Question: I will give a thumbs up for the correct answer. Current Attempt in Progress Sandhill Corporation has income from continuing operations of $298,000 for the

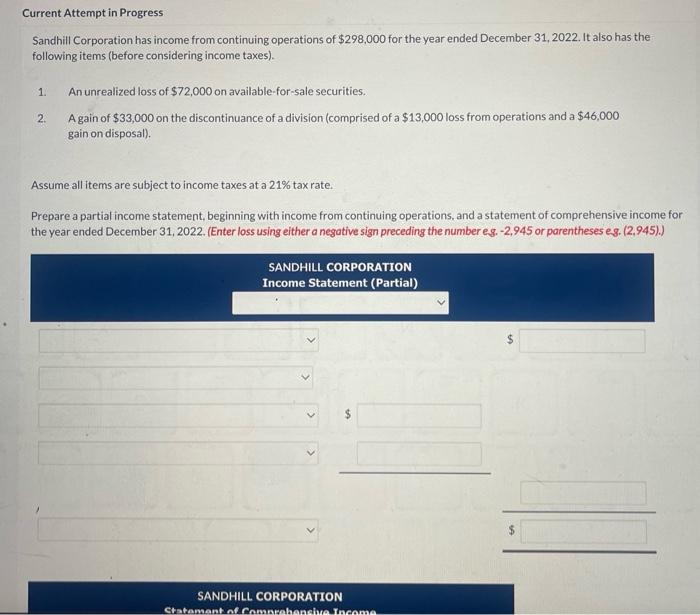

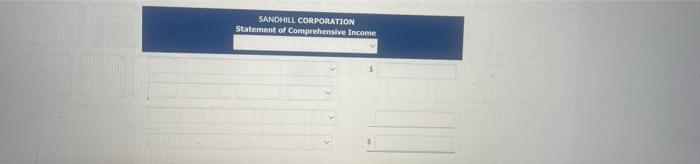

Current Attempt in Progress Sandhill Corporation has income from continuing operations of $298,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes). 1. An unrealized loss of $72,000 on available-for-sale securities. Again of $33,000 on the discontinuance of a division (comprised of a $13,000 loss from operations and a $46,000 gain on disposal). 2. Assume all items are subject to income taxes at a 21% tax rate. Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income for the year ended December 31, 2022. (Enter loss using either a negative sign preceding the number eg.-2,945 or parentheses eg. (2,945).) SANDHILL CORPORATION Income Statement (Partial) > SANDHILL CORPORATION Statement of Com abansive Income SANDHILL CORPORATION Statement of Comprehensive Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts