Question: I would like a clear set up answer for this please. And within 30min please Tara Ltd is a company that sells widgets. They are

I would like a clear set up answer for this please. And within 30min please

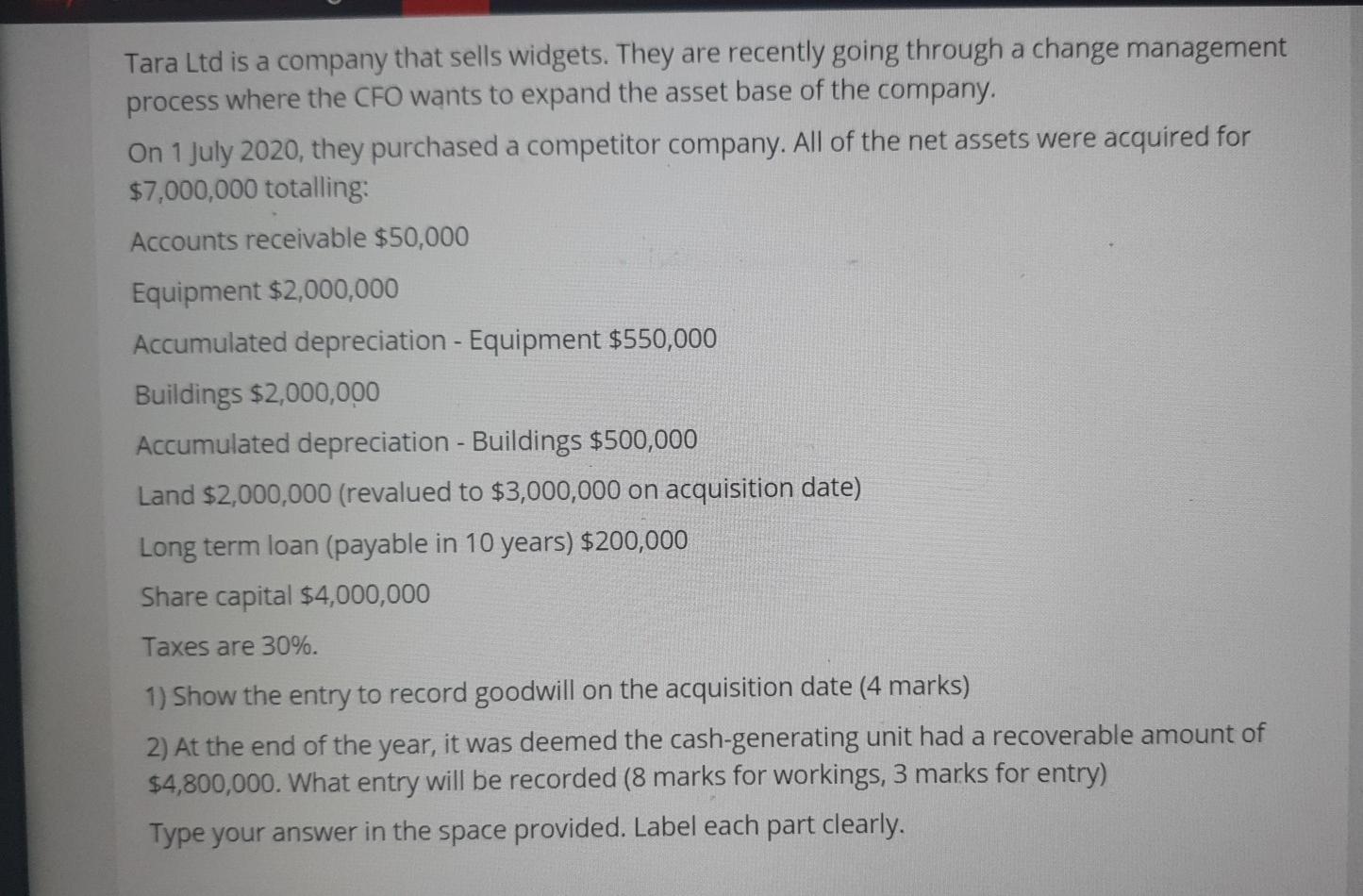

Tara Ltd is a company that sells widgets. They are recently going through a change management process where the CFO wants to expand the asset base of the company. On 1 July 2020, they purchased a competitor company. All of the net assets were acquired for $7,000,000 totalling: Accounts receivable $50,000 Equipment $2,000,000 Accumulated depreciation - Equipment $550,000 Buildings $2,000,000 Accumulated depreciation - Buildings $500,000 Land $2,000,000 (revalued to $3,000,000 on acquisition date) Long term loan (payable in 10 years) $200,000 Share capital $4,000,000 Taxes are 30%. 1) Show the entry to record goodwill on the acquisition date (4 marks) 2) At the end of the year, it was deemed the cash-generating unit had a recoverable amount of $4,800,000. What entry will be recorded (8 marks for workings, 3 marks for entry) Type your answer in the space provided. Label each part clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts