Question: I will vote your answer don't give Wrong Answer thank you 20000 8000 1400 S28 5300 3000 Sale of medic Visiting fees Consultation fee Less

I will vote your answer don't give Wrong Answer thank you

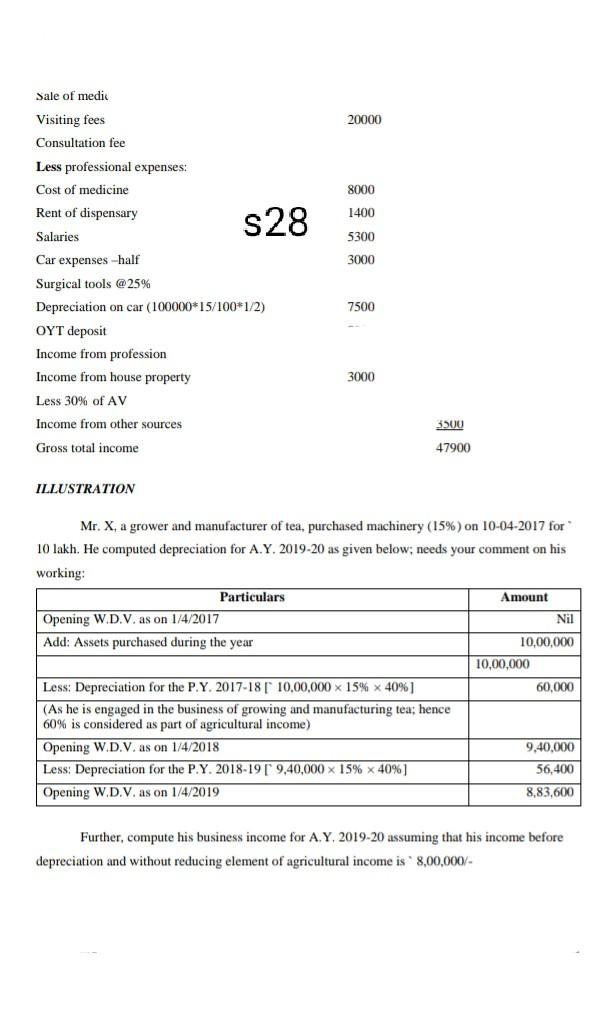

20000 8000 1400 S28 5300 3000 Sale of medic Visiting fees Consultation fee Less professional expenses: Cost of medicine Rent of dispensary Salaries Car expenses-half Surgical tools @ 25% Depreciation on car (100000*15/100*1/2) OYT deposit Income from profession Income from house property Less 30% of AV Income from other sources Gross total income 7500 3000 3500 47900 ILLUSTRATION Mr. X, a grower and manufacturer of tea, purchased machinery (15%) on 10-04-2017 for 10 lakh. He computed depreciation for A.Y. 2019-20 as given below; needs your comment on his working: Particulars Amount Opening W.D.V. as on 1/4/2017 Nil Add: Assets purchased during the year 10,00,000 10,00,000 Less: Depreciation for the P.Y. 2017-18 [ 10,00,000 x 15% x 40%] 60,000 (As he is engaged in the business of growing and manufacturing tea; hence 60% is considered as part of agricultural income) Opening W.D.V. as on 1/4/2018 9,40,000 Less: Depreciation for the P.Y. 2018-191 9,40,000 x 15% x 40%] 56,400 Opening W.D.V. as on 1/4/2019 8,83,600 Further, compute his business income for A.Y. 2019-20 assuming that his income before depreciation and without reducing element of agricultural income is 8,00,000/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts