Question: I will provide the assignment Then I will provide the student submission And finally the professor notes Revise the assignment based on the feedback and

- I will provide the assignment

- Then I will provide the student submission

- And finally the professor notes

- Revise the assignment based on the feedback and correctly answer the assignment

The assignment:

The student submission:

- New Contribution Margin = (Original Contribution Margin / (1 + Price Increase Percentage))

In this case, the original contribution margin is 40 percent, and the price increase is 10 percent. Plug these values into the formula:

New Contribution Margin = (40%1+10%)

New Contribution Margin = (40%1.10)

Now, divide 40% by 1.10:

New Contribution Margin 36.36%:

So, if the company raises its prices by 10%, the new contribution margin would be 36.36%.

Change in Sales = (Original Contribution - New Contribution) / New Contribution Margin

Original Contribution = $8 billion (Louis Vuitton sales) 40% (Original Contribution Margin) = $8 billion 0.40 = $3.2 billion

New Contribution = $8 billion (Louis Vuitton sales) 36.36%(New Contribution Margin) = $8 billion 0.3636 $2.91 billion

Change in Sales = $3.2billion$2.91billion0.3636

$0.29billion0.3636

$797.89million

So, the company's sales can drop by $797.89 million and still maintain the same total contribution it had when the contribution margin was 40 percent.

Price to Consumers = (Total Cost + Desired Margin) / (1 Desired Margin Percentage)

In this case, the desired margin is 40 percent, and you have the total cost of producing the sheet set.

Desired Margin Percentage = 40%

= 0.40

Price to Consumers = $28.00+$12.00+$10.00+$3.00+$16.00+$14.00+$5.00+$8.00+$15.00+$30.00+$15.00+$500,00010.40

Price to Consumers =$163.00+$500,0000.60

Price to Consumers = $500,163.000.60

Price to Consumers $833,605

So, if the company desires a 40 percent margin on sales and plans to sell directly to consumers online, they should price the king-size sheet set at $833,605.

The company sells to the wholesaler at a price W such that the wholesaler desires a 10 percent margin on sales:

W = C / (1 Wholesaler Margin Percentage)

W=$833,605110%

W=$833,6050.90

W$926,227.78

The wholesaler, in turn, sells to the retailer at a price R such that the retailer desires a 20 percent margin on sales:

R = W / (1 Retailer Margin Percentage)

R=$926,227.78120%

R=$926,227.780.80

R$1,157,784.72

So, if the company wants to maintain a consumer price of $833,605 when selling through retailers, they should sell the product to wholesalers at $926,228, and the wholesalers can then sell it to retailers at $1,157,785.

The company can set a consumer price of $833,605 when selling directly online and still achieve a 40 percent margin. If they choose to sell through retailers, the product should be sold to wholesalers at $926,228 and then to retailers at $1,157,785 to maintain the same consumer price while accounting for the desired margins of both the wholesaler and retailer in the distribution chain.

Professor feedback:

the contribution margin goes up rather than go down. Follow your notes on my example on Monday. Current Revenue 1,000,000 Margin % now 30% Margin value now $300,000 Costs now $700,000 Price goes up 20% New Revenue $1,200,0000 Costs now $700,000 Margin value new $500,000 Margin % new = 500,000/1,200,000 = 41.66% Margin value before $300,000 Sales needed to reach with new margin = 300,000/.4166 = $720,115 Sales can go down by close to $280,000

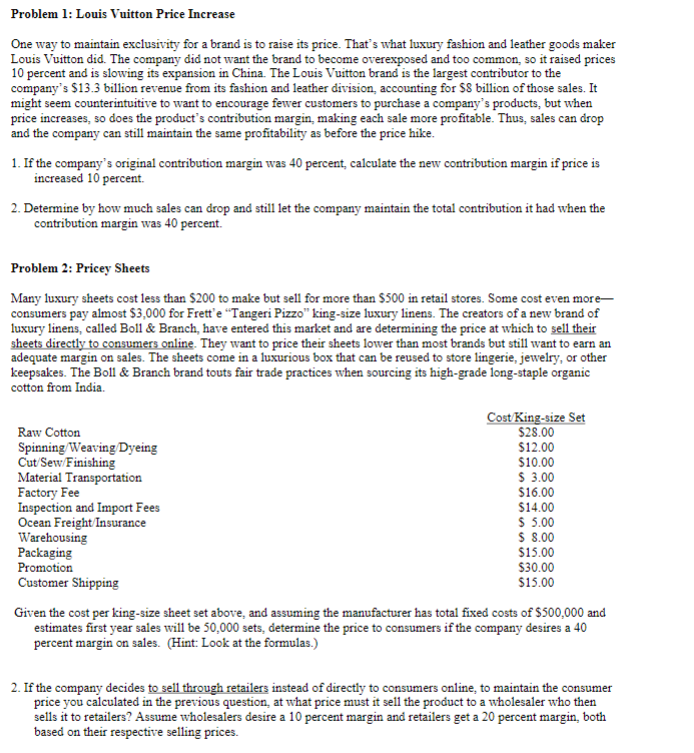

Problem 1: Louis Vuitton Price Increase One way to maintain exclusivity for a brand is to raise its price. That's what luxury fashion and leather goods maker Louis Vuitton did. The company did not want the brand to become overexposed and too common, so it raised prices 10 percent and is slowing its expansion in China. The Louis Vuitton brand is the largest contributor to the company's $13.3 billion revenue from its fashion and leather division, accounting for $ billion of those sales. It might seem counterintuitive to want to encourage fewer customers to purchase a company's products, but when price increases, so does the product's contribution margin, making each sale more profitable. Thus, sales can drop and the company can still maintain the same profitability as before the price hike. 1. If the company's original contribution margin was 40 percent, calculate the new contribution margin if price is increased 10 percent. 2. Determine by how much sales can drop and still let the company maintain the total contribution it had when the contribution margin was 40 percent. Problem 2: Pricey Sheets Many luxury sheets cost less than $200 to make but sell for more than $500 in retail stores. Some cost even moreconsumers pay almost $3,000 for Frett'e "Tangeri Pizzo" king-size luxury linens. The creators of a new brand of luxury linens, called Boll \& Branch, have entered this market and are determining the price at which to sell their sheets directly to consumers online. They want to price their sheets lower than most brands but still want to earn an adequate margin on sales. The sheets come in a luxurious box that can be reused to store lingerie, jewelry, or other keepsakes. The Boll \& Branch brand touts fair trade practices when sourcing its high-grade long-staple organic cotton from India. Given the cost per king-size sheet set above, and assuming the manufacturer has total fixed costs of $500,000 and estimates first year sales will be 50,000 sets, determine the price to consumers if the company desires a 40 percent margin on sales. (Hint: Look at the formulas.) 2. If the company decides to sell through retailers instead of directly to consumers online, to maintain the consumer price you calculated in the previous question, at what price must it sell the product to a wholesaler who then sells it to retailers? Assume wholesalers desire a 10 percent margin and retailers get a 20 percent margin, both based on their respective selling prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts