Question: I will give a thumps up for correct working for the correct answers given. The Arjoon Corporation CFO, Mr. Ray Arjoon, is considering whether to

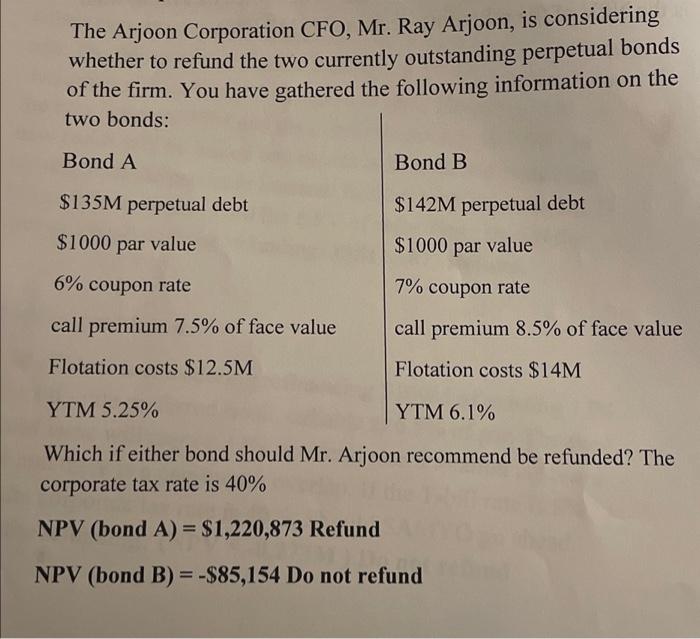

The Arjoon Corporation CFO, Mr. Ray Arjoon, is considering whether to refund the two currently outstanding perpetual bonds of the firm. You have gathered the following information on the Which if either bond should Mr. Arjoon recommend be refunded? The corporate tax rate is 40% NPV (bond A) =$1,220,873 Refund NPV ( bond B) =$85,154 Do not refund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts