Question: I will thumbs up the correct answer. Prefer the answer done through Excel, thanks. MGMT FFAC Ch 5: Exercises Part A. The following information is

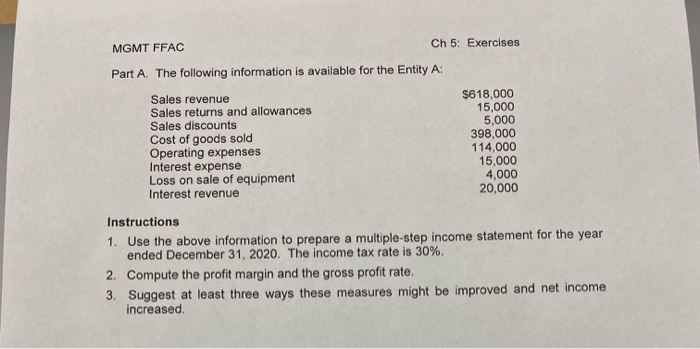

MGMT FFAC Ch 5: Exercises Part A. The following information is available for the Entity A: Sales revenue $618,000 Sales returns and allowances 15,000 Sales discounts 5,000 Cost of goods sold 398,000 Operating expenses 114,000 Interest expense 15,000 Loss on sale of equipment 4,000 Interest revenue 20,000 Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2020. The income tax rate is 30%. 2. Compute the profit margin and the gross profit rate. 3. Suggest at least three ways these measures might be improved and net income increased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts