Question: I will give it a like :) You are a portfolio manager and have $100 million to invest. Per the guideline, you have to maintain

I will give it a like :)

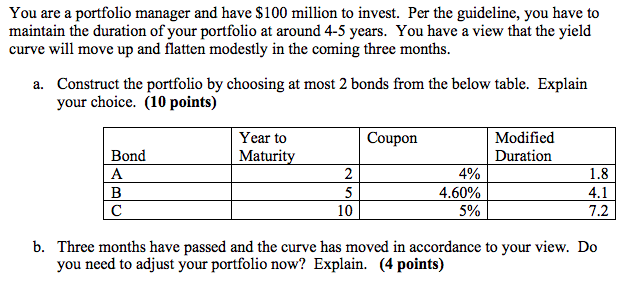

You are a portfolio manager and have $100 million to invest. Per the guideline, you have to maintain the duration of your portfolio at around 4-5 years. You have a view that the yield curve will move up and flatten modestly in the coming three months. a. Construct the portfolio by choosing at most 2 bonds from the below table. Explain your choice. (10 points) Coupon Year to Maturity Modified Duration Bond A B 2 5 10 4% 4.60% 5% 1.8 4.1 7.2 b. Three months have passed and the curve has moved in accordance to your view. Do you need to adjust your portfolio now? Explain. (4 points) You are a portfolio manager and have $100 million to invest. Per the guideline, you have to maintain the duration of your portfolio at around 4-5 years. You have a view that the yield curve will move up and flatten modestly in the coming three months. a. Construct the portfolio by choosing at most 2 bonds from the below table. Explain your choice. (10 points) Coupon Year to Maturity Modified Duration Bond A B 2 5 10 4% 4.60% 5% 1.8 4.1 7.2 b. Three months have passed and the curve has moved in accordance to your view. Do you need to adjust your portfolio now? Explain. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts