Question: I WILL REPORT YOUR ANSWER if you simply copy and paste from other sources (you know which) Please solve using Excel and show all formulas

I WILL REPORT YOUR ANSWER if you simply copy and paste from other sources (you know which)

Please solve using Excel and show all formulas clearly so I can learn the concept better. Thank you.

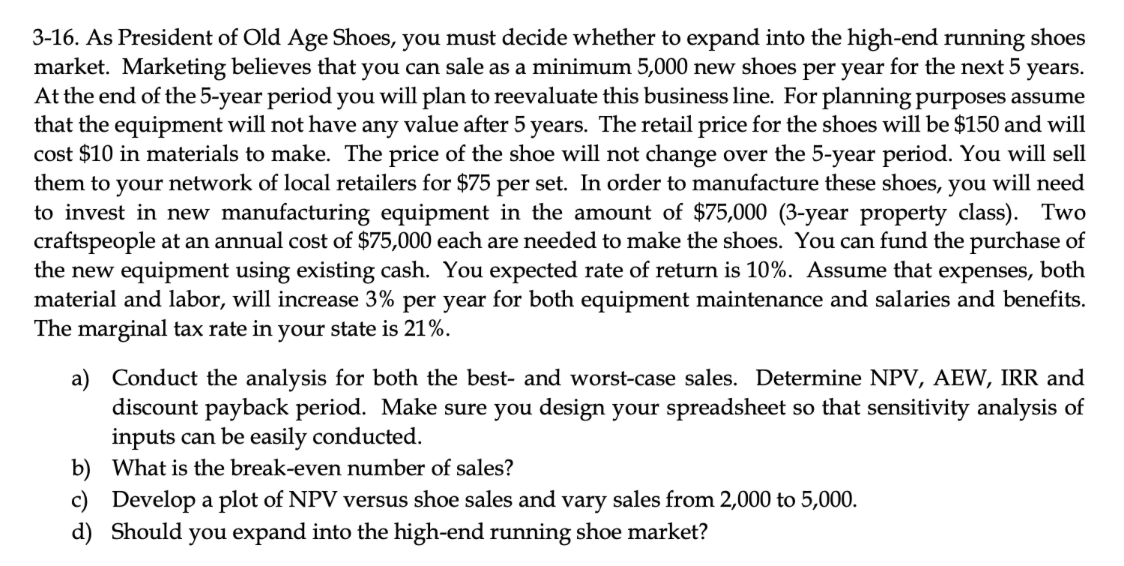

3-16. As President of Old Age Shoes, you must decide whether to expand into the high-end running shoes market. Marketing believes that you can sale as a minimum 5,000 new shoes per year for the next 5 years. At the end of the 5-year period you will plan to reevaluate this business line. For planning purposes assume that the equipment will not have any value after 5 years. The retail price for the shoes will be $150 and will cost $10 in materials to make. The price of the shoe will not change over the 5 -year period. You will sell them to your network of local retailers for $75 per set. In order to manufacture these shoes, you will need to invest in new manufacturing equipment in the amount of $75,000 (3-year property class). Two craftspeople at an annual cost of $75,000 each are needed to make the shoes. You can fund the purchase of the new equipment using existing cash. You expected rate of return is 10%. Assume that expenses, both material and labor, will increase 3% per year for both equipment maintenance and salaries and benefits. The marginal tax rate in your state is 21%. a) Conduct the analysis for both the best- and worst-case sales. Determine NPV, AEW, IRR and discount payback period. Make sure you design your spreadsheet so that sensitivity analysis of inputs can be easily conducted. b) What is the break-even number of sales? c) Develop a plot of NPV versus shoe sales and vary sales from 2,000 to 5,000. d) Should you expand into the high-end running shoe market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts