Question: I will give thumbs up for correct answers + explanations! Thank you!! On December 31, Parent acquires Subsidiary's outstanding stock by paying $188,000 in cash

I will give thumbs up for correct answers + explanations! Thank you!!

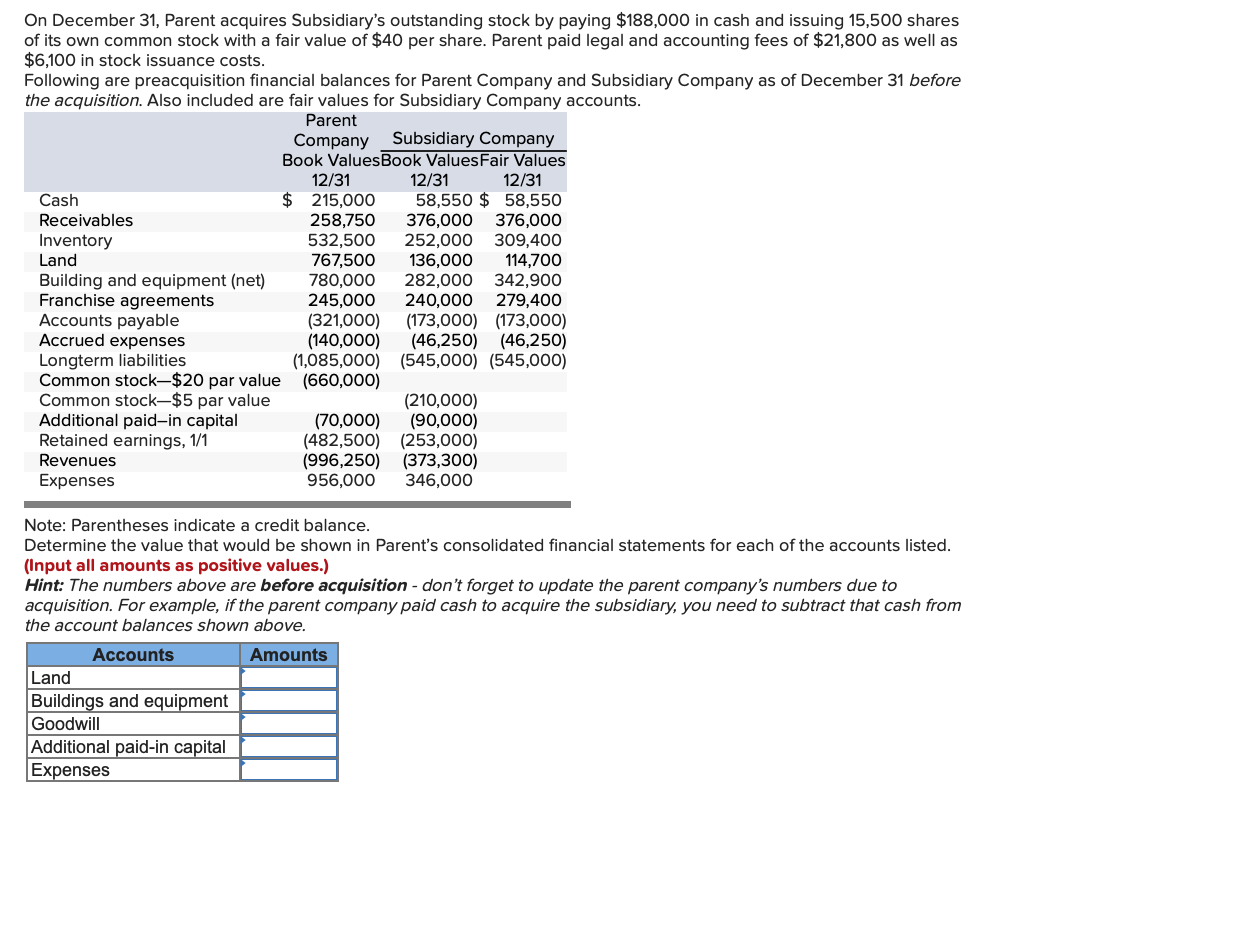

On December 31, Parent acquires Subsidiary's outstanding stock by paying $188,000 in cash and issuing 15,500 shares of its own common stock with a fair value of $40 per share. Parent paid legal and accounting fees of $21,800 as well as $6,100 in stock issuance costs. Following are preacquisition financial balances for Parent Company and Subsidiary Company as of December 31 before the acquisition. Also included are fair values for Subsidiary Company accounts. Note: Parentheses indicate a credit balance. Determine the value that would be shown in Parent's consolidated financial statements for each of the accounts listed. (Input all amounts as positive values.) Hint: The numbers above are before acquisition - don't forget to update the parent company's numbers due to acquisition. For example, if the parent company paid cash to acquire the subsidiary, you need to subtract that cash from the account balances shown above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts