Question: I will definitely vote your Answer please don't give wrong Answer Q. No. 9 (a) Mr. C Joshi sold his residential house on 1-11-2014 for

I will definitely vote your Answer please don't give wrong Answer

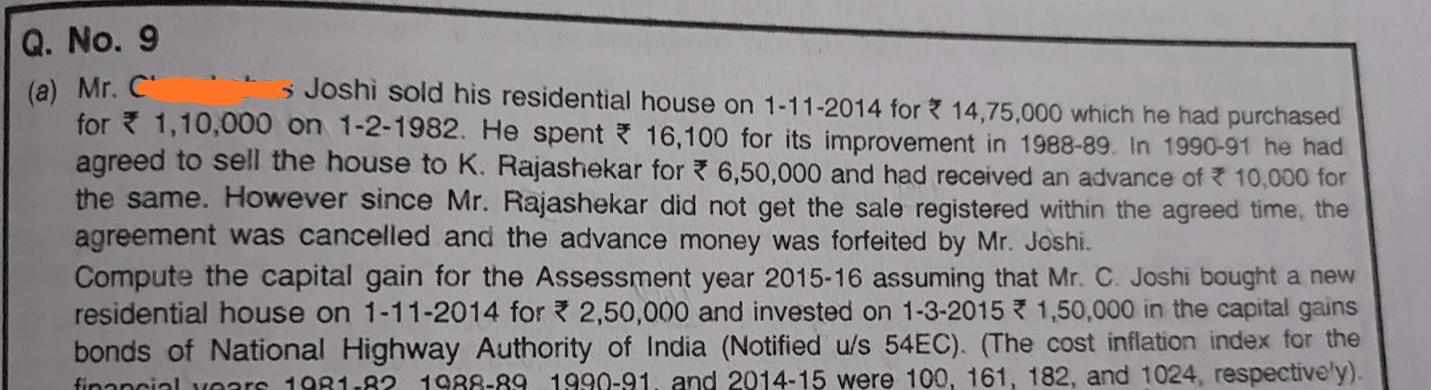

Q. No. 9 (a) Mr. C Joshi sold his residential house on 1-11-2014 for 14,75,000 which he had purchased for 1,10,000 on 1-2-1982. He spent * 16,100 for its improvement in 1988-89. In 1990-91 he had agreed to sell the house to K. Rajashekar for * 6,50,000 and had received an advance of 10,000 for the same. However since Mr. Rajashekar did not get the sale registered within the agreed time, the agreement was cancelled and the advance money was forfeited by Mr. Joshi. Compute the capital gain for the Assessment year 2015-16 assuming that Mr. C. Joshi bought a new residential house on 1-11-2014 for 2,50,000 and invested on 1-3-2015 * 1,50,000 in the capital gains bonds of National Highway Authority of India (Notified u/s 54EC). (The cost inflation index for the 1990-91. and 2014-15 were 100, 161, 182, and 1024, respectively). financial years 1981-82 1988-89Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock