Question: I will give you vote up , reply fast only 30 minutes left Al, Basel and Ziad are sharing income and loss in a 4:32

I will give you vote up , reply fast only 30 minutes left

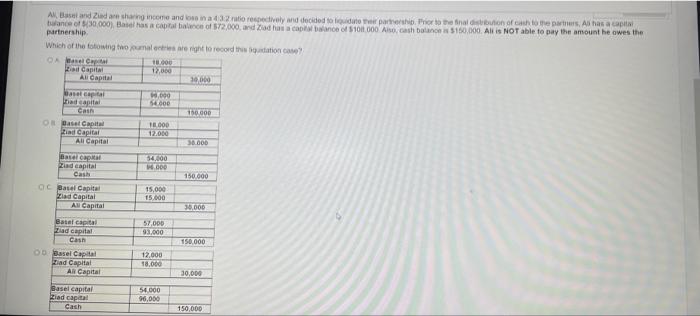

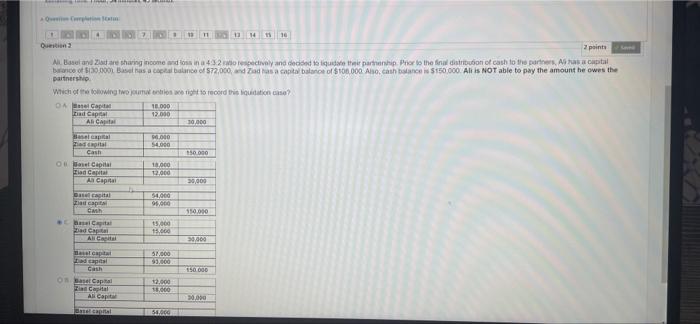

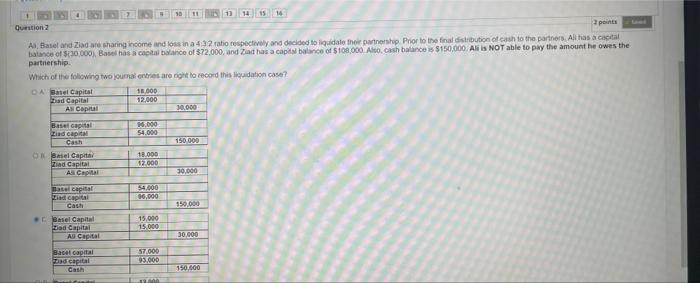

Al, Basel and Ziad are sharing income and loss in a 4:32 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash to the partners, Al has a capital balance of 530,000), Basel has a capital balance of $72,000, and Ziad has a capital balance of $10,000 Also, cash balance is $150,000. All is NOT able to pay the amount he owes the partnership. Which of the fotowing two journal entries are right to record this quidation case? O Manel Capital 18.000 Ziad Capital 12,000 30.000 $9,000 Basel capital Ziad capital Cash 54.000 150.000 OB Baset Capital 10.000 Ziad Capital 12.000 All Capital 30.000 Basel capital 54,000 16.000 Ziad capital Cash 150,000 OC Basel Capital 15,000 Ziad Capital 15,000 All Capital 30,000 57,000 Basel capital Ziad capital 93,000 Cash 150,000 OD Basel Capital 12,000 Ziad Capital 18,000 All Capital 30,000 54,000 Basel capital Ziad capital Cash 96,000 150,000 All Capital enge Fot AQ Completion SE Question 2 2 points All Basel and Ziad are sharing income and loss in a 4:32 rato respectively and decided to liquidate their partnership Prior to the final distribution of cash to the partners, Aa capital balance of $30,000) Basel has a capital balance of $72,000, and Ziad has a capital balance of $108,000 Also, cash balance is $150,000. All is NOT able to pay the amount he owes the partnership Which of the following two journal entries are right to record this liquidation case? Al Capital 18.000 12.000 iad Capital Al Capital 10,000 Basel capital 90.000 $4.000 ad capital Cash 150.000 O Basel Capital 18,000 Ziad Capital 12.000 30,000 Basel capital 54,000 95,000 ad capital CMh 110.000 Base Capital 15,000 ad Capital 30,000 Basel capital 57,000 ad capital $1,000 Gash 150.000 On Basel Capital 12,000 in Capital 18.000 All Capital 30,000 Basel capital 54.000 All Capital All Capital 13 14 15 16 Question 2 2 points Ai, Basel and Ziad are sharing income and loss in a 4:32 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash to the partners, All has a capital balance of $30,000), Basel has a capital balance of $72,000, and Ziad has a capital balance of $108,000 Also, cash balance is $150,000. All is NOT able to pay the amount he owes the partnership. Which of the following two journal entries are right to record this liquidation case? DA Basel Capital 18,000 Ziad Capital 12,000 All Capital 30,000 Basel capital 96,000 Ziad capital 54.000 Cash 150,000 Basel Capita 18.000 Ziad Capital 12,000 30,000 Basel capital 54.000 96,000 Ziad capital Cash 150,000 Basel Capital 15,000 Ziad Capital 15,000 All Capital 30.000 Bacel capital 57,000 Zad capital 93.000 Cash 150.000 De Consu 12.000 As Capital #1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts