Question: I will attempt to answer this question, however I am sure I am making very big mistakes. I tried to use a Slovak individual, but

I will attempt to answer this question, however I am sure I am making very big mistakes. I tried to use a Slovak individual, but a US calculator.

So first, I will write out some essential data for this basic/generic average Slovak person using the public scheme only (first pillar) based on some research (please note there are so many variables involved):

- Age of the individual: 25 years old (year of expected completion of university and working full-time).

- Average annual earnings: 15,275 (according to data in 2020 from statista.com)

- Monthly retirement contributions: total 7% for pension insurance (4% to old-age pension and 3% to disability insurance info from ec.europa.eu)

- Employer matching contributions: total 17% for pension insurance (14% to old-age pension and 3% to disability insurance info from ec.europa.eu)

- Pensionable Age: 64 years old (for any man or woman born after 1966 with 0 children raised, data from Socilna Poisova).

- Expected number of years until retirement: 39 years (64 - 25 = 39)

The term, retirement age is very subjective today, for example you could have a successful business, financial luck, inheritance, or a high paid job position for this to happen.

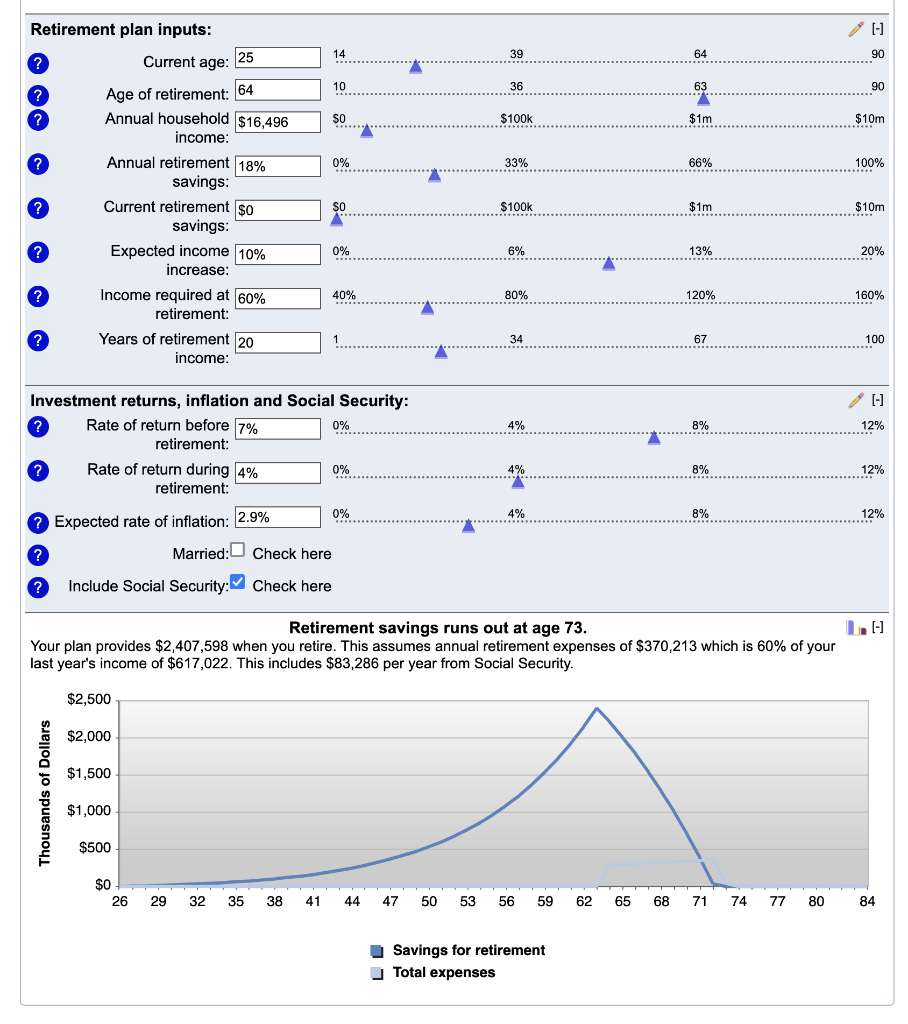

I used an online calculator from Bankrate.com to calculate the amount of savings adding an 10% expected income increase, $0 current savings, 60% income required (as I would hope to have a home), and needed income at retirement at 20 years.

As the online calculators are using US$ dollars, I did a currency conversion to euro. 15,275 at 1 EUR = 1.0800 USD equals $16,496.30

I reversed the currency conversion back to euro. $2,407,598 at 1 USD = 0.9260 EUR equals 2,229,351.48

It formulated my retirement money will run out by the age 73.

PLEASE CAN YOU CHECK IF IT'S CORRECT AND LET ME KNOW WHAT NEEDS TO BE CHANGED WITH APPROPRIATE COMMENT? MANY THANKS!

(-) 14 64 90 10 90 SO $100k $1m $10m 0% 33% 66% 100% Retirement plan inputs: Current age: 25 Age of retirement: 64 Annual household $16,496 income: ? Annual retirement 18% savings: ? Current retirement $0 savings: ? Expected income 10% increase: ? Income required at 60% retirement: ? Years of retirement 20 income: so $100K $1m $10m 0% 6% 13% 20% 40% 80% 120% 160% 67 100 [-] 12% 12% Investment returns, inflation and Social Security: Rate of return before 7% 0% retirement: Rate of return during 4% 0% retirement: 0% Expected rate of inflation: 2.9% Married: Check here Include Social Security Check here 8% 12% Retirement savings runs out at age 73. LC- Your plan provides $2,407,598 when you retire. This assumes annual retirement expenses of $370,213 which is 60% of your last year's income of $617,022. This includes $83,286 per year from Social Security. $2,500 $2,000 $1,500 Thousands of Dollars $1,000 $500 $O 26 29 32 35 38 41 44 47 50 53 56 59 62 65 68 71 74 77 80 84 LL Savings for retirement Total expenses (-) 14 64 90 10 90 SO $100k $1m $10m 0% 33% 66% 100% Retirement plan inputs: Current age: 25 Age of retirement: 64 Annual household $16,496 income: ? Annual retirement 18% savings: ? Current retirement $0 savings: ? Expected income 10% increase: ? Income required at 60% retirement: ? Years of retirement 20 income: so $100K $1m $10m 0% 6% 13% 20% 40% 80% 120% 160% 67 100 [-] 12% 12% Investment returns, inflation and Social Security: Rate of return before 7% 0% retirement: Rate of return during 4% 0% retirement: 0% Expected rate of inflation: 2.9% Married: Check here Include Social Security Check here 8% 12% Retirement savings runs out at age 73. LC- Your plan provides $2,407,598 when you retire. This assumes annual retirement expenses of $370,213 which is 60% of your last year's income of $617,022. This includes $83,286 per year from Social Security. $2,500 $2,000 $1,500 Thousands of Dollars $1,000 $500 $O 26 29 32 35 38 41 44 47 50 53 56 59 62 65 68 71 74 77 80 84 LL Savings for retirement Total expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts