Question: I would like as much help as possible please. In preparing for the upcoming holiday season, fresh Toy Company (FTC) designed a new doll called

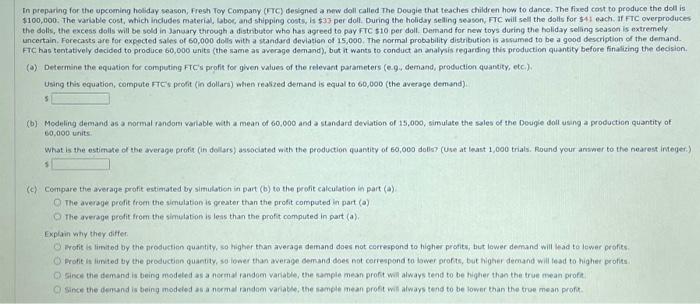

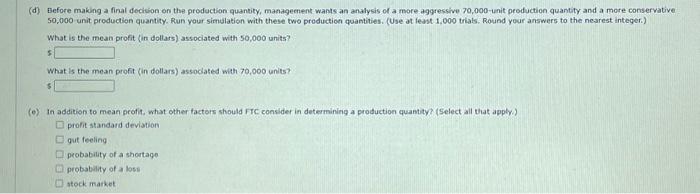

In preparing for the upcoming holiday season, fresh Toy Company (FTC) designed a new doll called The Doogie that teaches children how to dance. The fixed cost to produce the doll is $100,000. The varable cost, which indudes material, Gboc, and stipping costs, is $33 per doll. During the holiday selling season, FTC will sell the dolls for $41 each. If fiC overproduces the dolls, the excess dolls will be sold in January throogh a distributor who has agreed to pay frC sto per doll. Demand for need toys during the hollday seling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000 , The normal probability distributico is assumed to be a good description of the demand. FTC has teotatively decidod to produce 60,000 units (the same as werage demand), but it wants to conduct an analy dis regarding this production quantity before finalizing the dedision. (o) Determine the equation for computing flC's profit for g iven values of the relevarit parameters (e.94, demand, production quantity, etci). Using this equation, compute fres profit (in dollara) when reasred demand is equal to 60,000 (the average demand). (b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000 , simulate the siles of the Deugie doll using a production quantity of 60,000 units. What is the estimate of the sverage profic (in dollars) associated weth the production quantity of 60,000 dollso (Use at least 1,000 trals. Round your answer to the nearest integer.) (c) Compare the werage profit estimated by simulation in part (b) to the profit calculation in part (a) The average profit from the simulation is qreater than the profit computed in part (o) The average profit from the simulation is less than the profit computed in part (a). Expiain why they differ. Frofit is limited by the production quantity, so higher than average demand does not cerrespond to higher profitw, but lower demand will lead to lawer orofits. Profit is limbed by the production quantity, so ioner than average demand does not correspond to lawer profits, but higher demand will tead to highee profits. Sinxe the demand is being modeled as a noemal random variable, the sample mean profit will always tend to be higher than the true mean profit. Sinse the denund is being modeled as a normal randam variable, the nample mean profit will always tend to be lower than the troe mean profi. (d) Before making a final decision on the prodoction quantity, manageenent wants an analysis of a more aggressive 70,000 -unit peoduction quantity and a more conservative 50,000 unit production quantity. Run your simulation with these two production qoantities. (Use at feast 1,000 trials. Round your answers to the nearest integer.) What is the mean profit (in dollars) associated with 50,000 units? What is the mean profit (in dollars) associated with 70,000 units? (e) In addition to mean profit, what other tactors should fre consider in determining a production quantity? (Select all that apply.) profit standand deviation qut feeling probability of a shortage probability of a los

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts