Question: (I will grade this question manually) Suppose a dealer is expecting the interest rate to rise overnight by 1%p. In the market right now, a

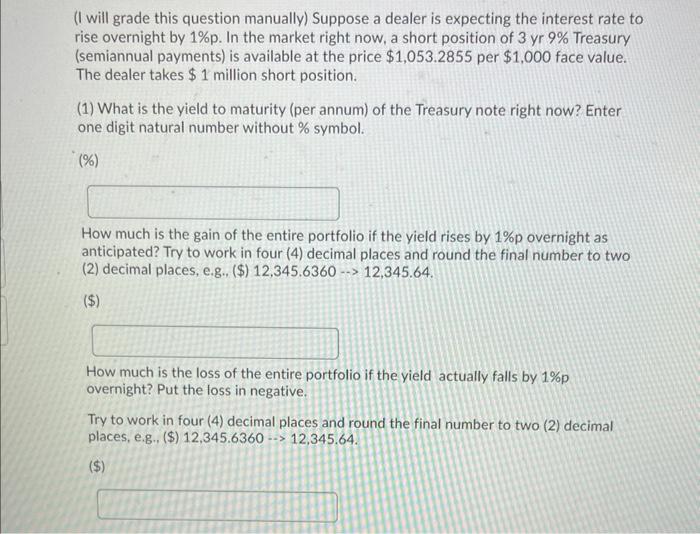

(I will grade this question manually) Suppose a dealer is expecting the interest rate to rise overnight by 1%p. In the market right now, a short position of 3 yr 9% Treasury (semiannual payments) is available at the price $1,053.2855 per $1,000 face value. The dealer takes $1 million short position. (1) What is the yield to maturity (per annum) of the Treasury note right now? Enter one digit natural number without % symbol. (%) How much is the gain of the entire portfolio if the yield rises by 1%p overnight as anticipated? Try to work in four (4) decimal places and round the final number to two (2) decimal places, e.g., (\$) 12,345.6360 . 12,345.64. ($) How much is the loss of the entire portfolio if the yield actually falls by 1%p overnight? Put the loss in negative. Try to work in four (4) decimal places and round the final number to two (2) decimal places, e.g.. (\$) 12,345.636012,345.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts