Question: I will thumbs up!! please help a brother out Question 20 1 pts STANDARD DEVIATION Which one of the following statements is correct concerning the

I will thumbs up!! please help a brother out

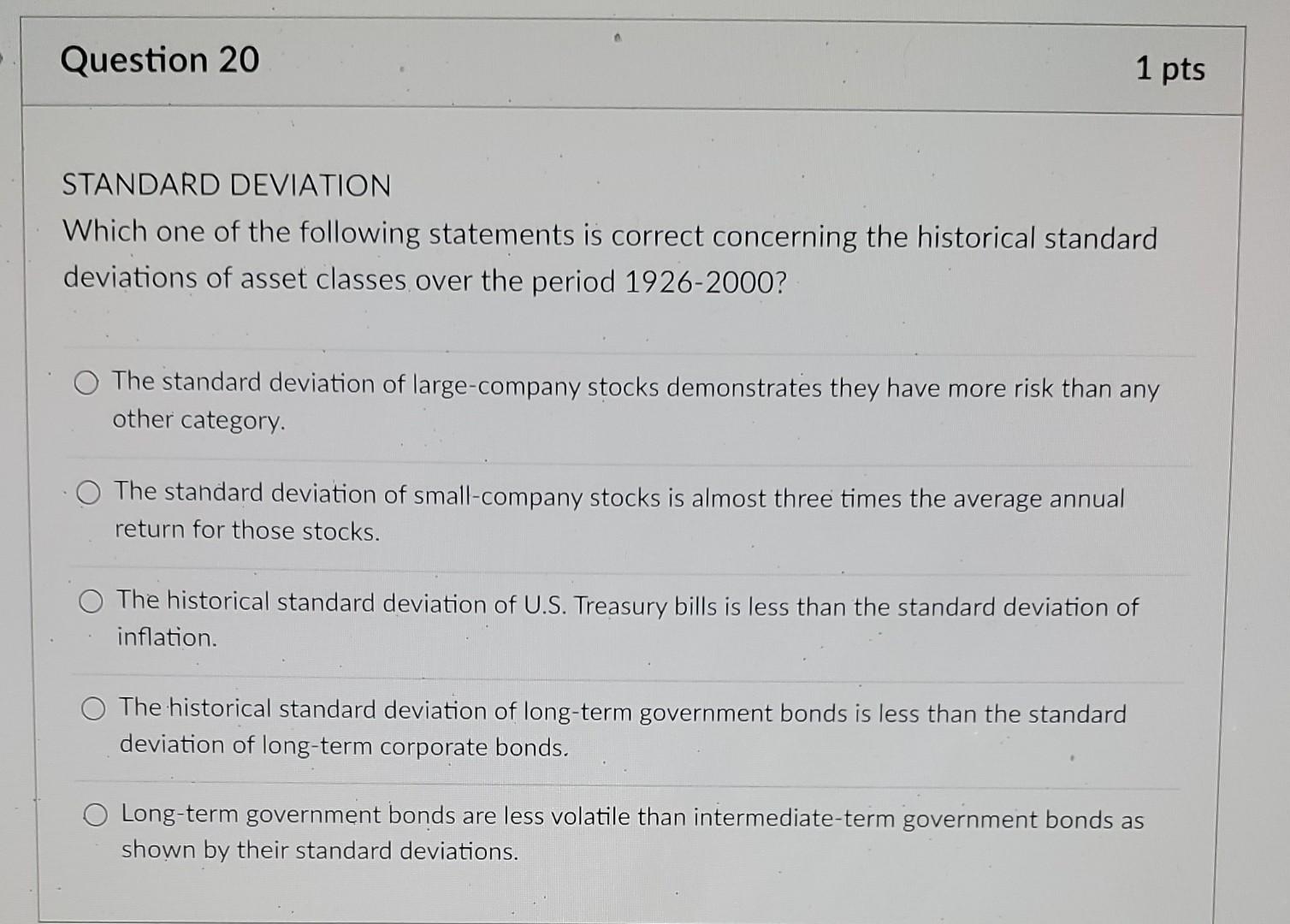

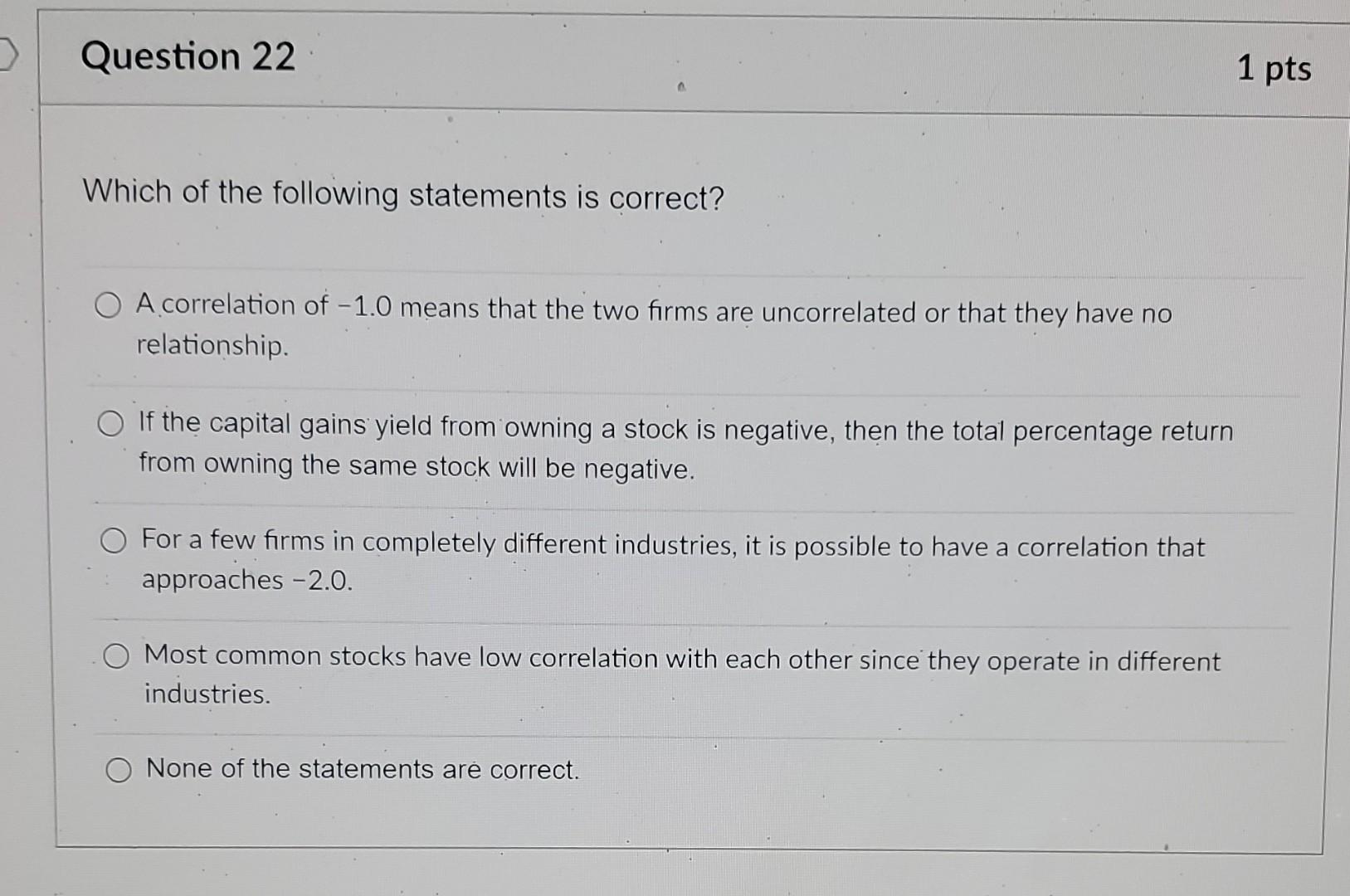

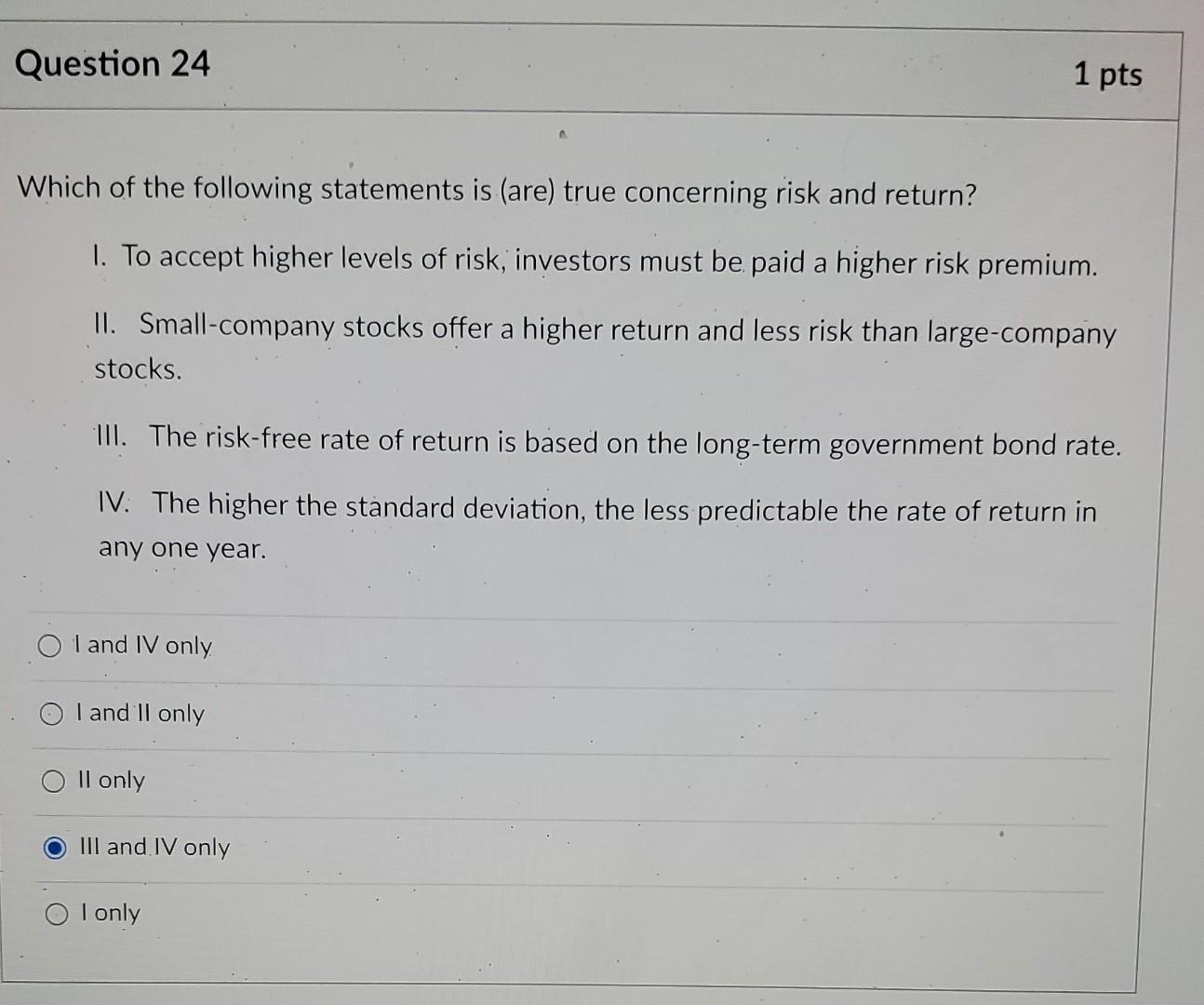

Question 20 1 pts STANDARD DEVIATION Which one of the following statements is correct concerning the historical standard deviations of asset classes over the period 1926-2000? O The standard deviation of large-company stocks demonstrates they have more risk than any other category. The standard deviation of small-company stocks is almost three times the average annual return for those stocks. The historical standard deviation of U.S. Treasury bills is less than the standard deviation of inflation. The historical standard deviation of long-term government bonds is less than the standard deviation of long-term corporate bonds. Long-term government bonds are less volatile than intermediate-term government bonds as shown by their standard deviations. Question 22 1 pts Which of the following statements is correct? O A correlation of -1.0 means that the two firms are uncorrelated or that they have no relationship O If the capital gains yield from owning a stock is negative, then the total percentage return from owning the same stock will be negative. a For a few firms in completely different industries, it is possible to have a correlation that approaches -2.0. O Most common stocks have low correlation with each other since they operate in different industries. None of the statements are correct. Question 24 1 pts Which of the following statements is (are) true concerning risk and return? 1. To accept higher levels of risk, investors must be paid a higher risk premium. II. Small-company stocks offer a higher return and less risk than large-company stocks. III. The risk-free rate of return is based on the long-term government bond rate. IV. The higher the standard deviation, the less predictable the rate of return in any one year. O I and IV only I and Il only Il only III and IV only I only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts