Question: I would be very happy if you do the operations on the paper in detail and if you explain the reasons Question 2. An investor

I would be very happy if you do the operations on the paper in detail and if you explain the reasons

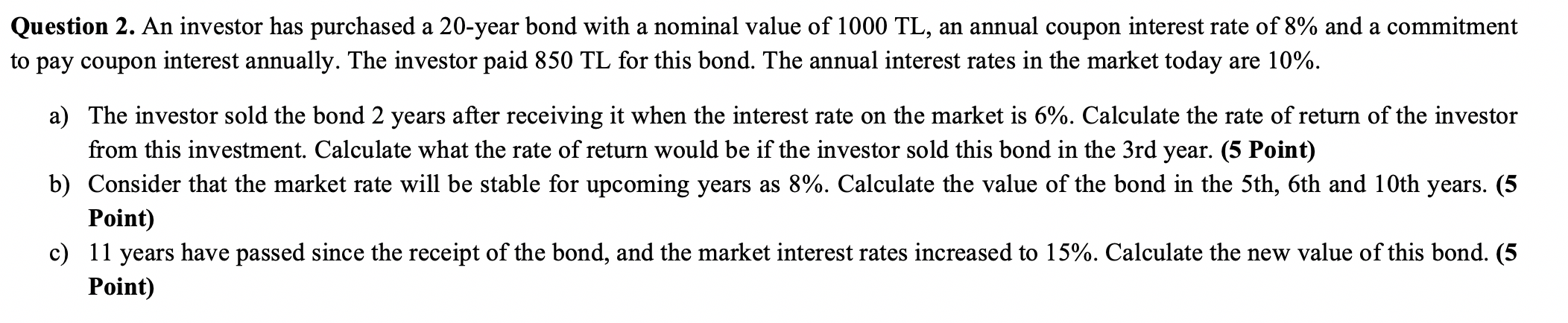

Question 2. An investor has purchased a 20-year bond with a nominal value of 1000 TL, an annual coupon interest rate of 8% and a commitment to pay coupon interest annually. The investor paid 850 TL for this bond. The annual interest rates in the market today are 10%. a) The investor sold the bond 2 years after receiving it when the interest rate on the market is 6%. Calculate the rate of return of the investor from this investment. Calculate what the rate of return would be if the investor sold this bond in the 3rd year. (5 Point) b) Consider that the market rate will be stable for upcoming years as 8%. Calculate the value of the bond in the 5th, 6th and 10th years. (5 Point) c) 11 years have passed since the receipt of the bond, and the market interest rates increased to 15%. Calculate the new value of this bond. (5 Point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts