1. Which company is undervalued or overvalued? 2. What do you see as the opportunity for the car makers? If any 3. What factors are affecting the automotive industry which will have a impact on the bottomline? Comparable Companies Analysis -HW 2 G OK Danies Analysis. lue Beta LTM Sales 2017 Sales 2018E Sales 2019E Sales Debt/Equity EV/Sales PIE EBITDA EV/EBITDA 6B IB B 4B 1,058 1,63 0,39 1,49 1,38 1,5738 89.38 210.213 237 778 941638 2172678 94.44B 216687 240 432 98.578 223 6728 101.76B 220 095 246 121 105 33B 2309638 104.028 227 223 266 010 109.428 2417528

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts