Question: i will really appreciate if some one help me , i know it is alot but this is my final assigment before graduation i need

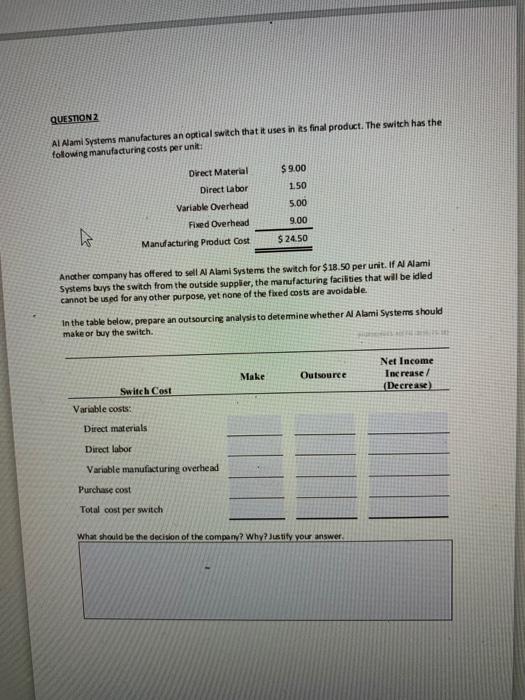

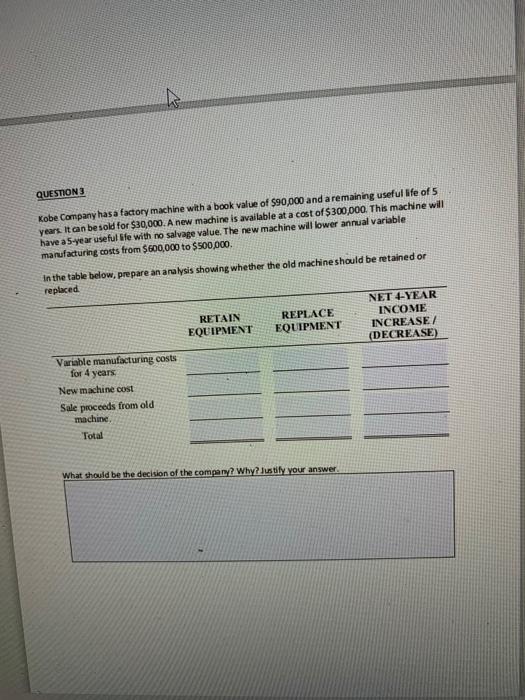

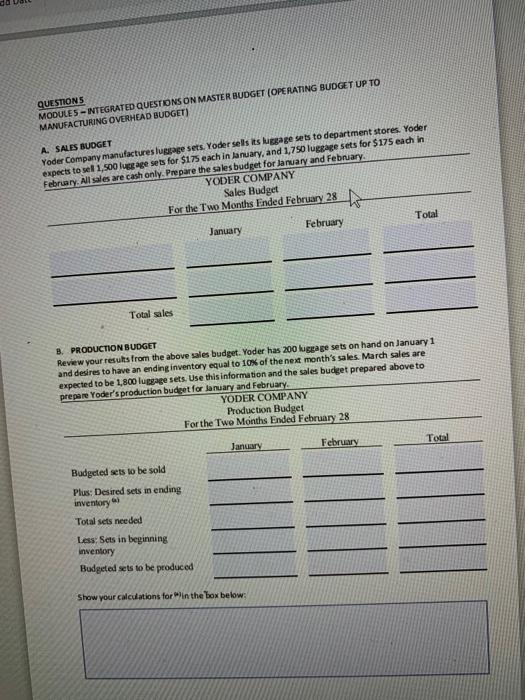

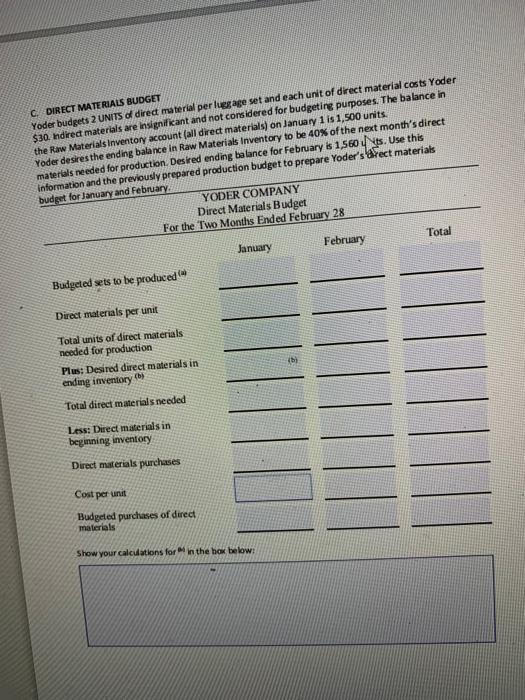

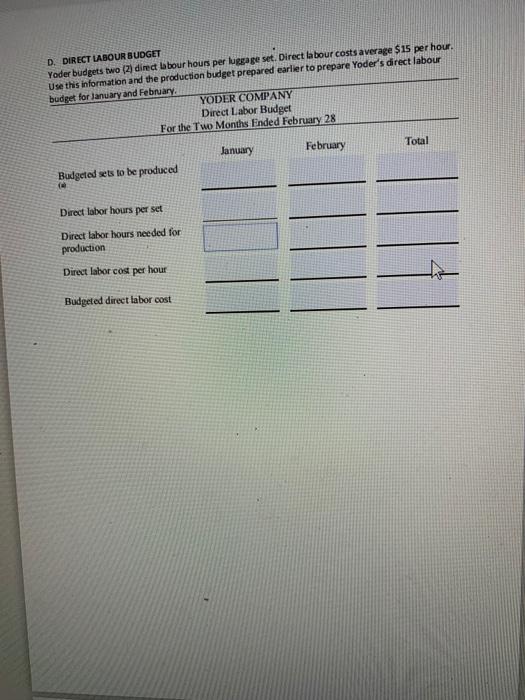

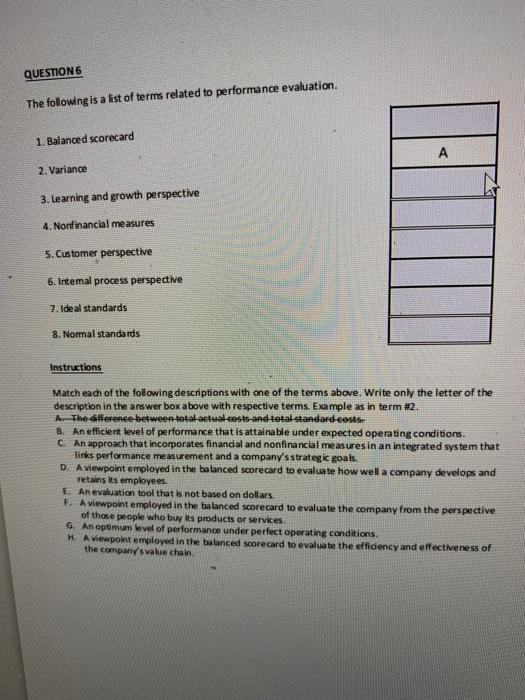

QUESTION1 Cocoaheaven processes cocoa beans into cocoa powder at a processing cost of $9,500 per batch. Cocoaheaven can sell the cocoa powder as is, or it can process the cocoa powder further into either chocolate syrup or boxed assorted chocolates Once processed, each batch of cocoa beans would result in the following sales revenue: Cocoa powder $ 16,500 Chocolate syrup 102.000 Boxed assorted chocolates 196,000 The cost of transforming the cocoa powder into chocolate syrup would be $70,000 Likewise, the company would incur a cost of $176,000 to transform the cocoa powder into boxed assorted chocolates The company president has decided to make baked assorted chocolates due to its high sales value and to the fact that the cocoa bean processing cost of $9,500 eats up most of the cocoa powder profits Has the president made the right or wrong decision? Explain your answer. Be sure to include the correct financial analysis in the table below to justify your response. PROCESS INTO BOXED ASSORTED CHOCOLATES: Process Further Net Income Increase (Decrease) Sell Costs Sales revenue per batch Costs of processing Total Net Income PROCESS INTOCHOCOLATE SYRUP: Process Further Net Income Increase / (Decrease Sell Costs Sales revenue per batch Costs of processing Total Net Income 1 Explanation of the president's dechion QUESTION 2 Al Alami Systems manufactures an optical switch that it uses in its final product. The switch has the following manufacturing costs per unit: $9.00 1.50 5.00 Direct Material Direct Labor Variable Overhead Fixed Overhead Manufacturing Product Cost 9.00 $24.50 Another company has offered to sell Al Alami Systems the switch for $18.50 per unit. If Al Alami Systems buys the switch from the outside supplier, the manufacturing facilities that will be idled cannot be used for any other purpose, yet none of the faced costs are avoidable. In the table below, prepare an outsourcing analysis to determine whether Al Alami Systems should make or buy the switch. Make Outsource Net Income Increase / (Decrease) Switch Cost Variable costs: Direct materials Direct labor Variable manufacturing overhead Purchase cost Total cost per switch What should be the decision of the company? Why? Justify your answer QUESTIONS Kobe Company has a factory machine with a book value of $90,000 and a remaining useful life of 5 years. It can be sold for $30,000. A new machine is available at a cost of $300,000. This machine will have a 5-year useful le with no salvage value. The new machine will lower annual variable manufacturing costs from $600,000 to $500,000 In the table below, prepare an analysis showing whether the old machine should be retained or replaced RETAIN EQUIPMENT REPLACE EQUIPMENT NET 4-YEAR INCOME INCREASE/ (DECREASE) Variable manufacturing costs for 4 years New machine cost Sale proceeds from old machine Total What should be the decision of the company? Why? Justify your answer QUESTIONS MODULES - INTEGRATED QUESTIONS ON MASTER BUDGET (OPERATING BUDGET UP TO MANUFACTURING OVERHEAD BUDGET A. SALES BUDGET Yoder Company manufactures luggage sets. Yoder sells its luggage sets to department stores. Yoder expects to sel 1,500 luggage sets for $175 each in January, and 1,750 luggage sets for $175 each in February. All sales are cash only. Prepare the sales budget for January and February YODER COMPANY Sales Budget For the Two Months Fnded February 28 Total February January Total sales B. PRODUCTION BUDGET Review your results from the above sales budget. Yoder has 200 kugege sets on hand on January 1 and desires to have an ending inventory equal to 10% of the next month's sales. March sales are expected to be 1.800 luggage sets. Use this information and the sales budget prepared above to prepare Yoder's production budeet for lanuary and February YODER COMPANY Production Budget For the Two Months Ended February 28 January February Total Budgeted sets to be sold Plus: Desired sets in ending inventory Total sets needed Less: Sets in beginning inventory Budgeted sets to be produced Show your calculations for in the box below: C DIRECT MATERIALS BUDGET Yoder budgets 2 UNITS of direct material per luggage set and each unit of direct material costs Yoder $30. Indirect materials are insignificant and not considered for budgeting purposes. The balance in the Raw Materials Inventory account (all direct materials) on January 1 is 1,500 units. Yoder desires the ending balance in Raw Materials Inventory to be 40% of the next month's direct materials needed for production Desired ending balance for February is 1,560 4 Nts. Use this information and the previously prepared production budget to prepare Yoder's rect materials budget for January and February YODER COMPANY Direct Materials Budget For the Two Months Ended February 28 Total February January Budgeted sets to be produced Direct materials per unit Total units of direct materials needed for production Plus: Desired direct materials in ending inventory Total direct materials needed Less: Direct materials in beginning inventory Direct materials purchases Cost per unit Budgeted purchases of direct materials Show your calculations for in the box below: D. DIRECT LABOUR BUDGET Yoder budgets two (2) direa Labour hours per luggage set. Direct labour costs average $15 per hour. Use this information and the production budget prepared earlier to prepare Yoder's direct labour budget for January and February YODER COMPANY Direct Labor Budget For the Two Months Ended February 28 January February Total Budgeted sets to be produced Direct labor hours per set Direct labor hours needed for production Direct labor cost per hour Budgeted direct labor cost QUESTION The following is a list of terms related to performance evaluation. 1. Balanced Scorecard A 2. Variance 3. Learning and growth perspective 4. Nonfinancial measures 5. Customer perspective 6. Intemal process perspective 7. Ideal Standards 8. Normal standards Instructions Match each of the following descriptions with one of the terms above. Write only the letter of the description in the answer box above with respective terms. Example as in term #2. A. The diference between total-actual costs and total-standard cost 8. An efficient level of performance that is attainable under expected operating conditions An approach that incorporates financial and nonfinancial measures in an integrated system that links performance measurement and a company's strategic goals. D. A viewpoint employed in the balanced Scorecard to evaluate how well a company develops and retains its employees. E. An evaluation tool that is not based on dollars. F. A viewpoint employed in the balanced Scorecard to evaluate the company from the perspective of those people who buy its products or services G. An optimum level of performance under perfect operating conditions. H. A viewpoint employed in the balanced Scorecard to evaluate the efficiency and effectiveness of the company's value chain QUESTION1 Cocoaheaven processes cocoa beans into cocoa powder at a processing cost of $9,500 per batch. Cocoaheaven can sell the cocoa powder as is, or it can process the cocoa powder further into either chocolate syrup or boxed assorted chocolates Once processed, each batch of cocoa beans would result in the following sales revenue: Cocoa powder $ 16,500 Chocolate syrup 102.000 Boxed assorted chocolates 196,000 The cost of transforming the cocoa powder into chocolate syrup would be $70,000 Likewise, the company would incur a cost of $176,000 to transform the cocoa powder into boxed assorted chocolates The company president has decided to make baked assorted chocolates due to its high sales value and to the fact that the cocoa bean processing cost of $9,500 eats up most of the cocoa powder profits Has the president made the right or wrong decision? Explain your answer. Be sure to include the correct financial analysis in the table below to justify your response. PROCESS INTO BOXED ASSORTED CHOCOLATES: Process Further Net Income Increase (Decrease) Sell Costs Sales revenue per batch Costs of processing Total Net Income PROCESS INTOCHOCOLATE SYRUP: Process Further Net Income Increase / (Decrease Sell Costs Sales revenue per batch Costs of processing Total Net Income 1 Explanation of the president's dechion QUESTION 2 Al Alami Systems manufactures an optical switch that it uses in its final product. The switch has the following manufacturing costs per unit: $9.00 1.50 5.00 Direct Material Direct Labor Variable Overhead Fixed Overhead Manufacturing Product Cost 9.00 $24.50 Another company has offered to sell Al Alami Systems the switch for $18.50 per unit. If Al Alami Systems buys the switch from the outside supplier, the manufacturing facilities that will be idled cannot be used for any other purpose, yet none of the faced costs are avoidable. In the table below, prepare an outsourcing analysis to determine whether Al Alami Systems should make or buy the switch. Make Outsource Net Income Increase / (Decrease) Switch Cost Variable costs: Direct materials Direct labor Variable manufacturing overhead Purchase cost Total cost per switch What should be the decision of the company? Why? Justify your answer QUESTIONS Kobe Company has a factory machine with a book value of $90,000 and a remaining useful life of 5 years. It can be sold for $30,000. A new machine is available at a cost of $300,000. This machine will have a 5-year useful le with no salvage value. The new machine will lower annual variable manufacturing costs from $600,000 to $500,000 In the table below, prepare an analysis showing whether the old machine should be retained or replaced RETAIN EQUIPMENT REPLACE EQUIPMENT NET 4-YEAR INCOME INCREASE/ (DECREASE) Variable manufacturing costs for 4 years New machine cost Sale proceeds from old machine Total What should be the decision of the company? Why? Justify your answer QUESTIONS MODULES - INTEGRATED QUESTIONS ON MASTER BUDGET (OPERATING BUDGET UP TO MANUFACTURING OVERHEAD BUDGET A. SALES BUDGET Yoder Company manufactures luggage sets. Yoder sells its luggage sets to department stores. Yoder expects to sel 1,500 luggage sets for $175 each in January, and 1,750 luggage sets for $175 each in February. All sales are cash only. Prepare the sales budget for January and February YODER COMPANY Sales Budget For the Two Months Fnded February 28 Total February January Total sales B. PRODUCTION BUDGET Review your results from the above sales budget. Yoder has 200 kugege sets on hand on January 1 and desires to have an ending inventory equal to 10% of the next month's sales. March sales are expected to be 1.800 luggage sets. Use this information and the sales budget prepared above to prepare Yoder's production budeet for lanuary and February YODER COMPANY Production Budget For the Two Months Ended February 28 January February Total Budgeted sets to be sold Plus: Desired sets in ending inventory Total sets needed Less: Sets in beginning inventory Budgeted sets to be produced Show your calculations for in the box below: C DIRECT MATERIALS BUDGET Yoder budgets 2 UNITS of direct material per luggage set and each unit of direct material costs Yoder $30. Indirect materials are insignificant and not considered for budgeting purposes. The balance in the Raw Materials Inventory account (all direct materials) on January 1 is 1,500 units. Yoder desires the ending balance in Raw Materials Inventory to be 40% of the next month's direct materials needed for production Desired ending balance for February is 1,560 4 Nts. Use this information and the previously prepared production budget to prepare Yoder's rect materials budget for January and February YODER COMPANY Direct Materials Budget For the Two Months Ended February 28 Total February January Budgeted sets to be produced Direct materials per unit Total units of direct materials needed for production Plus: Desired direct materials in ending inventory Total direct materials needed Less: Direct materials in beginning inventory Direct materials purchases Cost per unit Budgeted purchases of direct materials Show your calculations for in the box below: D. DIRECT LABOUR BUDGET Yoder budgets two (2) direa Labour hours per luggage set. Direct labour costs average $15 per hour. Use this information and the production budget prepared earlier to prepare Yoder's direct labour budget for January and February YODER COMPANY Direct Labor Budget For the Two Months Ended February 28 January February Total Budgeted sets to be produced Direct labor hours per set Direct labor hours needed for production Direct labor cost per hour Budgeted direct labor cost QUESTION The following is a list of terms related to performance evaluation. 1. Balanced Scorecard A 2. Variance 3. Learning and growth perspective 4. Nonfinancial measures 5. Customer perspective 6. Intemal process perspective 7. Ideal Standards 8. Normal standards Instructions Match each of the following descriptions with one of the terms above. Write only the letter of the description in the answer box above with respective terms. Example as in term #2. A. The diference between total-actual costs and total-standard cost 8. An efficient level of performance that is attainable under expected operating conditions An approach that incorporates financial and nonfinancial measures in an integrated system that links performance measurement and a company's strategic goals. D. A viewpoint employed in the balanced Scorecard to evaluate how well a company develops and retains its employees. E. An evaluation tool that is not based on dollars. F. A viewpoint employed in the balanced Scorecard to evaluate the company from the perspective of those people who buy its products or services G. An optimum level of performance under perfect operating conditions. H. A viewpoint employed in the balanced Scorecard to evaluate the efficiency and effectiveness of the company's value chain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts