Question: I will automatically Thumpdown if you don't complete all tasks below do not come at me with Cheggs guidelines please, Thanks in Advance for your

I will automatically Thumpdown if you don't complete all tasks below do not come at me with Cheggs guidelines please, Thanks in Advance for your work.

B)____________________________

C)__________________

D__________________

D__________________

E)______________ F)______________

F)______________

G)________________

G)________________

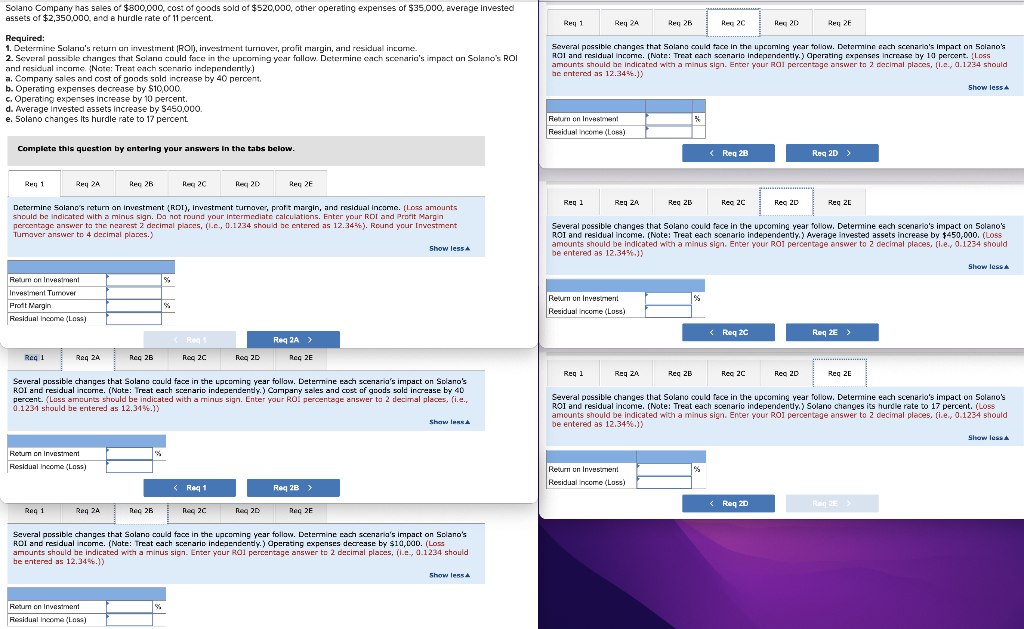

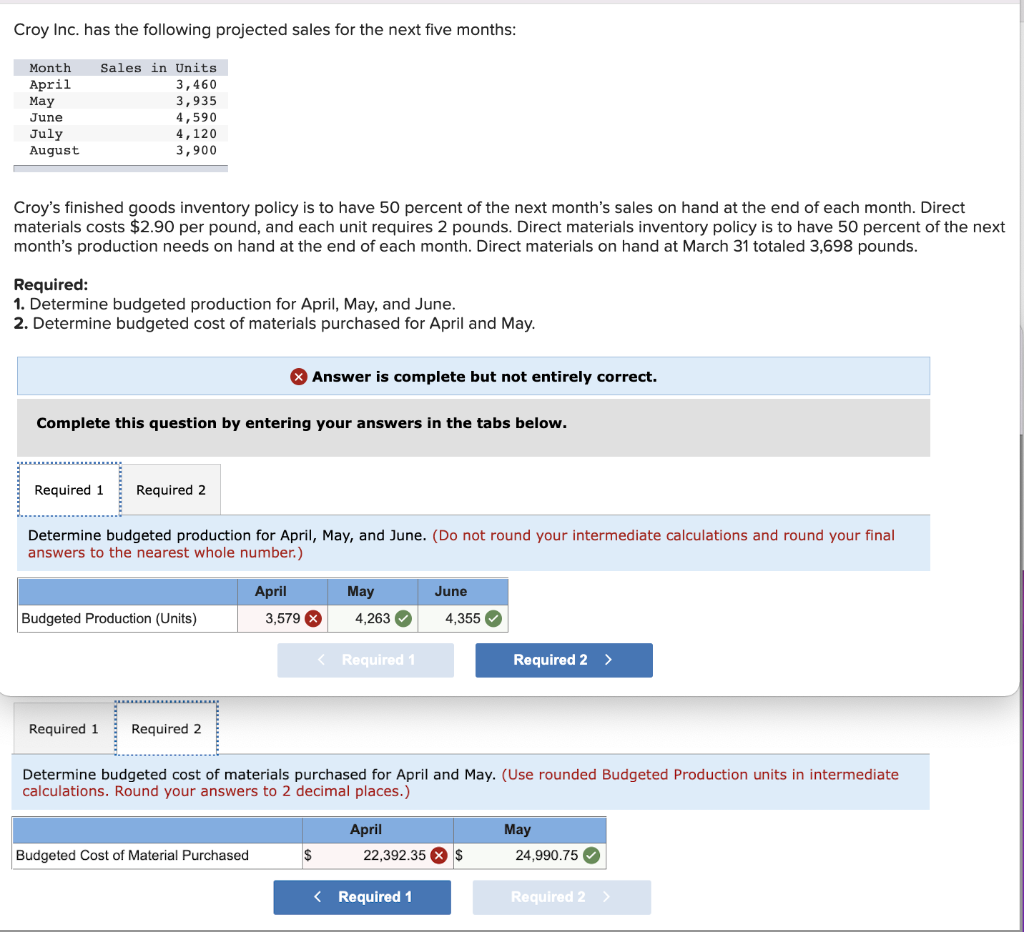

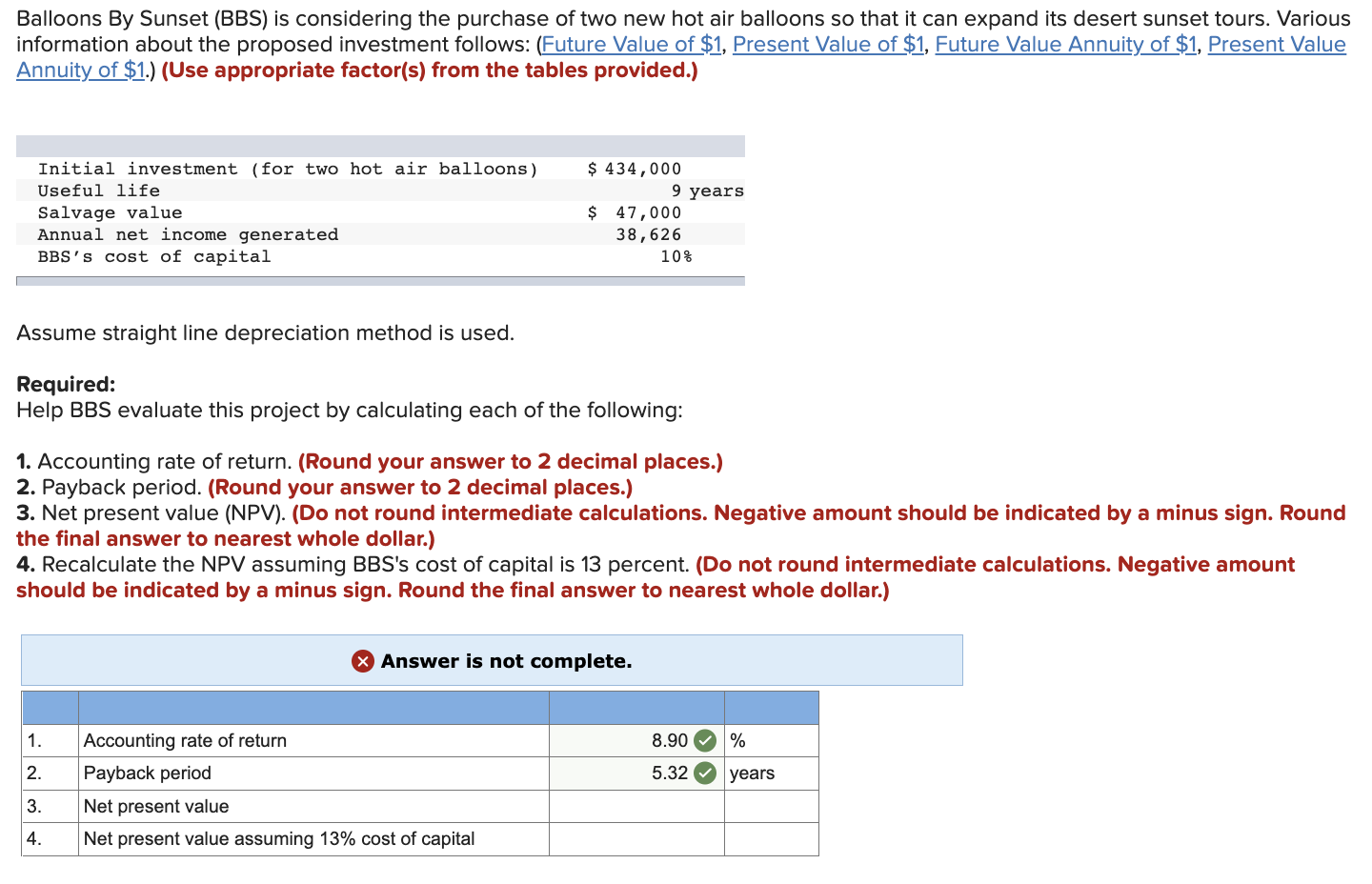

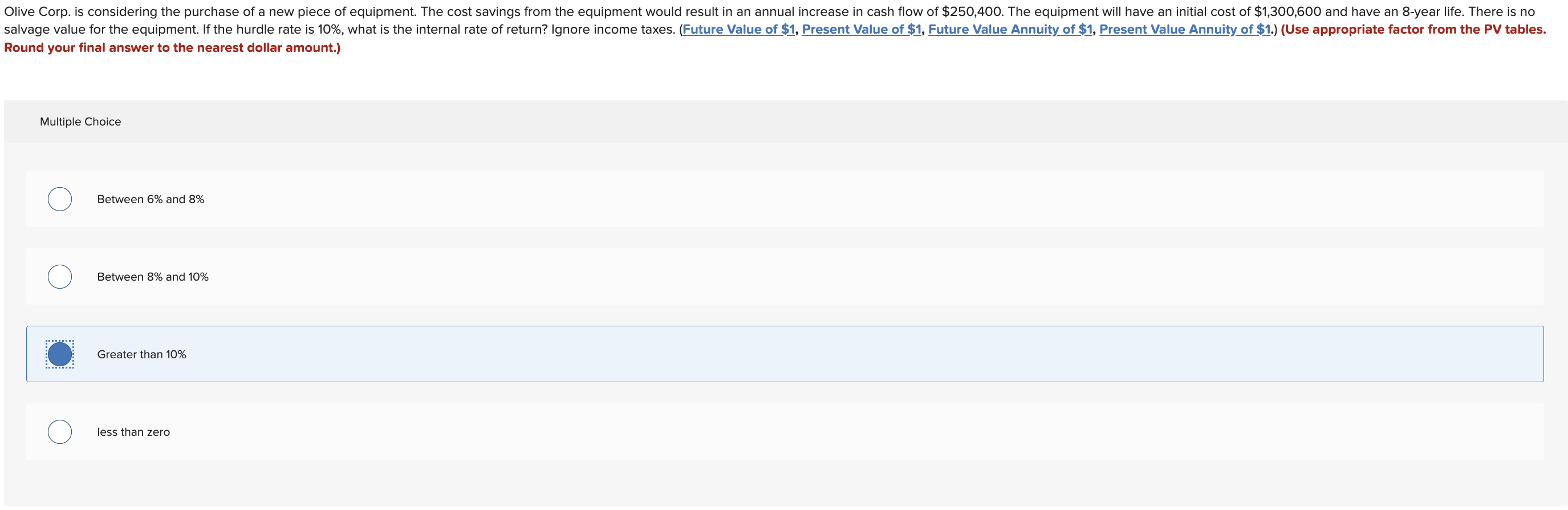

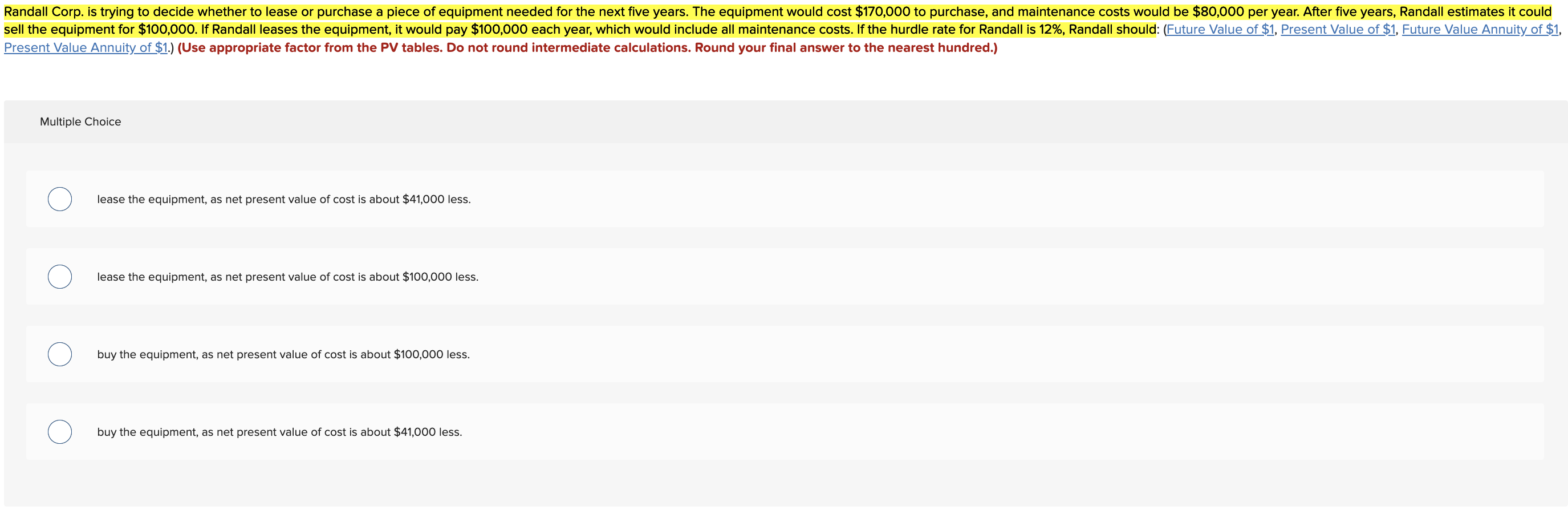

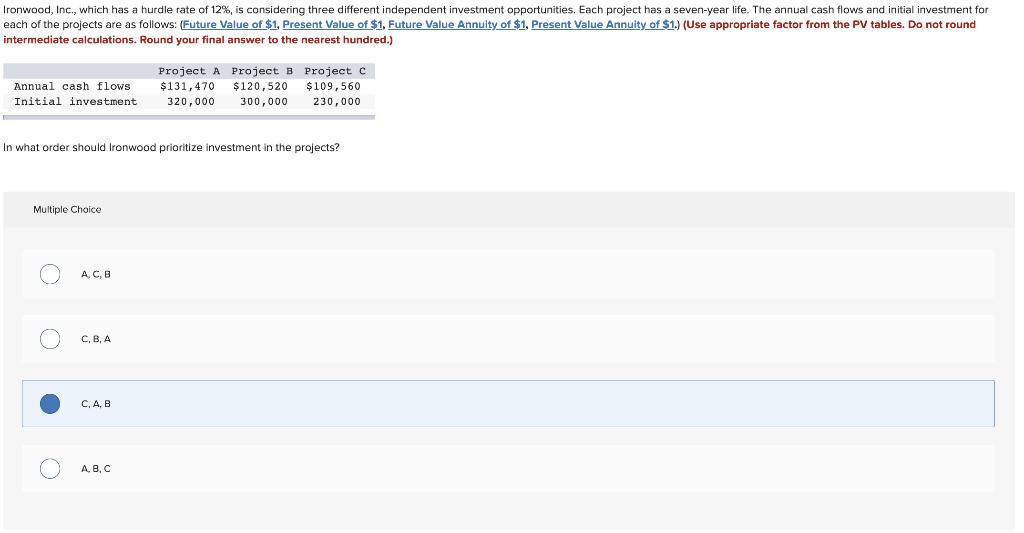

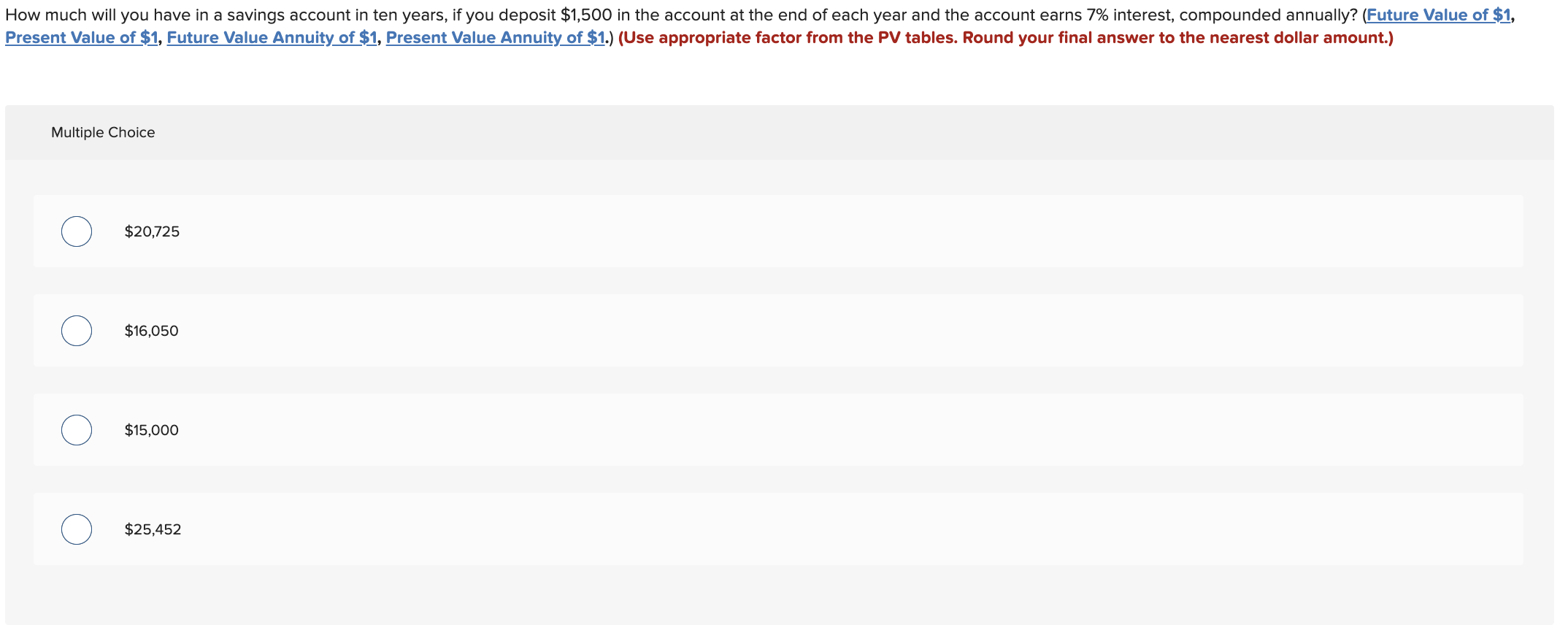

Solano Company has sales of $800,000. cost of goods sold of $520,000, other operating expenses of $35.000average invested assets of $2,350.000, end e hurdle rate of 11 percent. Rey 1 Rey2A Rey 26 Reg 2C Reg 20 Rey 2 Required: 1. Determine Solana's return ar investirent (ROI), investment turnover, profit margin, and residual income. 2. Several possible changes that Salana could face in the upcoming year follow. Determine cach scenaria's impact on Solano's ROI and residual income. Note: Treat each scenario independently) a. Company sales and cost of goods sold increase by 40 percent b. Operating expenses decrease by $10,000 c. Operating expenses increase by 10 percent. d. Average invested assets increase by $450.000. e. Solano changes its hurdle rate to 17 percent Several possible changes that Solana could face in the upcoming year follow. Determine each scenario's Impact on Solano's Rol and residual income. (Note: Treat each scenario Independently.) Operating expenses increase by 10 percent. (Loss amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, (i.c., 0.1234 should be entered as 12.34%) Show less Return on Investment Residual income (06) Complete this question by entering your answers in the tabs below. Rey 1 Rey 24 Ree 2 Rex 2C Rex 20 R2F Reg 1 Reg 2 Reg 20 Reg 20 Res 20 Reg 26 Determine Solano's retum an Investment (ROI), Investment turaver, pratt margin, and residual Income. (Loss amounts should be indicated with a minus sign. Da not round your intermediate calculations. Enter your ROI and Protit Margin percentage answer to the nearest 2 decimal places, (.c., 0.1234 should be entered as 12.345). Round your investment Tumaver answer to 4 decimal places.) Show less Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Sclano's ROI and residual income. (Note: Treat each scenario independently.) Average invested assets increase by $450,000. (LOSS amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Show less Return on Investment Invernal Tumwer Proft Mergin Residual invecme (Loss) $ Return on investment Residual income (LU) . Reg Reg 2 > Reg 1 Req 24 Reg 26 Reg 2 Rog 2D Reg 2E Reg 1 Reg 24 Reg 2 Rec 20 Reg 2D Reg 2E Several possible changes that Solane could face in the upcoming year follow. Determine each scenaria's impact on Solano's ROI and residual income. (Note: Treat each scenario indecendendy.) Company sales and cost of goods sold increase by 40 percent. (Loss amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, i.e., 0.1231 should be entered as 12.31%.)) Show less Several possible changes that Solano could fece in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Solano changes its hurdle rate to 17 percent. (Loss amounts should be indicated with a minus sign. Enter your ROI percentage answer to 2 decimal places, (i.e., 0.1234 should be entered as 12.34%.)) Show less Room on Investment Residual income (Loss) Return on Investment Residual income (LOS) Required 1 Required 2 Determine budgeted cost of materials purchased for April and May. (Use rounded Budgeted Production units in intermediate calculations. Round your answers to 2 decimal places.) May April 22,392.35 X $ Budgeted Cost of Material Purchased $ 24,990.75 Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided.) Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 434,000 9 years $ 47,000 38,626 10% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. (Round your answer to 2 decimal places.) 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value (NPV). (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) 4. Recalculate the NPV assuming BBS's cost of capital is 13 percent. (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) X Answer is not complete. 1. 8.90 % 2. 5.32 years Accounting rate of return Payback period Net present value Net present value assuming 13% cost of capital 3. 4. Olive Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in cash flow of $250,400. The equipment will have an initial cost of $1,300,600 and have an 8-year life. There is no salvage value for the equipment. If the hurdle rate is 10%, what is the internal rate of return? Ignore income taxes. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor from the PV tables. Round your final answer to the nearest dollar amount.) Multiple Choice Between 6% and 8% Between 8% and 10% Greater than 10% less than zero Randall Corp. is trying to decide whether to lease or purchase a piece of equipment needed for the next five years. The equipment would cost $170,000 to purchase, and maintenance costs would be $80,000 per year. After five years, Randall estimates it could sell the equipment for $100,000. If Randall leases the equipment, it would pay $100,000 each year, which would include all maintenance costs. If the hurdle rate for Randall is 12%, Randall should: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor from the PV tables. Do not round intermediate calculations. Round your final answer to the nearest hundred.) Multiple Choice lease the equipment, as net present value of cost is about $41,000 less. lease the equipment, as net present value of cost is about $100,000 less. buy the equipment, as net present value of cost is about $100,000 less. buy the equipment, as net present value of cost is about $41,000 less. Ironwood, Inc., which has a hurdle rate of 12%, is considering three different independent investment opportunities. Each project has a seven-year life. The annual cash flows and initial investment for each of the projects are as follows: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1. (Use appropriate factor from the PV tables. Do not round intermediate calculations. Round your final answer to the nearest hundred.) Annual cash flows Initial investment Project A Project B Project C $131, 470 $ 120,520 $109,560 320,000 300,000 230,000 In what order should Ironwood prioritize investment in the projects? Multiple Choice ACB O CBA C, A,B A,B,C O How much will you have in a savings account in ten years, if you deposit $1,500 in the account at the end of each year and the account earns 7% interest, compounded annually? (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor from the PV tables. Round your final answer to the nearest dollar amount.) Multiple Choice $20,725 $16,050 $15,000 $25,452

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts