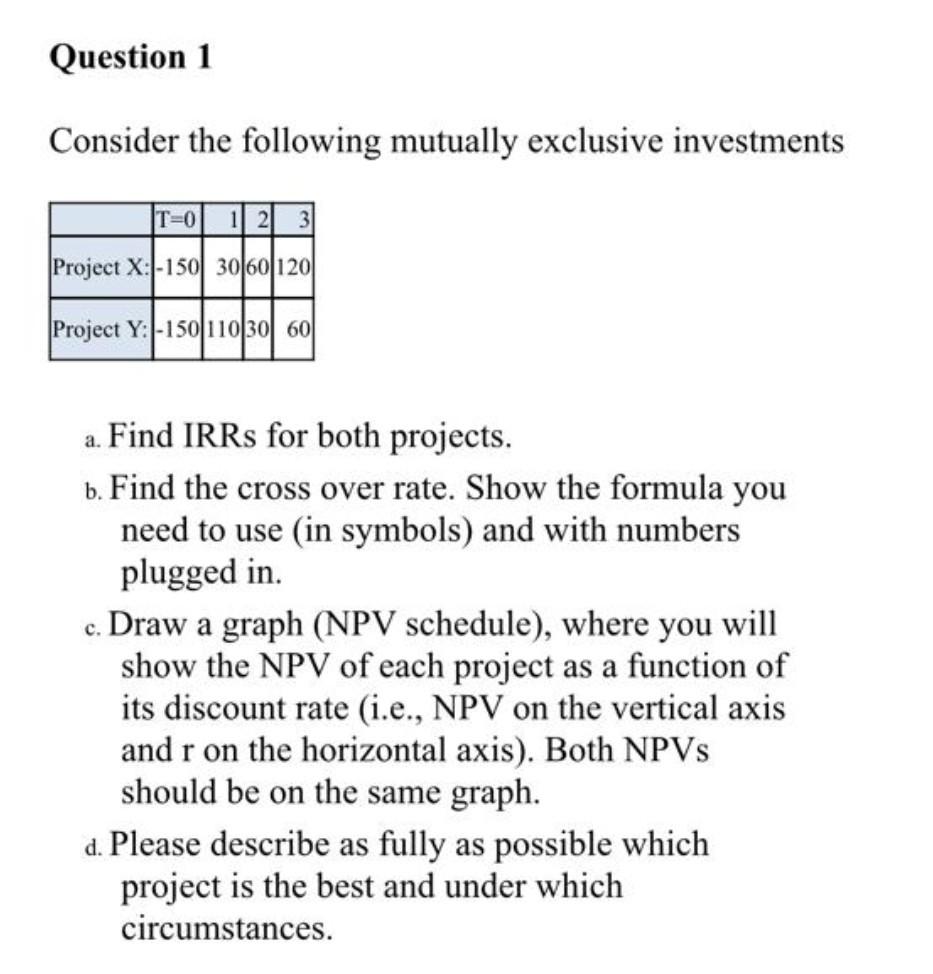

Question: I will sure p ut like Question 1 Consider the following mutually exclusive investments T=0 1 2 3 Project X: -150 3060120 Project Y: -150|11030

I will sure put like

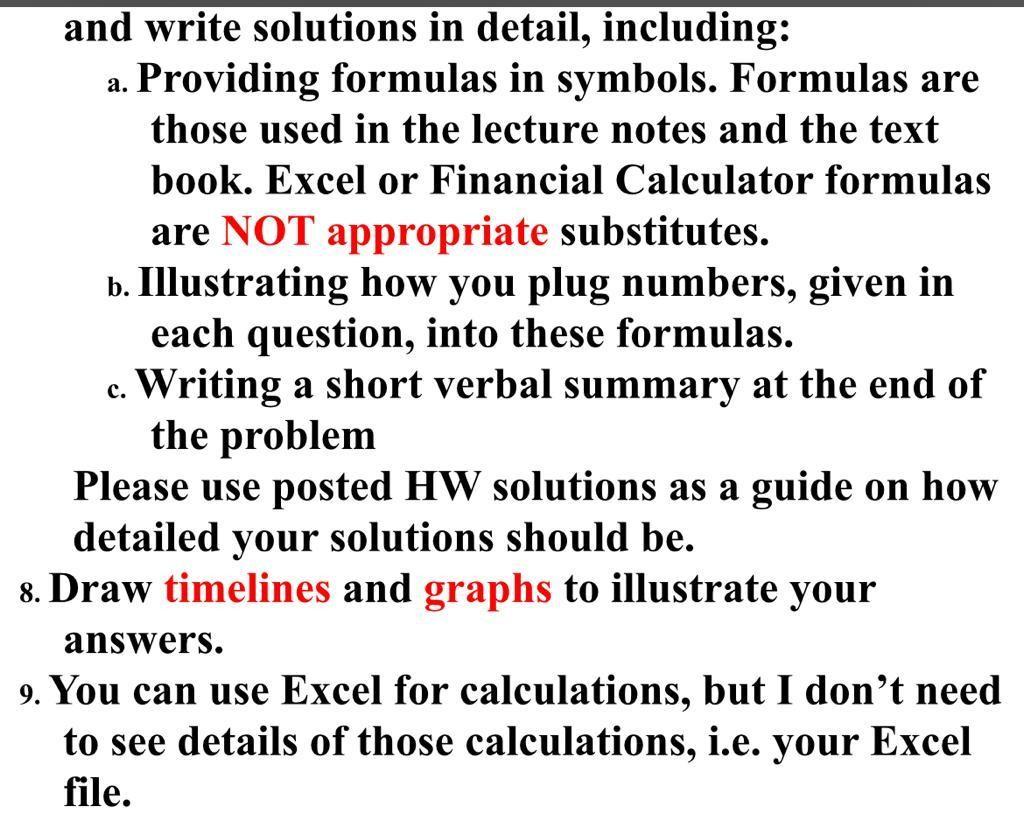

Question 1 Consider the following mutually exclusive investments T=0 1 2 3 Project X: -150 3060120 Project Y: -150|11030 60 a. Find IRRs for both projects. b. Find the cross over rate. Show the formula you need to use (in symbols) and with numbers plugged in. c. Draw a graph (NPV schedule), where you will show the NPV of each project as a function of its discount rate (i.e., NPV on the vertical axis and r on the horizontal axis). Both NPVs should be on the same graph. d. Please describe as fully as possible which project is the best and under which circumstances. a. c. and write solutions in detail, including: Providing formulas in symbols. Formulas are those used in the lecture notes and the text book. Excel or Financial Calculator formulas are NOT appropriate substitutes. b. Illustrating how you plug numbers, given in each question, into these formulas. Writing a short verbal summary at the end of the problem Please use posted HW solutions as a guide on how detailed your solutions should be. 8. Draw timelines and graphs to illustrate your answers. 9. You can use Excel for calculations, but I don't need to see details of those calculations, i.e. your Excel file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts