Question: I wonder how to solve the problem. Will the withdrawals affect the deposit amounts that are going to be compounded next year reduce it before

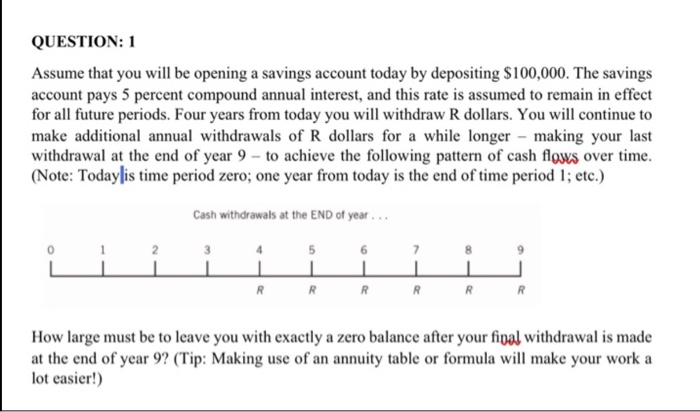

QUESTION: 1 Assume that you will be opening a savings account today by depositing S100,000. The savings account pays 5 percent compound annual interest, and this rate is assumed to remain in effect for all future periods. Four years from today you will withdraw R dollars. You will continue to make additional annual withdrawals of R dollars for a while longer making your last withdrawal at the end of year 9-to achieve the following pattern of cash flows over time. (Note: Todaylis time period zero; one year from today is the end of time period 1; etc.) Cash withdrawals at the END of year... How large must be to leave you with exactly a zero balance after your fipal withdrawal is made at the end of year 9? (Tip: Making use of an annuity table or formula will make your work a lot easier!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts