Question: I would be glad if you explain it step by step in your own words in detail. especially with how the transactions are and the

I would be glad if you explain it step by step in your own words in detail. especially with how the transactions are and the calculations of the transactions, thank you in advance.

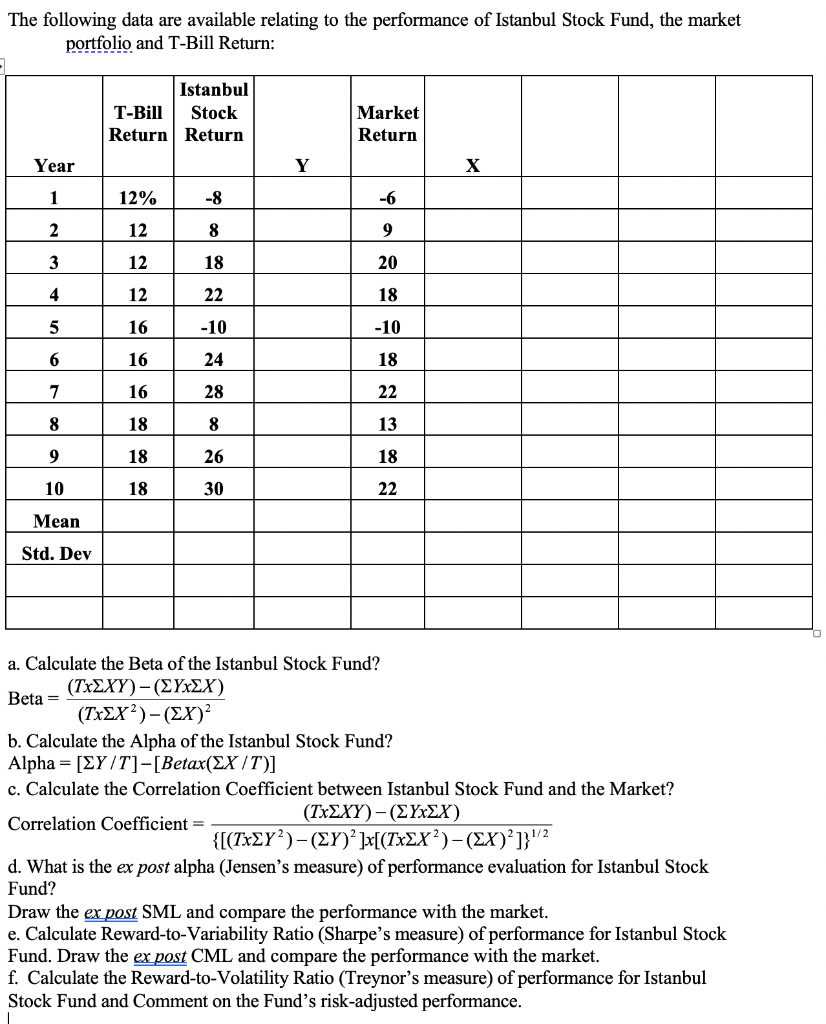

The following data are available relating to the performance of Istanbul Stock Fund, the market portfolio and T-Bill Return: Istanbul T-Bill Stock Return Return Market Return Year Y x 1 12% -8 -6 2 12 8 9 3 12 18 20 4 12 22 18 5 16 -10 -10 6 16 24 18 7 16 28 22 8 18 8 13 9 18 26 18 10 18 30 22 Mean Std. Dev a. Calculate the Beta of the Istanbul Stock Fund? ()- (x) Beta = (TxEX?)- (EX) b. Calculate the Alpha of the Istanbul Stock Fund? Alpha = [EY/T]-[Betax(EX/T)] c. Calculate the correlation Coefficient between Istanbul Stock Fund and the Market? Correlation Coefficient = (TxEXY)-(EYxEX) {[(TxEY?)(EY)?]~[(TxEX?)(EX)?]}\/2 d. What is the ex post alpha (Jensen's measure) of performance evaluation for Istanbul Stock Fund? Draw the ex post SML and compare the performance with the market. e. Calculate Reward-to-Variability Ratio (Sharpe's measure) of performance for Istanbul Stock Fund. Draw the ex post CML and compare the performance with the market. f. Calculate the Reward-to-Volatility Ratio (Treynor's measure) of performance for Istanbul Stock Fund and Comment on the Fund's risk-adjusted performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts