Question: I will give good rating. Please answer as soon as possible (within 2 hours). Thank you so much 6. value: 13.00 points Pachel Corporation reports

I will give good rating. Please answer as soon as possible (within 2 hours). Thank you so much

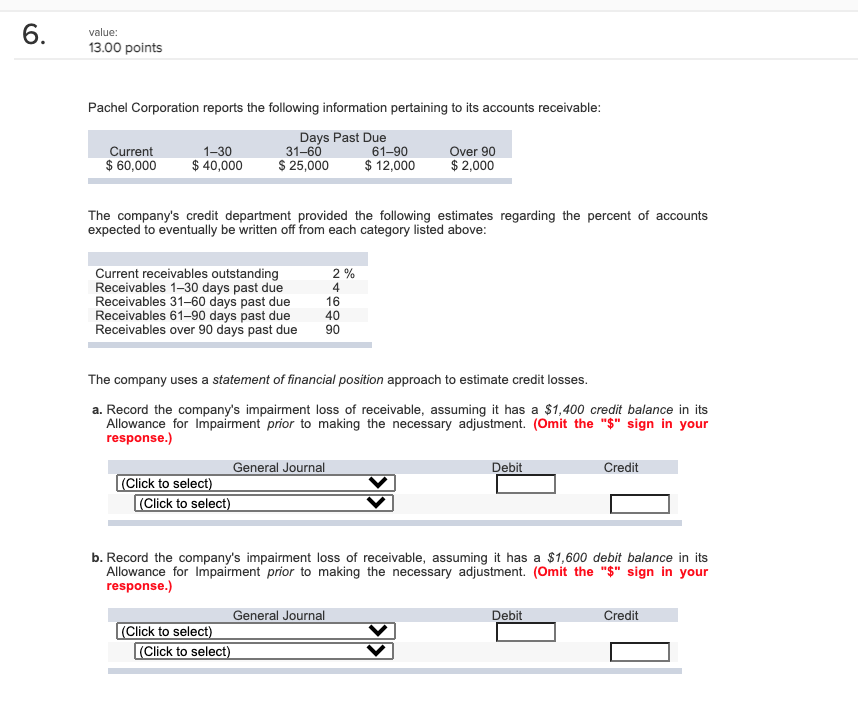

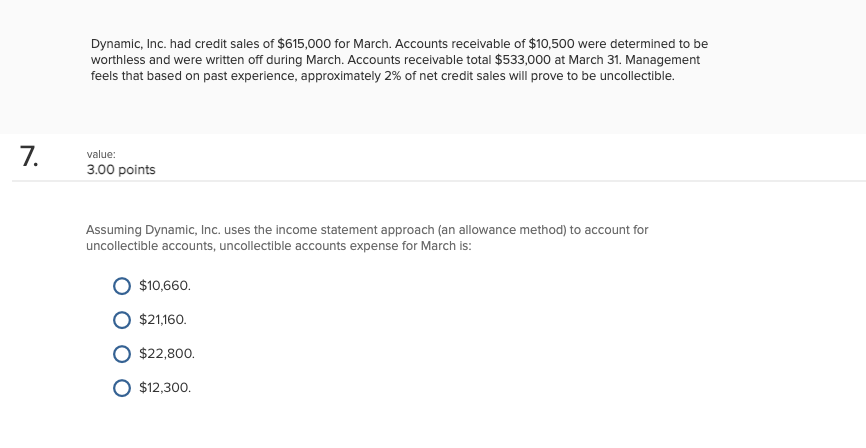

6. value: 13.00 points Pachel Corporation reports the following information pertaining to its accounts receivable: Days Past Due Current 1-30 31-60 6190 Over 90 $ 60,000 $ 40,000 $ 25,000 $ 12,000 $2,000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above: Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due 2% 4 16 40 90 The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) General Journal Debit Credit (Click to select) (Click to select) b. Record the company's impairment loss of receivable, assuming it has a $1,600 debit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) General Journal Debit Credit (Click to select) (Click to select) Dynamic, Inc. had credit sales of $615,000 for March. Accounts receivable of $10,500 were determined to be worthless and were written off during March. Accounts receivable total $533,000 at March 31. Management feels that based on past experience, approximately 2% of net credit sales will prove to be uncollectible. 7. value: 3.00 points Assuming Dynamic, Inc. uses the income statement approach (an allowance method) to account for uncollectible accounts, uncollectible accounts expense for March is: $10,660. $21,160. $22,800. $12,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts