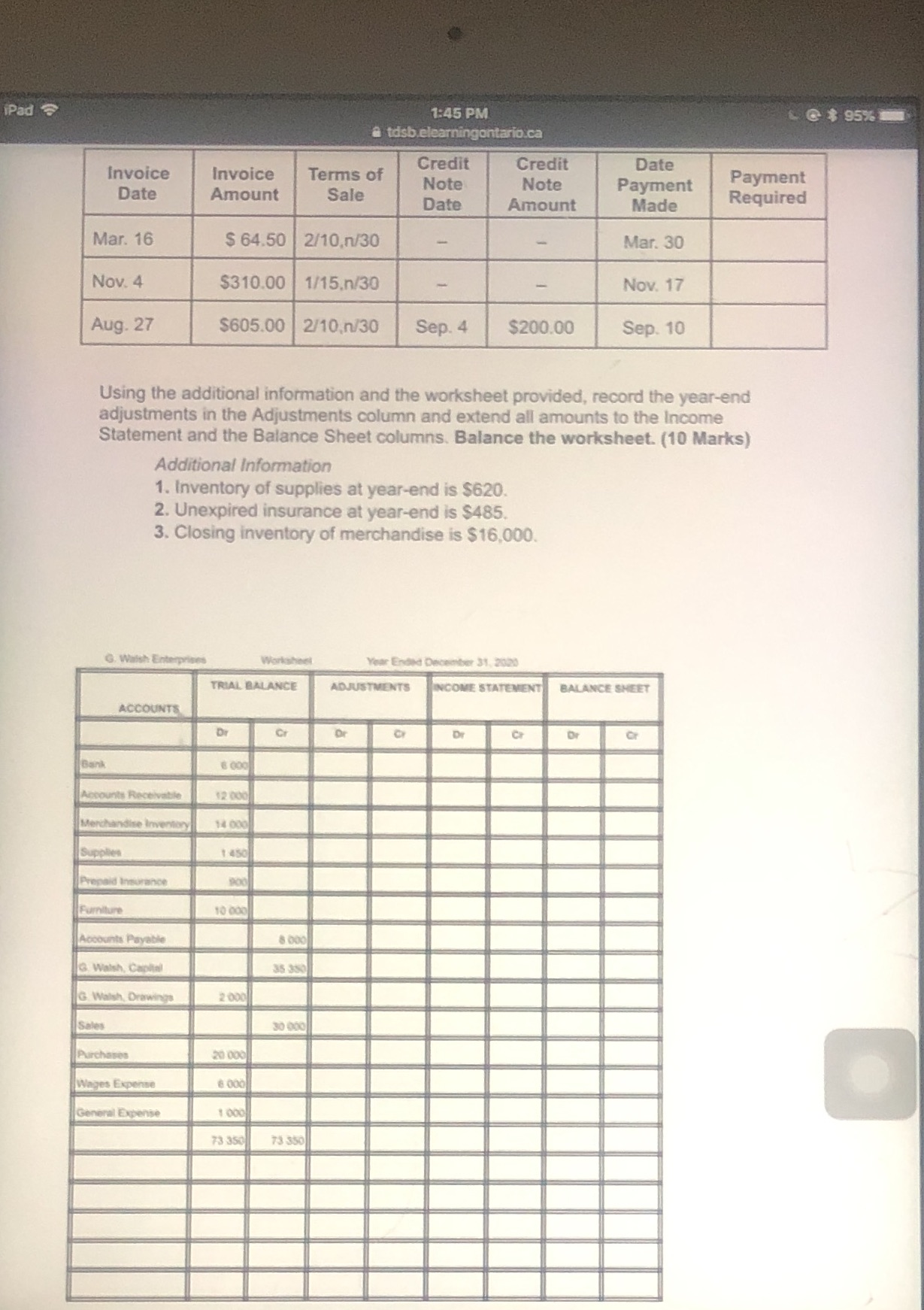

Question: I would like help completing my assignment.Step one: Answer the following schedule by calculating the amount of the payment in each case. When credit notes

I would like help completing my assignment.Step one: Answer the following schedule by calculating the amount of the payment in each case. When credit notes are involved, assume that the discount period is adjusted to start from the date on the credit note.

iPad 1:45 PM @ $ 95% a tdsb.elearningontario.ca Credit Credit Date Invoice Invoice Terms of Note Note Payment Payment Date Amount Sale Date Amount Made Required Mar. 16 $ 64.50 2/10,n/30 Mar. 30 Nov. 4 $310.00 1/15.n/30 Nov. 17 Aug. 27 $605.00 2/10.n/30 Sep. 4 $200.00 Sep. 10 Using the additional information and the worksheet provided, record the year-end adjustments in the Adjustments column and extend all amounts to the Income Statement and the Balance Sheet columns. Balance the worksheet. (10 Marks) Additional Information 1. Inventory of supplies at year-end is $620. 2. Unexpired insurance at year-end is $485. 3. Closing inventory of merchandise is $16,000. G. Walsh Enterprise Worksheel Year Ended December 31, 2020 TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET ACCOUNTS Dr Cr 12 000 archandise Inventory 14 00 Supplies 1 450 Prepaid Insurance Furniture 10 000 Accounts Payable 8 000 G Walsh, Capital 35 38 G. Walsh, Drawing 2:000 Sales 30 000 Purchases 20 000 Wages Expense 8 000 General Expense 1 000 73 350 73 350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts