Question: ****I would appreciate it if you could solve the question with clear and explanatory steps. Thank you in advance for your interest.**** 1. Assume that

****I would appreciate it if you could solve the question with clear and explanatory steps. Thank you in advance for your interest.****

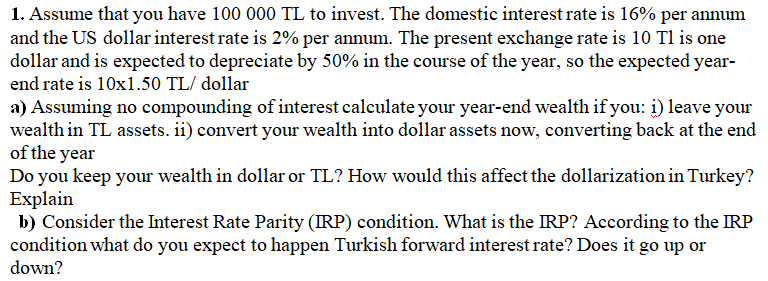

1. Assume that you have 100 000 TL to invest. The domestic interest rate is 16% per annum and the US dollar interest rate is 2% per annum. The present exchange rate is 10 Tl is one dollar and is expected to depreciate by 50% in the course of the year, so the expected year- end rate is 10x1.50 TL/ dollar a) Assuming no compounding of interest calculate your year-end wealth if you: i) leave your wealth in TL assets. ii) convert your wealth into dollar assets now, converting back at the end of the year Do you keep your wealth in dollar or TL? How would this affect the dollarization in Turkey? Explain b) Consider the Interest Rate Parity (IRP) condition. What is the IRP? According to the IRP condition what do you expect to happen Turkish forward interest rate? Does it go up or down? 1. Assume that you have 100 000 TL to invest. The domestic interest rate is 16% per annum and the US dollar interest rate is 2% per annum. The present exchange rate is 10 Tl is one dollar and is expected to depreciate by 50% in the course of the year, so the expected year- end rate is 10x1.50 TL/ dollar a) Assuming no compounding of interest calculate your year-end wealth if you: i) leave your wealth in TL assets. ii) convert your wealth into dollar assets now, converting back at the end of the year Do you keep your wealth in dollar or TL? How would this affect the dollarization in Turkey? Explain b) Consider the Interest Rate Parity (IRP) condition. What is the IRP? According to the IRP condition what do you expect to happen Turkish forward interest rate? Does it go up or down

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts