Question: I will thumbs up the answer Condensed balance sheet and income statement data for Flounder Corporation are presented here. FLOUNDER CORPORATION Balance Sheets December 31

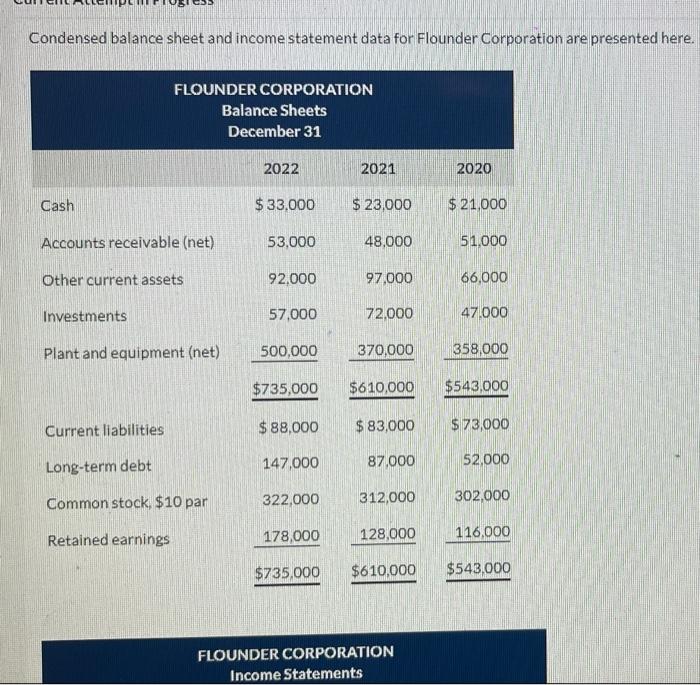

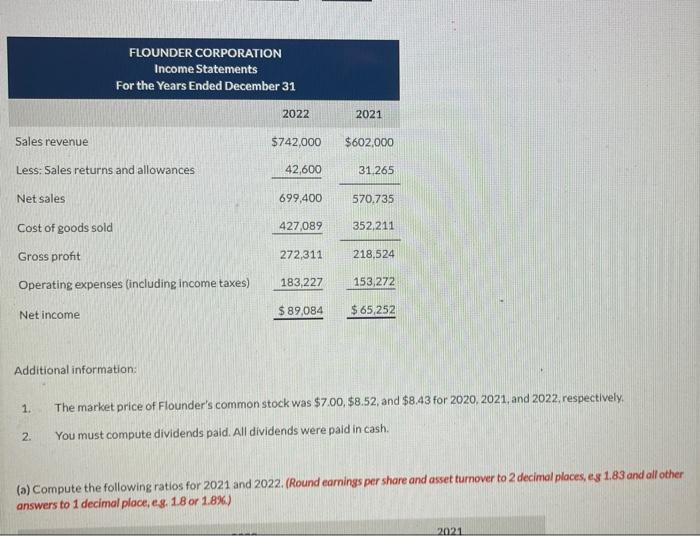

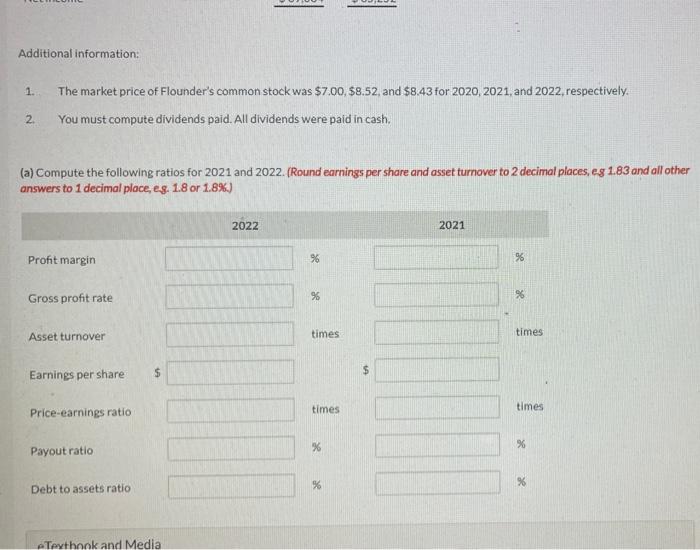

Condensed balance sheet and income statement data for Flounder Corporation are presented here. FLOUNDER CORPORATION Balance Sheets December 31 2022 2021 2020 Cash $ 33,000 $ 23,000 $ 21.000 Accounts receivable (net) 53,000 48.000 51,000 Other current assets 92,000 97,000 66,000 Investments 57,000 72.000 47.000 Plant and equipment (net) 500,000 370,000 358,000 $735,000 $610,000 $543.000 Current liabilities $ 88,000 $ 83,000 $ 73,000 147,000 Long-term debt 87.000 52.000 Common stock, $10 par 322,000 312,000 302.000 Retained earnings 178,000 128,000 116,000 $735,000 $610,000 $543,000 FLOUNDER CORPORATION Income Statements FLOUNDER CORPORATION Income Statements For the Years Ended December 31 2022 2021 Sales revenue $742,000 $602,000 Less: Sales returns and allowances 42,600 31.265 Net sales 699,400 570.735 Cost of goods sold 427,089 352,211 Gross profit 272,311 218,524 Operating expenses (including income taxes) 183,227 153,272 Net income $ 89,084 $ 65,252 Additional information: 1. The market price of Flounder's common stock was $7.00, $8.52, and $8.43 for 2020 2021, and 2022, respectively, 2. You must compute dividends paid. All dividends were paid in cash. (a) Compute the following ratios for 2021 and 2022. (Round earnings per share and asset turnover to 2 decimal places, es 1.83 and all other answers to 1 decimal place, eg. 1.8 or 1.8%) 2021 Additional information: 1. The market price of Flounder's common stock was $7.00, $8.52 and $8.43 for 2020, 2021 and 2022, respectively. You must compute dividends paid. All dividends were paid in cash, 2 (a) Compute the following ratios for 2021 and 2022. (Round earnings per share and asset turnover to 2 decimal places, eg 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 1.8%.) 2022 2021 Profit margin % % % Gross profit rate % Asset turnover times times Earnings per share $ times times Price earnings ratio % %6 Payout ratio % % % Debt to assets ratio Teythonk and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts