Question: I would appreciate explaining the answer. This was a practice test for an Ezam and would like to know where I went wrong and how

I would appreciate explaining the answer. This was a practice test for an Ezam and would like to know where I went wrong and how to solve these. Thanks!

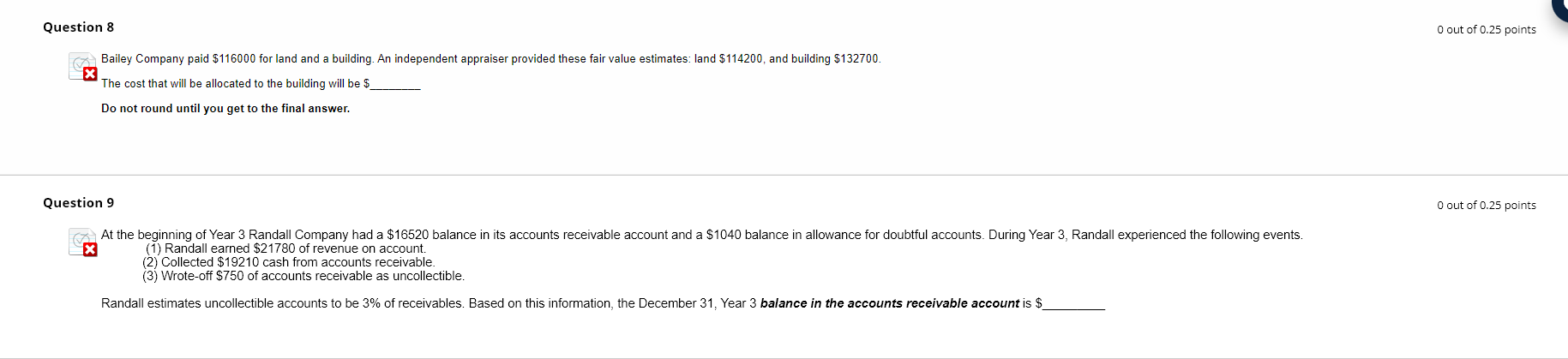

Bailey Company paid $116000 for land and a building. An independent appraiser provided these fair value estimates: land $114200, and building $132700. The cost that will be allocated to the building will be 9 Do not round until you get to the final answer. Question 9 (1) Randall earned $21780 of revenue on account. (2) Collected $19210 cash from accounts receivable. (3) Wrote-off $750 of accounts receivable as uncollectible. What is the interest revenue Kevin Co will recognize in 2017? Bailey Company paid $116000 for land and a building. An independent appraiser provided these fair value estimates: land $114200, and building $132700. The cost that will be allocated to the building will be 9 Do not round until you get to the final answer. Question 9 (1) Randall earned $21780 of revenue on account. (2) Collected $19210 cash from accounts receivable. (3) Wrote-off $750 of accounts receivable as uncollectible. What is the interest revenue Kevin Co will recognize in 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts