Question: i will thumbs up for correct answer and fast response James Co.'s defined benefit pension plan has the following information: Plan assets value on 1/1/2018

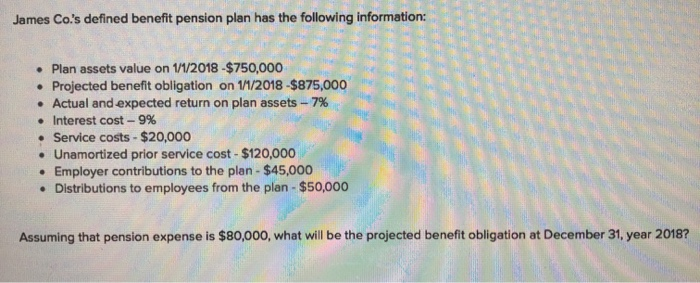

James Co.'s defined benefit pension plan has the following information: Plan assets value on 1/1/2018 - $750,000 Projected benefit obligation on 1/1/2018 -$875,000 Actual and expected return on plan assets - 7% Interest cost-9% Service costs - $20,000 Unamortized prior service cost - $120,000 Employer contributions to the plan - $45,000 Distributions to employees from the plan - $50,000 Assuming that pension expense is $80,000, what will be the projected benefit obligation at December 31, year 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts