Question: i will tive a thumbs up it you answer correctly! MACRS At the beginning of the current year. Poplock began a calendar-year dog boardint business

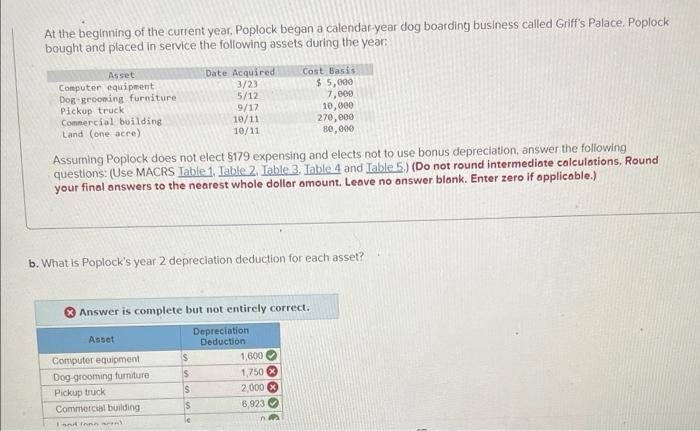

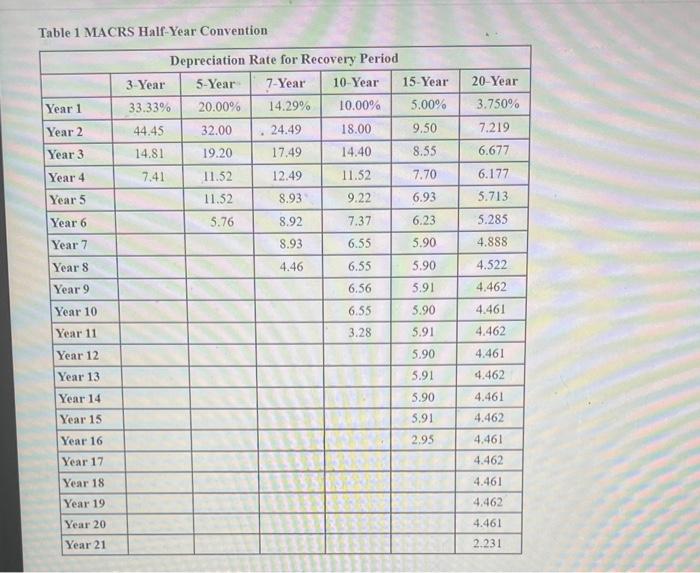

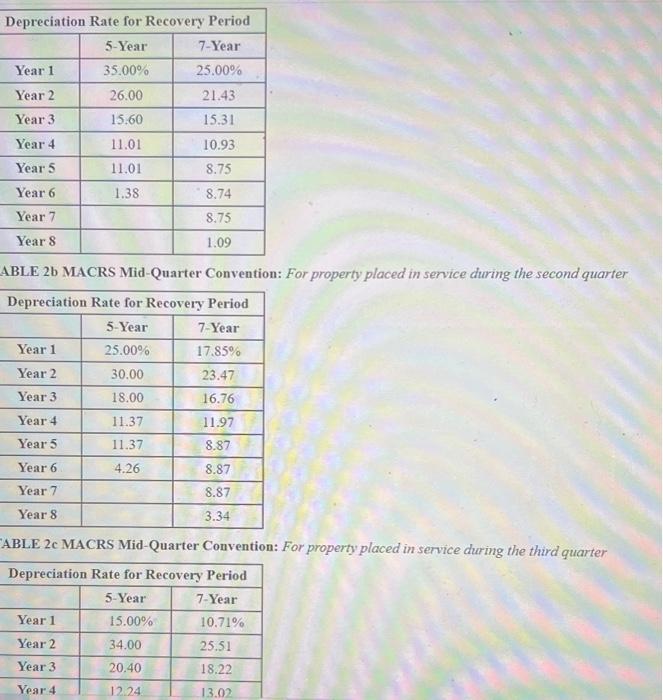

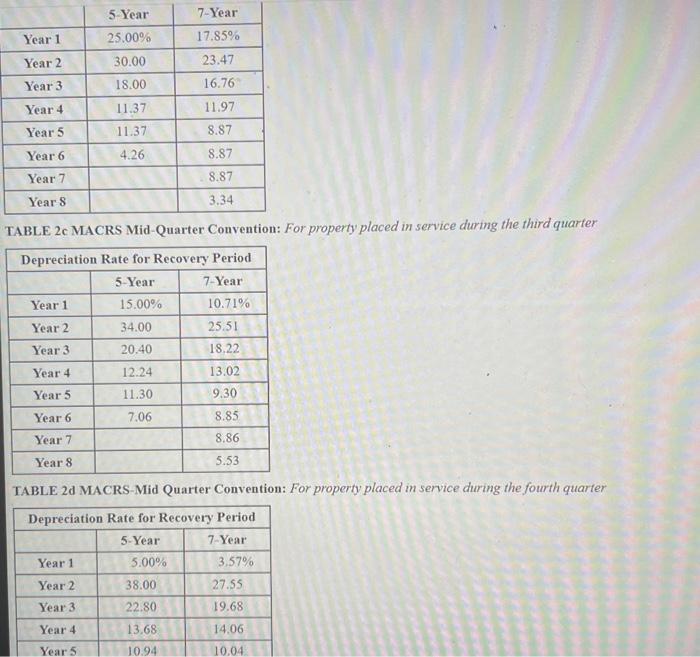

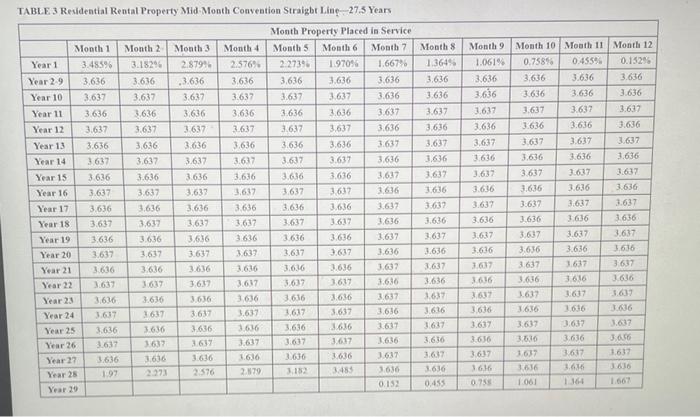

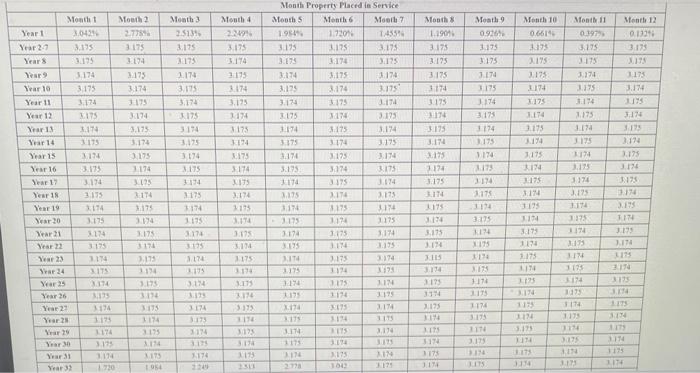

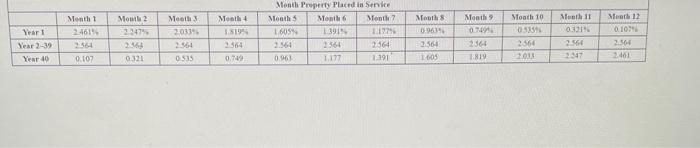

At the beginning of the current year. Poplock began a calendar-year dog boardint business called Griff's Palace. Poplock bought and placed in service the following assets during the year: Assuming Poplock does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Iable 1. Table 2. Iable 3, Table 4 and Table 5.) (Do not round intermediate colculotions, Round your final onswers to the nearest whole dollor amount. Leave no onswer blank. Enter zero if applicable.) b. What is Poplock's year 2 depreciation deduction for each asset? Answer is complete but not entirely correct. Table 1 MACRS Half-Year Convention ABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter ABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Conveation Straigbt Liee- -27.5 Years Month Property Flactd ie Service Month Property Plated in Sarvice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts