Question: i will rate! Question 3 (CHAPTER 8) Last year, you bought a share of stock for $75. Today, you decided to sell it, since it

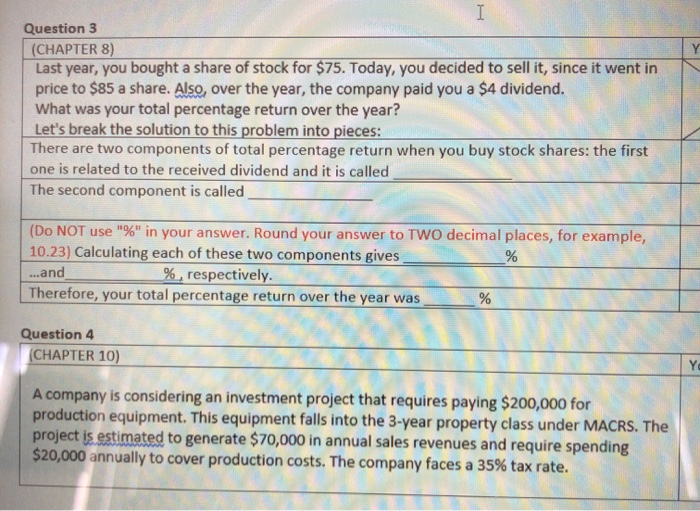

Question 3 (CHAPTER 8) Last year, you bought a share of stock for $75. Today, you decided to sell it, since it went in price to $85 a share. Also, over the year, the company paid you a $4 dividend. What was your total percentage return over the year? Let's break the solution to this problem into pieces: There are two components of total percentage return when you buy stock shares: the first one is related to the received dividend and it is called The second component is called (Do NOT use "%" in your answer. Round your answer to TWO decimal places, for example, 10.23) Calculating each of these two components gives ...and %, respectively. Therefore, your total percentage return over the year was Question 4 (CHAPTER 10) A company is considering an investment project that requires paying $200,000 for production equipment. This equipment falls into the 3-year property class under MACRS. The project is estimated to generate $70,000 in annual sales revenues and require spending $20,000 annually to cover production costs. The company faces a 35% tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts