Question: I will read your answer and vote for u 4. Identify and define the borrower-specific and market-specific factors that enter into the credit decision. What

I will read your answer and vote for u

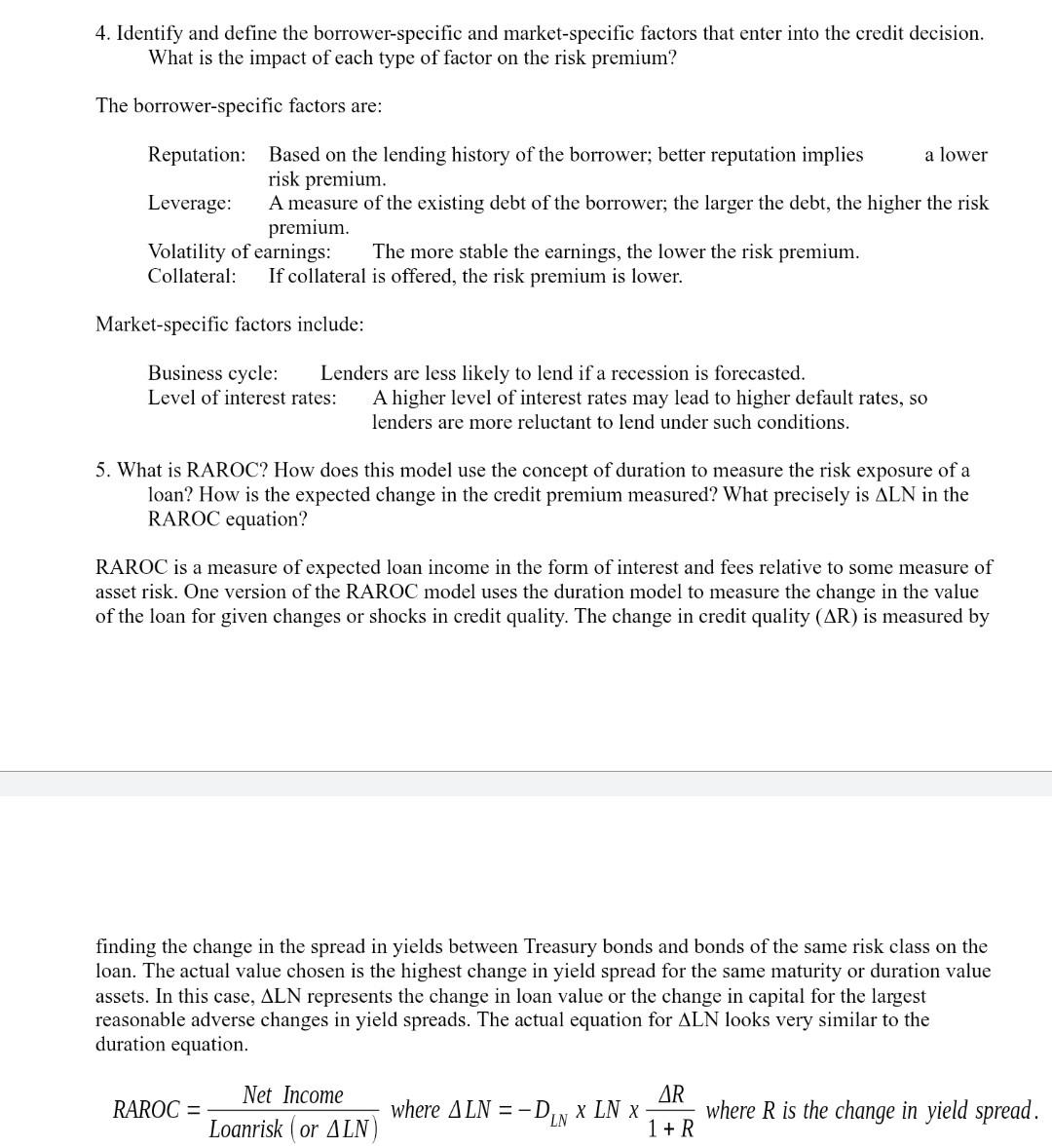

4. Identify and define the borrower-specific and market-specific factors that enter into the credit decision. What is the impact of each type of factor on the risk premium? The borrower-specific factors are: Reputation: Based on the lending history of the borrower; better reputation implies a lower risk premium Leverage: A measure of the existing debt of the borrower; the larger the debt, the higher the risk premium. Volatility of earnings: The more stable the earnings, the lower the risk premium. Collateral: If collateral is offered, the risk premium is lower. Market-specific factors include: Business cycle: Lenders are less likely to lend if a recession is forecasted. Level of interest rates: A higher level of interest rates may lead to higher default rates, so lenders are more reluctant to lend under such conditions. 5. What is RAROC? How does this model use the concept of duration to measure the risk exposure of a loan? How is the expected change in the credit premium measured? What precisely is ALN in the RAROC equation? RAROC is a measure of expected loan income in the form of interest and fees relative to some measure of asset risk. One version of the RAROC model uses the duration model to measure the change in the value of the loan for given changes or shocks in credit quality. The change in credit quality (AR) is measured by finding the change in the spread in yields between Treasury bonds and bonds of the same risk class on the loan. The actual value chosen is the highest change in yield spread for the same maturity or duration value assets. In this case, ALN represents the change in loan value or the change in capital for the largest reasonable adverse changes in yield spreads. The actual equation for ALN looks very similar to the duration equation. Net Income RAROC = Loanrisk or ALN AR where ALN = - Din X LN X 1 + R where R is the change in yield spreadStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock